Glossary

BankingManagement Buyout (MBO)

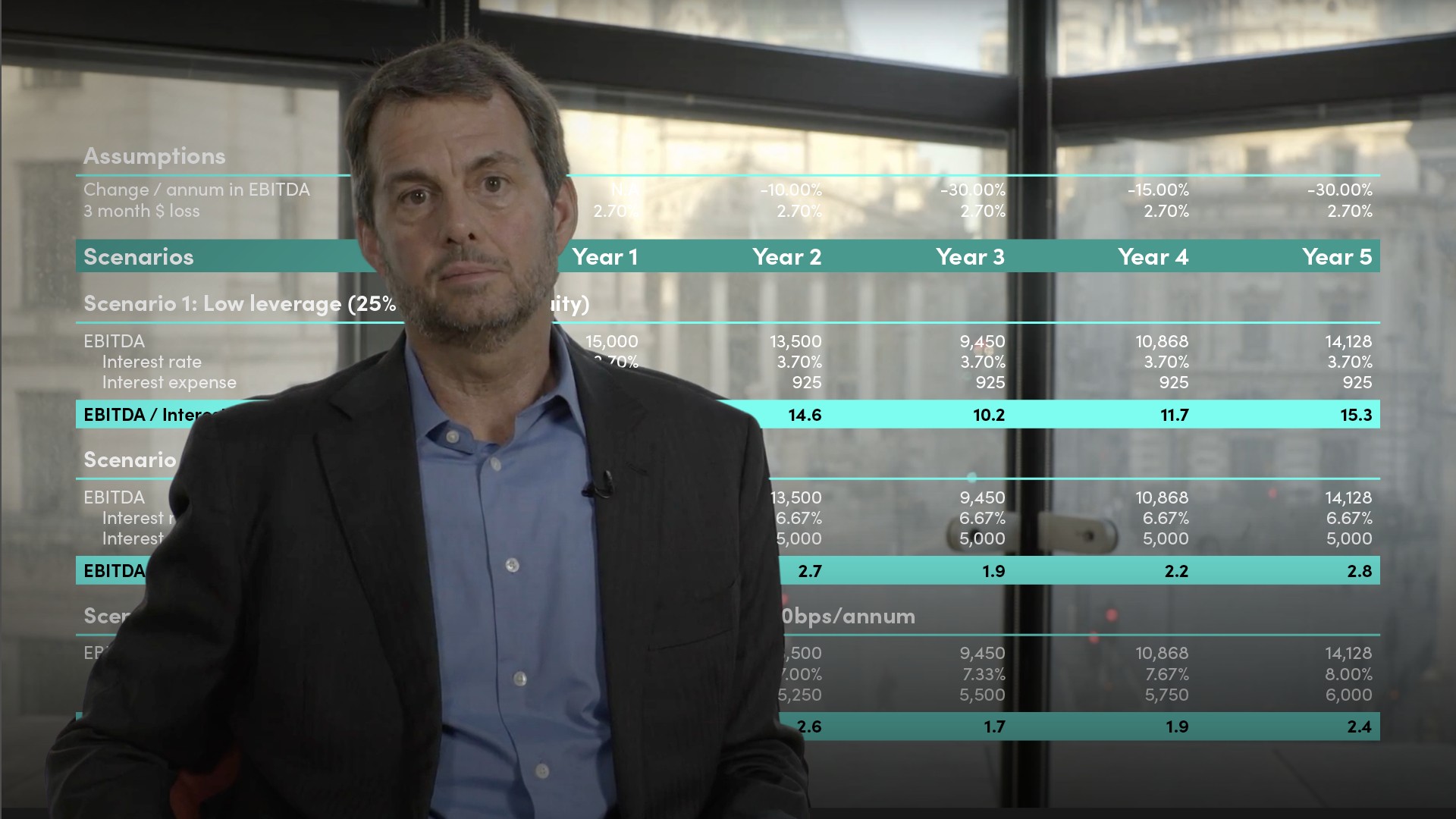

A management buyout (MBO) is an acquisition of a company or a division of a company by its management team. MBOs are funded by a combination of the management team’s own resources (equity) invariably with debt financing from any of a variety of sources, including banks, asset finance companies, private equity firms and vendor financing. Lenders will fund MBOs on the basis that company cash flows are sufficient to pay down the debt on a potentially accelerated schedule. For management, owning the company in successful MBOs offers significant financial upside compared to being employees.