Trending Videos

Types of Data and Data Privacy

The media often talks about privacy in the Fintech world. In this video in the series on Fintech Data, Marta answers key privacy questions, including what anonymised data is, what pseudonymised data is and what the advantages of using pseudonymised data are.

Marta Dunphy-Moriel • 07:54

Most recent videos

Bond Bookbuilding Pre-launch

While bond pricing has different processes and conventions in individual markets, the bookbuilding process is much more universal. Nigel begins to explain this process by outlining the purpose of bookbuilding and the role of the syndicate bankers once the mandate is received.

Nigel Owen • 07:07

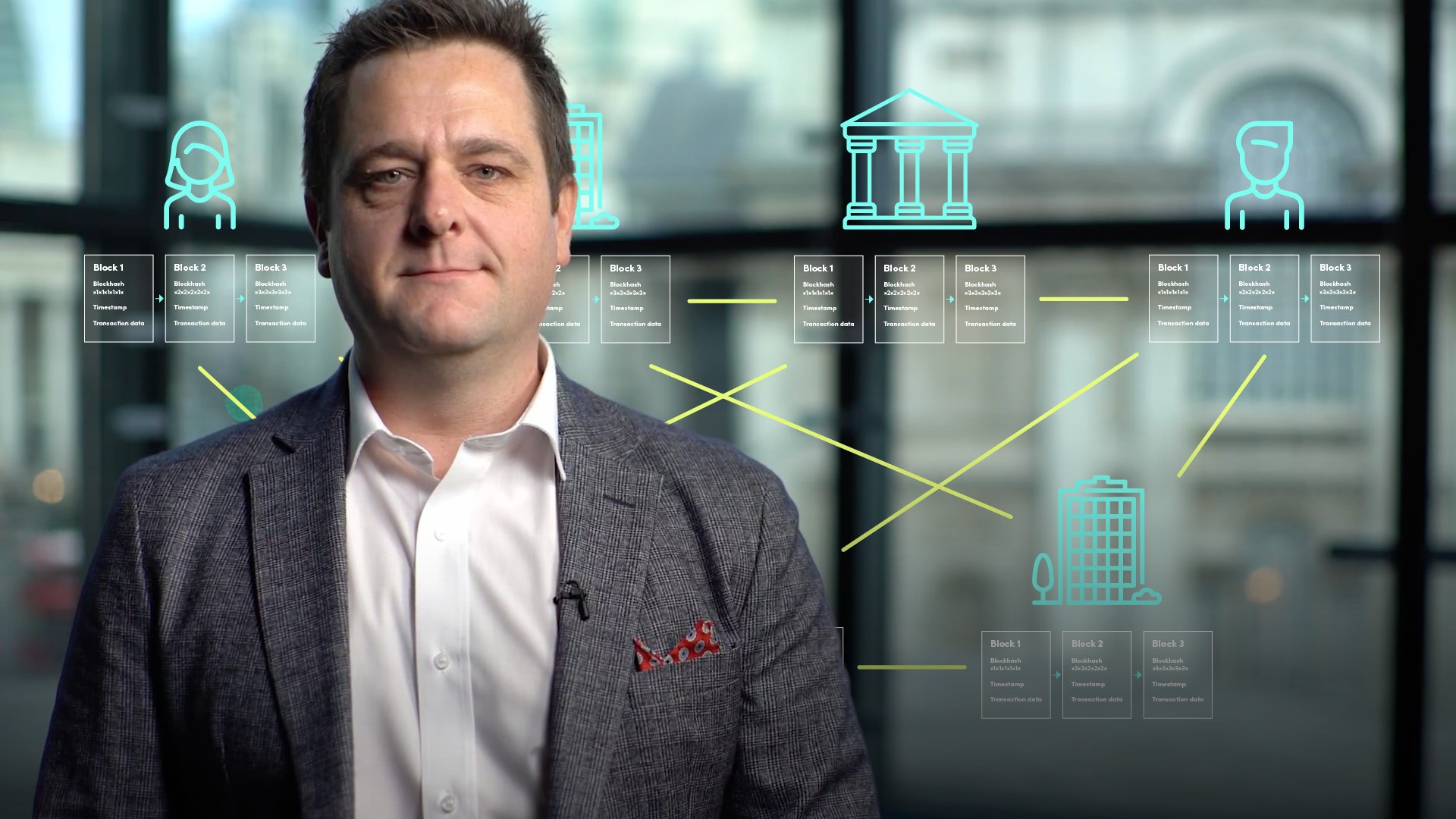

Introduction to Blockchain in Trade Finance

Blockchain can be applicable to solving real world problems, specifically in trade finance. In the first part of this two part series, Andrew provides an introduction to blockchain in trade finance and explains how it can be used to address certain challenges.

