Macaulay Duration

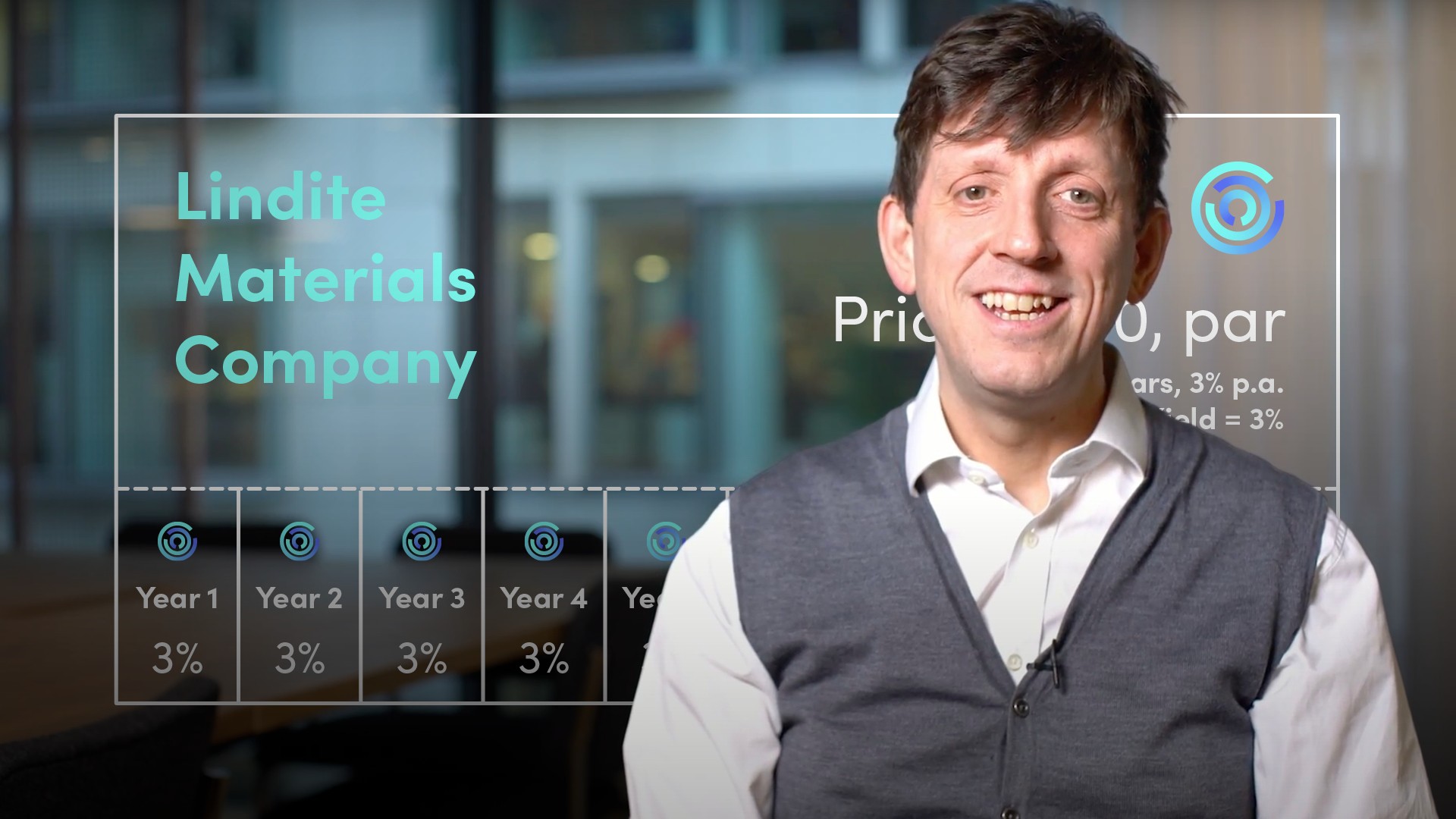

Macaulay duration of how long, on average, the cash flows on an instrument are fixed for. The calculator takes the net present value of a bond’s cash flows (valued at its yield, so that the sum of the values equals its price) and uses them as weights of the time when the cash flows occur, giving the outcome in years. Investors use duration to compare bonds with different maturities and coupons. The duration of a coupon-paying bond is lower than its stated maturity (when yields are positive) because coupons are paid throughout the life of the bond. Lower coupons lead to longer duration because the cash flows are lower. Similarly, long-maturity bonds have higher duration because the cash flows are received over a longer period of time.