Global Bond

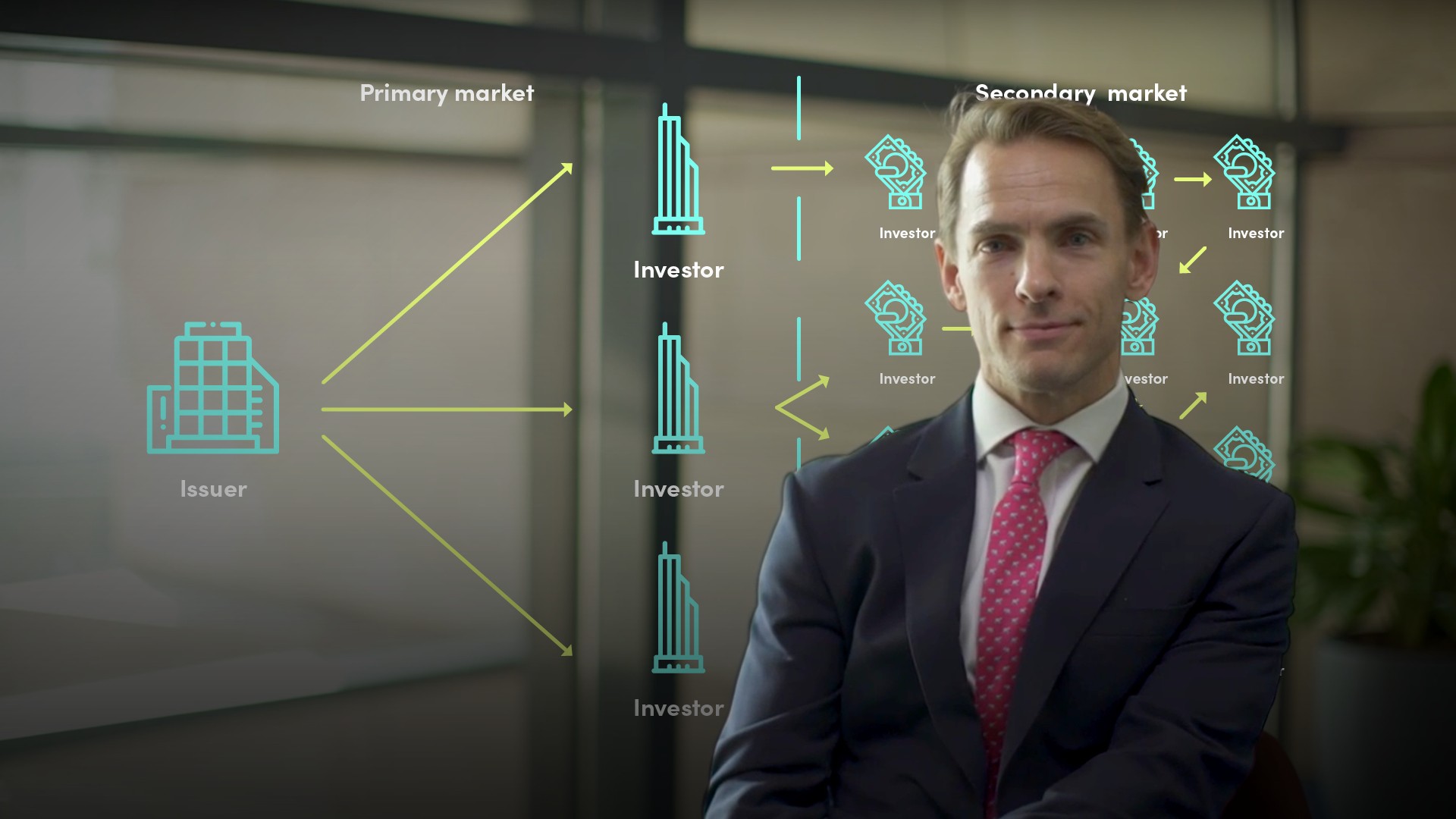

The Global Bond format was inaugurated by the World Bank in September 1989 as an innovative development in international capital markets and now widely used by borrowers. The format is an amalgam of a US domestic bond and a eurobond. Globals were launched simultaneously in the euromarkets, the US domestic market, and depending on the issuer, in Asian capital markets. This format gives issuers the ability to issue in bigger size and achieve investor diversification by distributing globally from one set of documentation. Pricing was decided following pricing discussions with investors world-wide. For trading purposes, investment bank dealers treated globals as home market instruments in the markets in which they were sold. Globals also had multiple clearing arrangements consistent with practices in each market.