Andrew English • 09:05

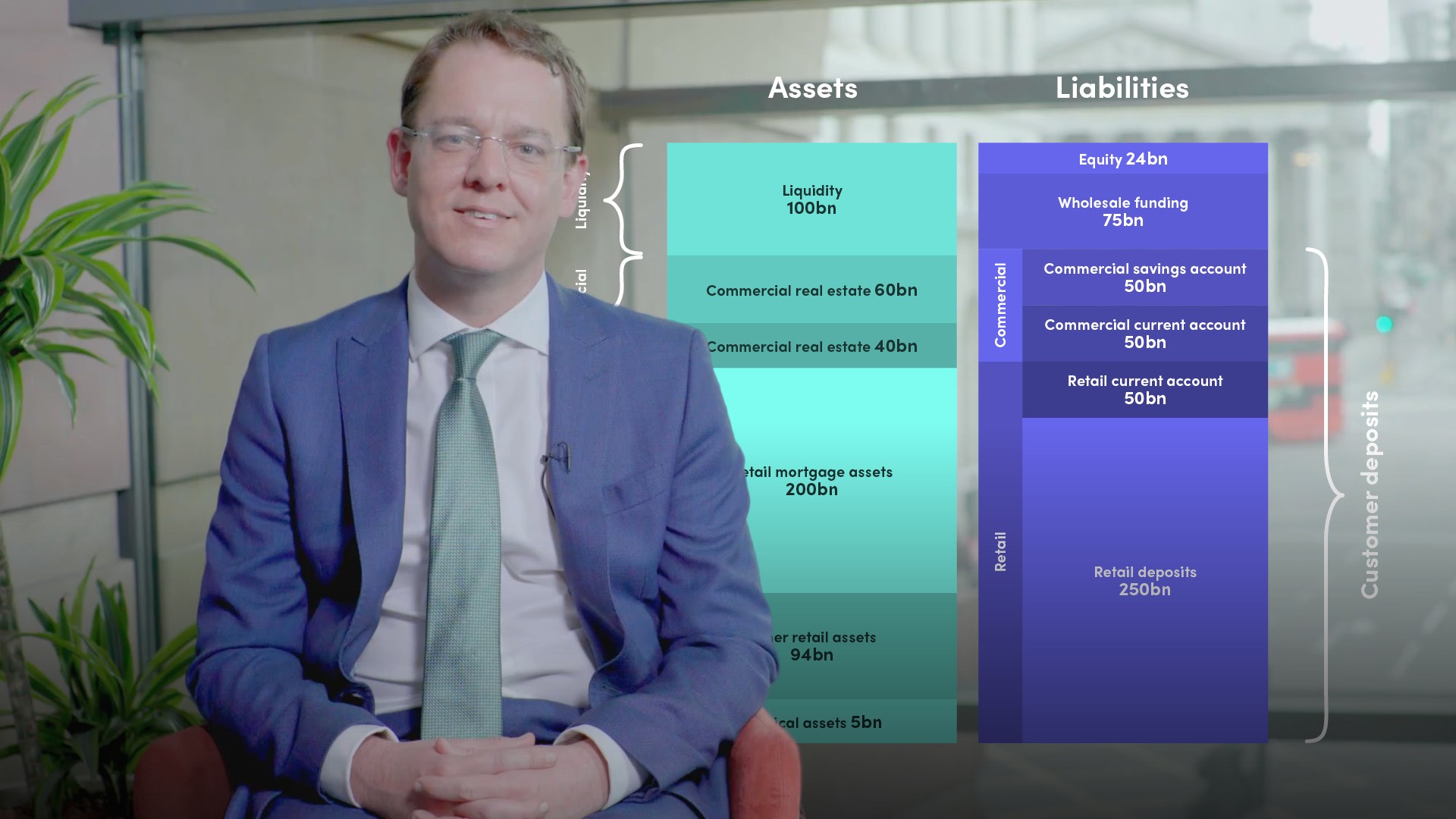

History of the Basel Accord

In the aftermath of the global financial crisis, there was an unprecedented overhaul of the global framework regulating the banking system. Sukhy explains this regulatory framework and discusses the strengths and weaknesses of Basel I and II that ultimately led to the current version - Basel III.

Sukhy Kaur • 15:54