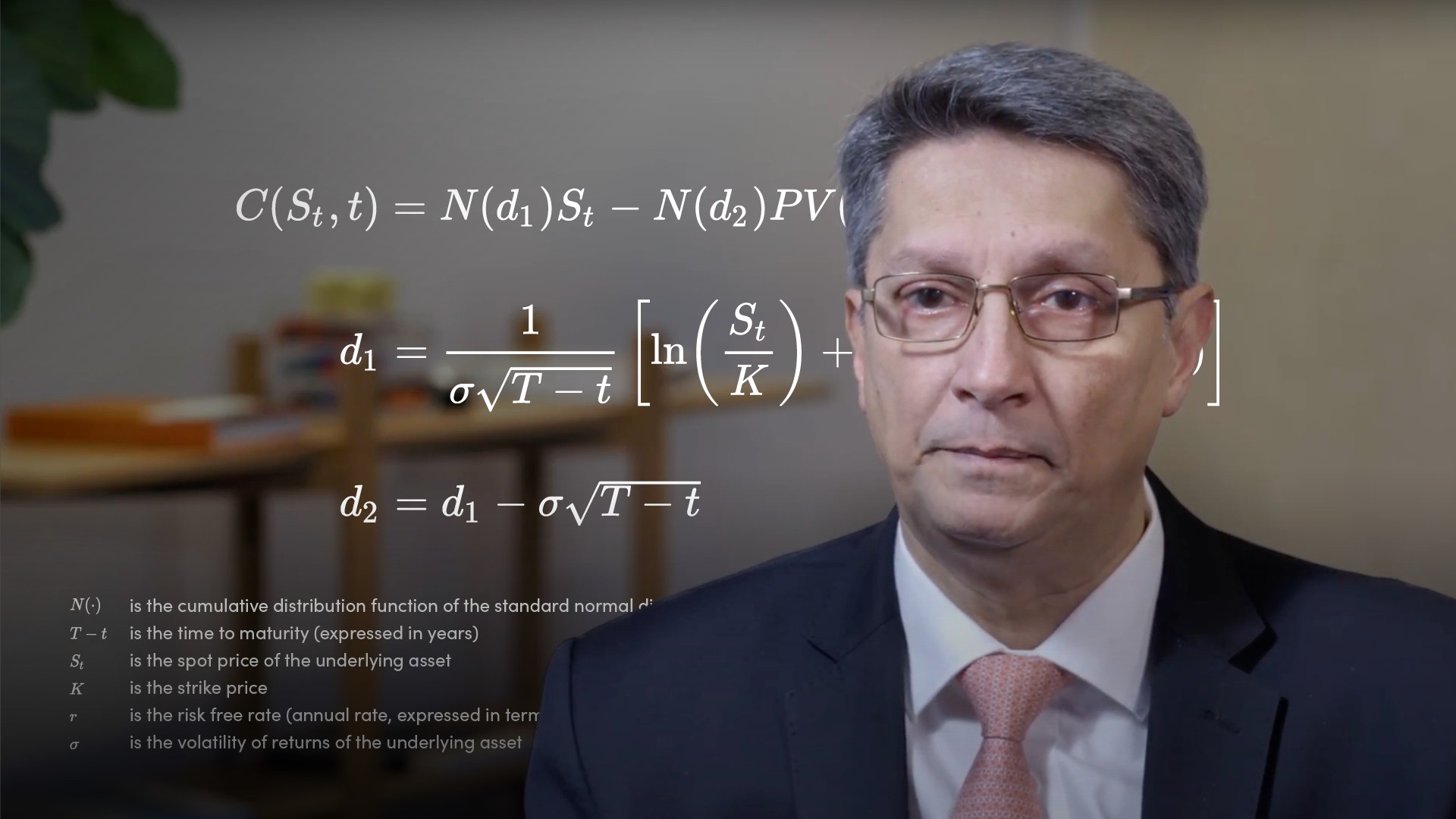

Black-Scholes Model

An options pricing model used to determine the theoretical value of a European call or a put option on a non-dividend paying stock, assuming among other things, constant risk-free interest rates, constant volatility and that markets are efficient.