Investment Fund

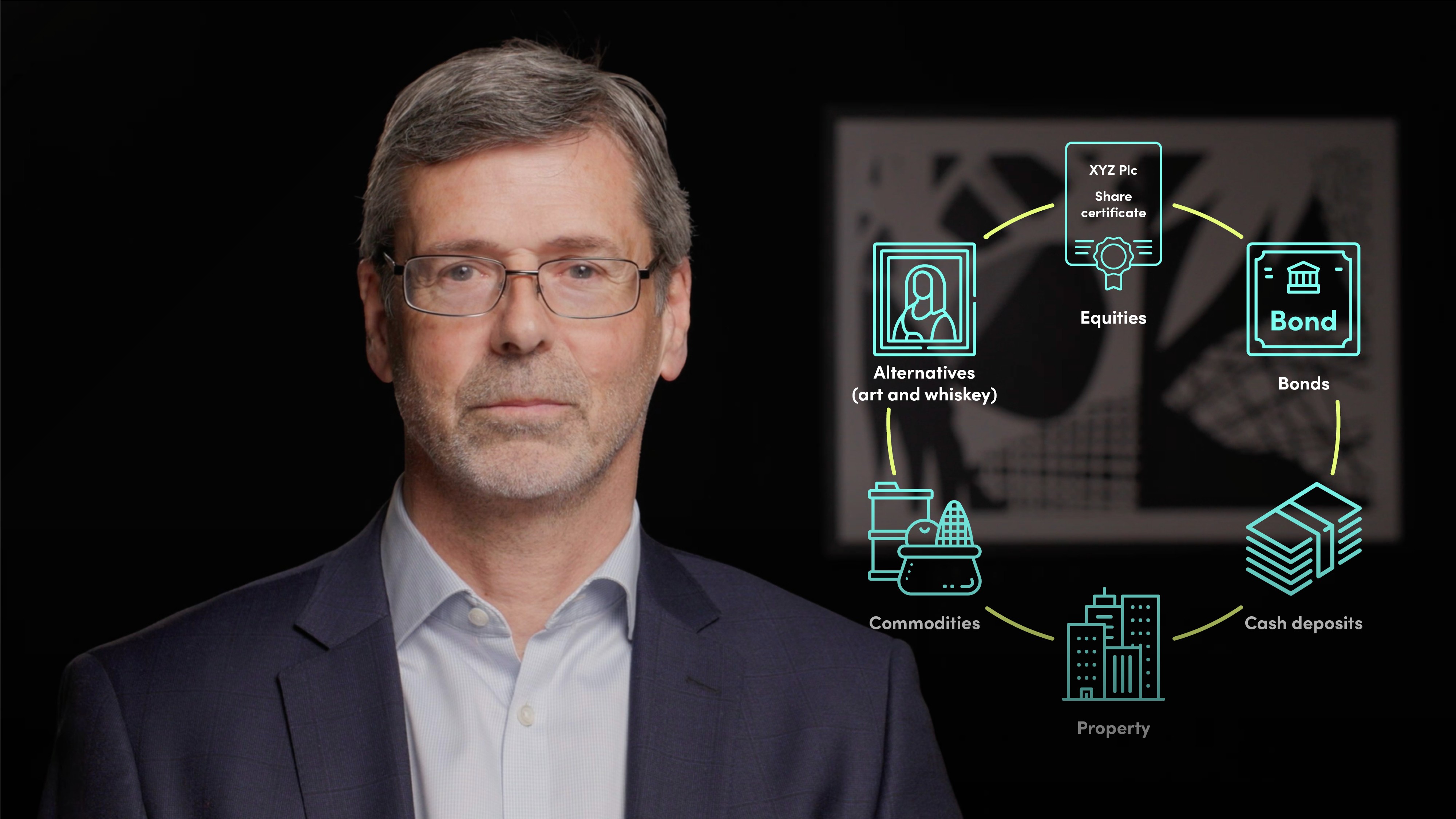

An investment fund is a collective investment scheme managed by a professional fund manager that pools the funds invested by clients. This offers the fund manager the benefits of being able to invest in size. Funds can invest in a wide range of securities (such as equities and bonds) and assets (such as property and commodities). They run the gamut of low risk to high risk. Because fund managers invest client money in a number of different securities or assets, it offers the benefits of diversification that clients would find difficult to replicate investing on their own. Funds move up and down depending on the performance of fund investments, so clients are exposed to the risk of loss. In general, Funds offer the benefits of daily liquidity, meaning investors can exit for cash on a daily basis. Active funds are those where the fund manager buy and sell with the aim of beating the market. Passive funds will track an underlying benchmark (such as the FTSE 100). Fees for passive funds are much lower than fees for active funds.