Glossary

BankingMake Whole Call Provision

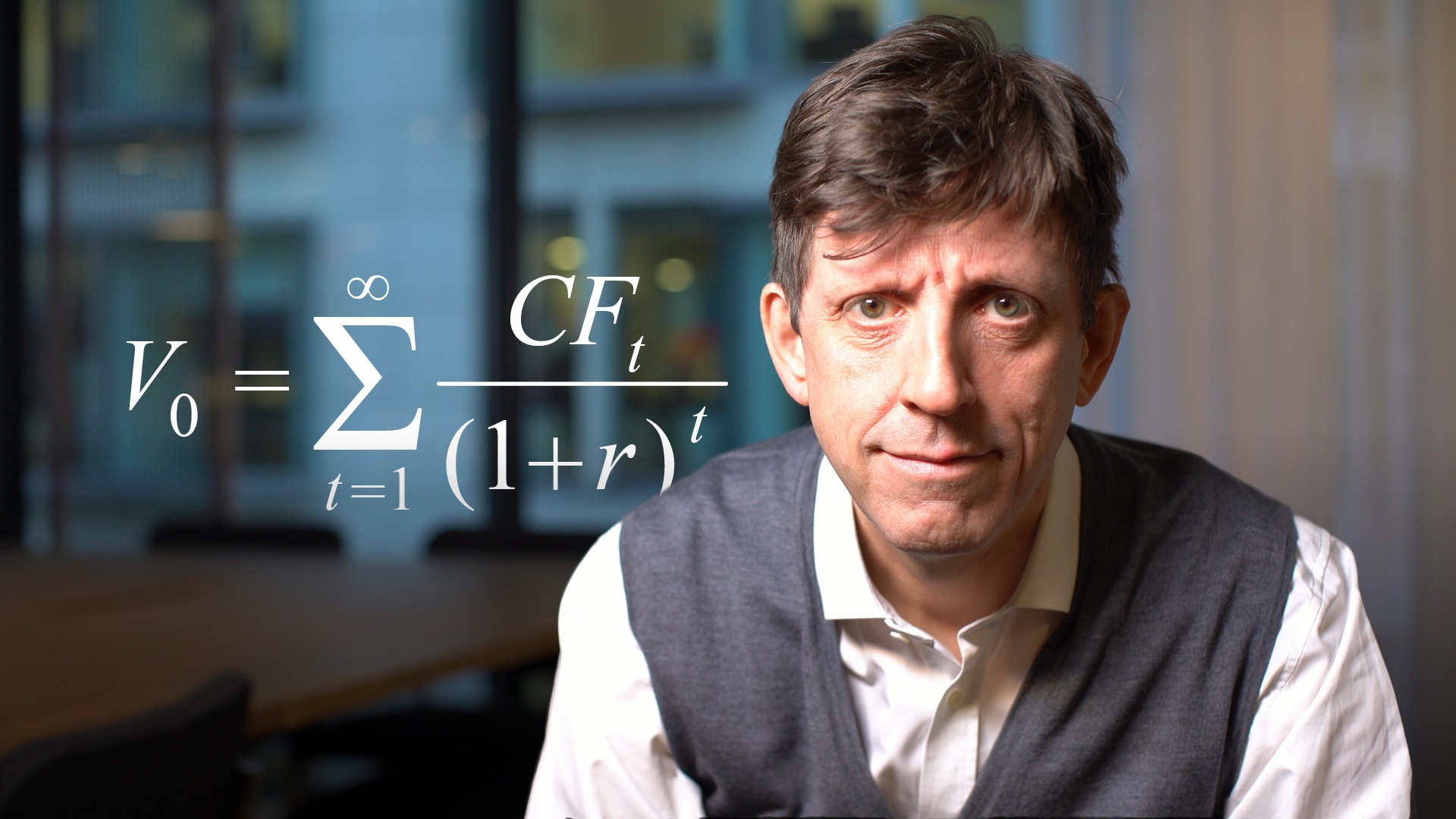

A make-whole call provision can be exercised when an issuer calls a bond i.e. when a bond is retired prior to maturity. Investors are ‘made whole’ i.e. compensated by the issuer to the extent that they receive the present value of the cash flows they would have received had the bond not been called. The make-whole formula (which includes a make-whole spread that acts as the discount rate) can yield a lump-sum payment that is higher than the amount inferred from the current market price of the bond.