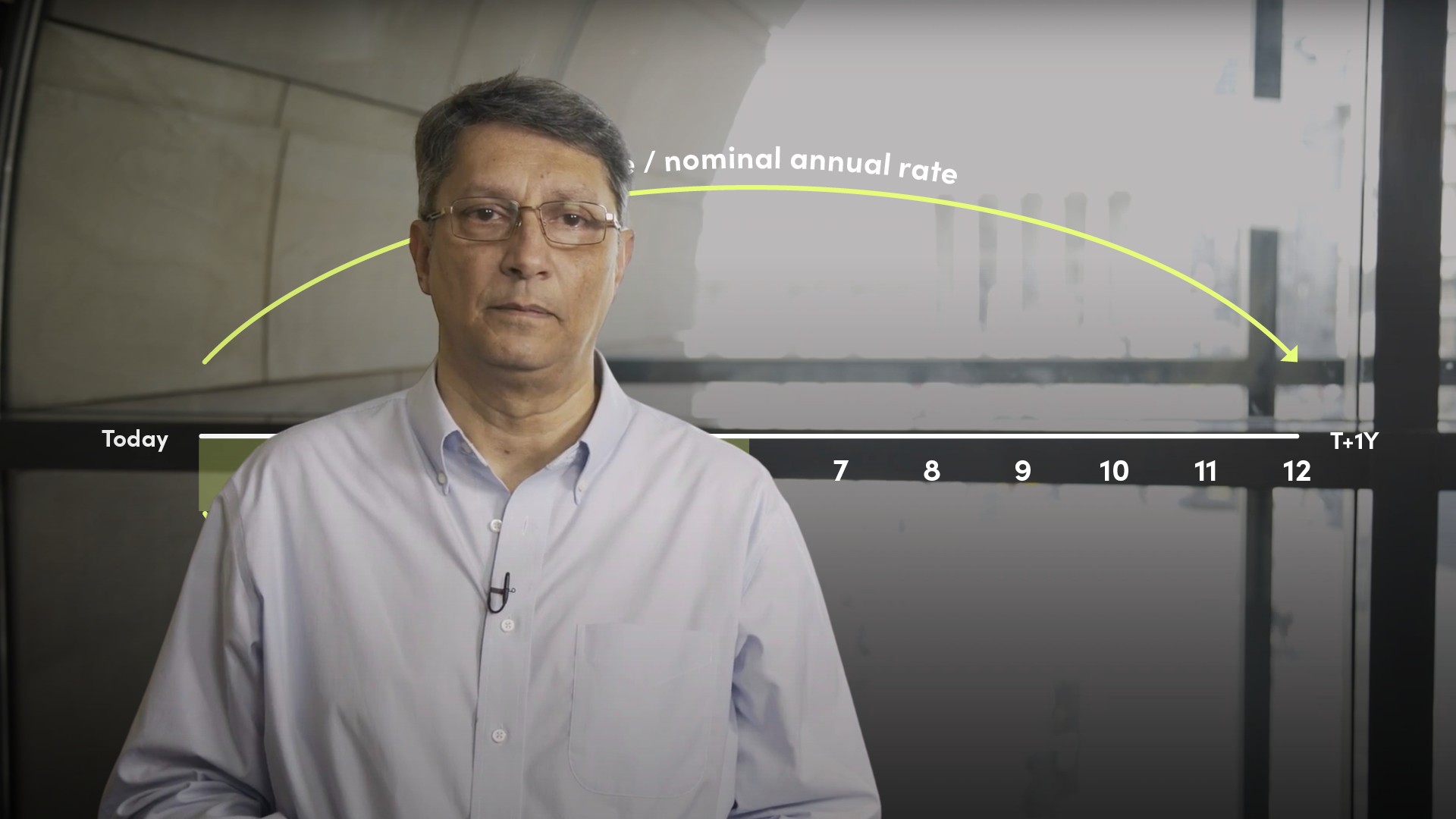

Annual Equivalent Rate (AER)

The Annual Equivalent Rate is the rate that investors will actually earn on an investment. LM: this suggests that it is the actual return investors will earn which it is not, as that is not known upfront (on a non-zero coupon bond). The AER on, say, a bond, will be higher than the headline coupon rate. Why? A semi-annual bond, for example, pays a coupon twice a year so the actual return will be higher owing to the effects of compounding. I am afraid I don’t use this measure so don’t have a definition.