Glossary

Investment ManagementButterfly Spread

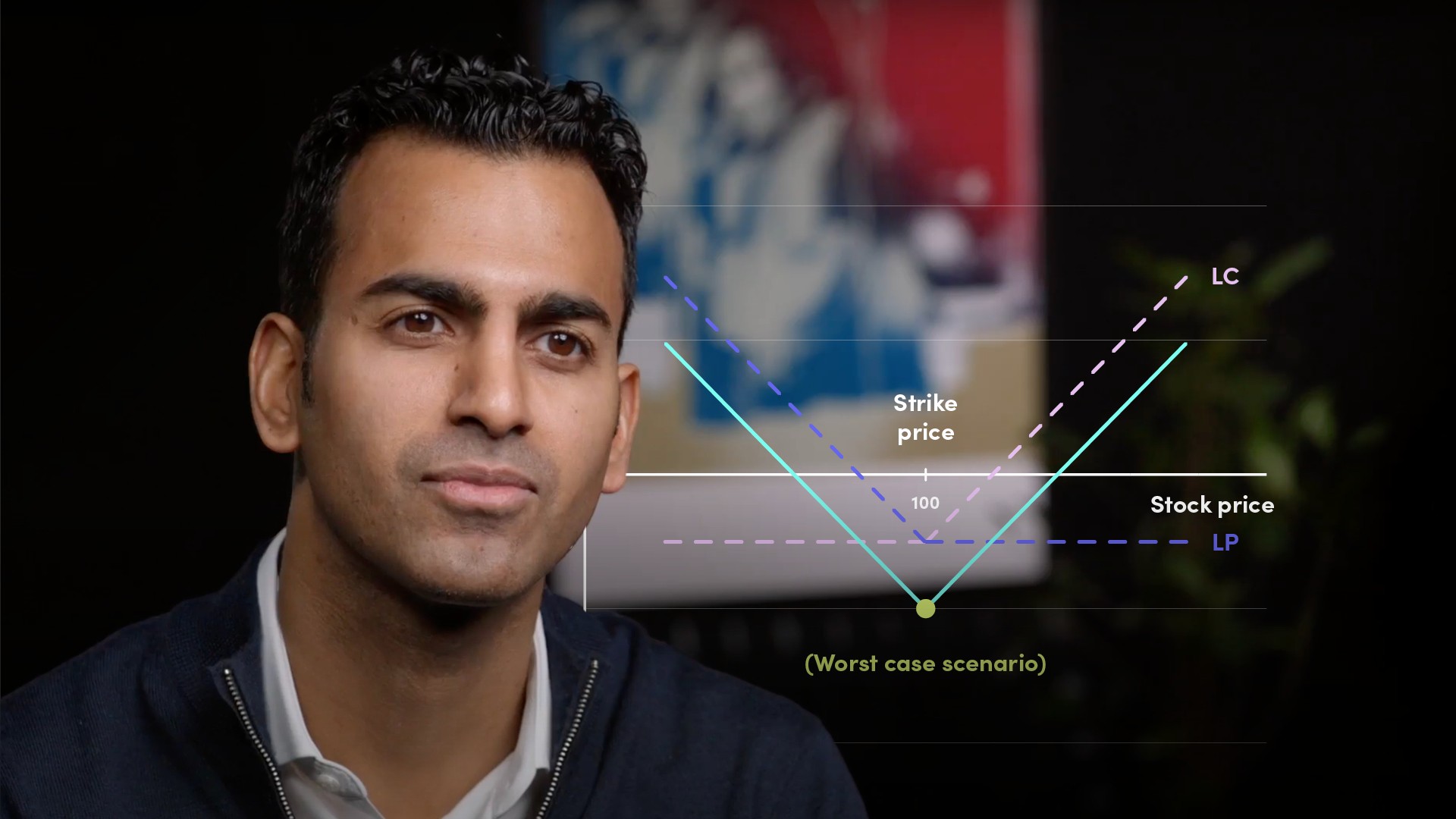

A neutral options strategy that is a combination of a bull spread and a bear spread. It is a limited profit, limited risk options strategy. A butterfly involves the purchase and sale of four options contracts with the same expiration at three different strike prices -- one each at the same levels above and below the at-the-money strike, and one at the ATM strike price. Butterflies can be constructed using calls or puts. Depending on the type of butterfly trade, the trader will buy and sell options in different combinations to set up the required payout bias.