Glossary

BankingHybrid Capital

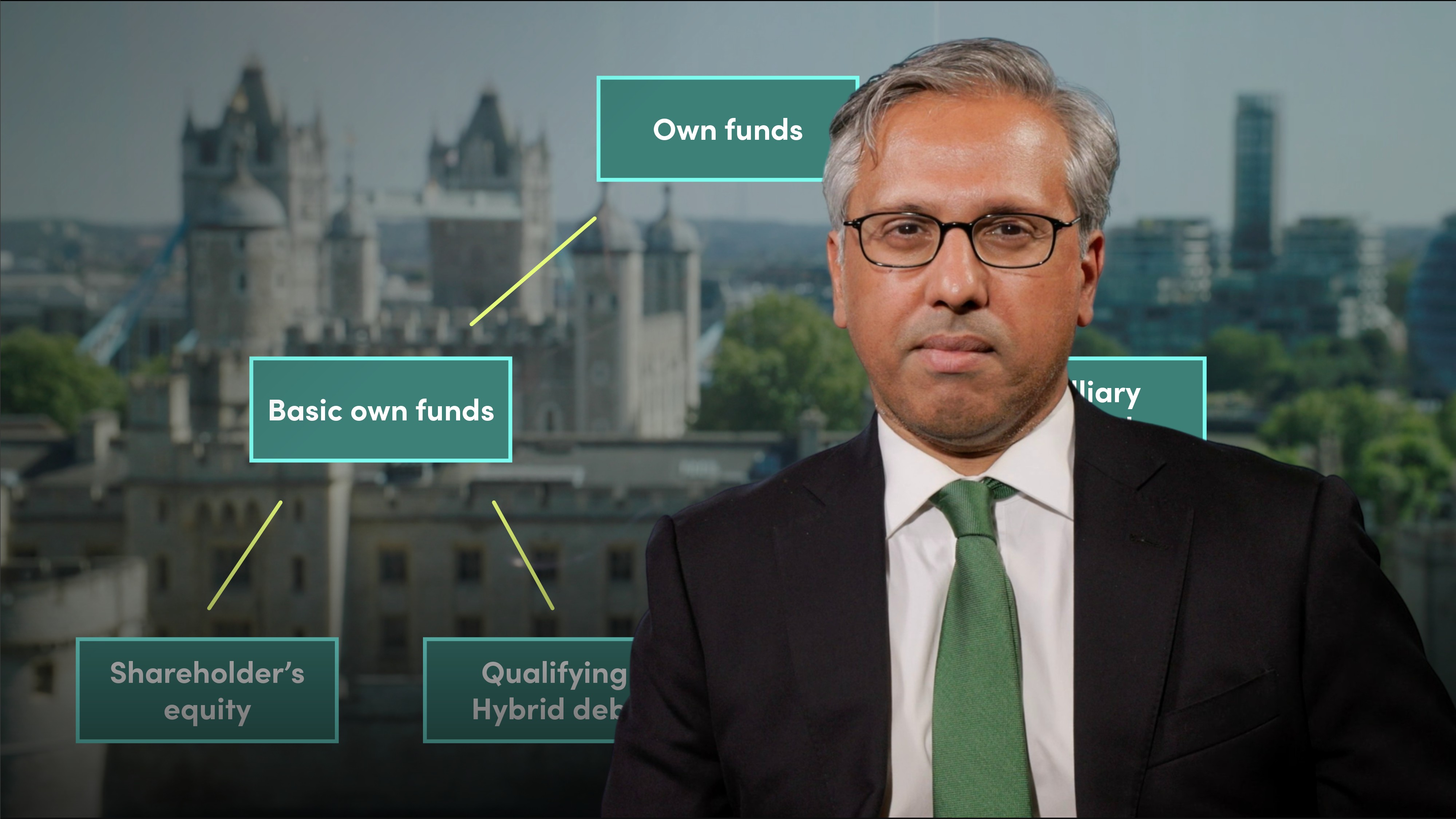

Hybrid capital, as the name suggests, sits at the intersection of debt and equity, sharing characteristics of both. Hybrid capital is deeply subordinated, and as such carries high relative yields. Hybrids can include features that enable issuers to cancel interest or dividend payments under certain conditions; they are typically perpetual or very long dated. Hybrids that are convertible into equity or write down under given circumstances will include specific triggers in the documentation.