Monte Carlo Simulation

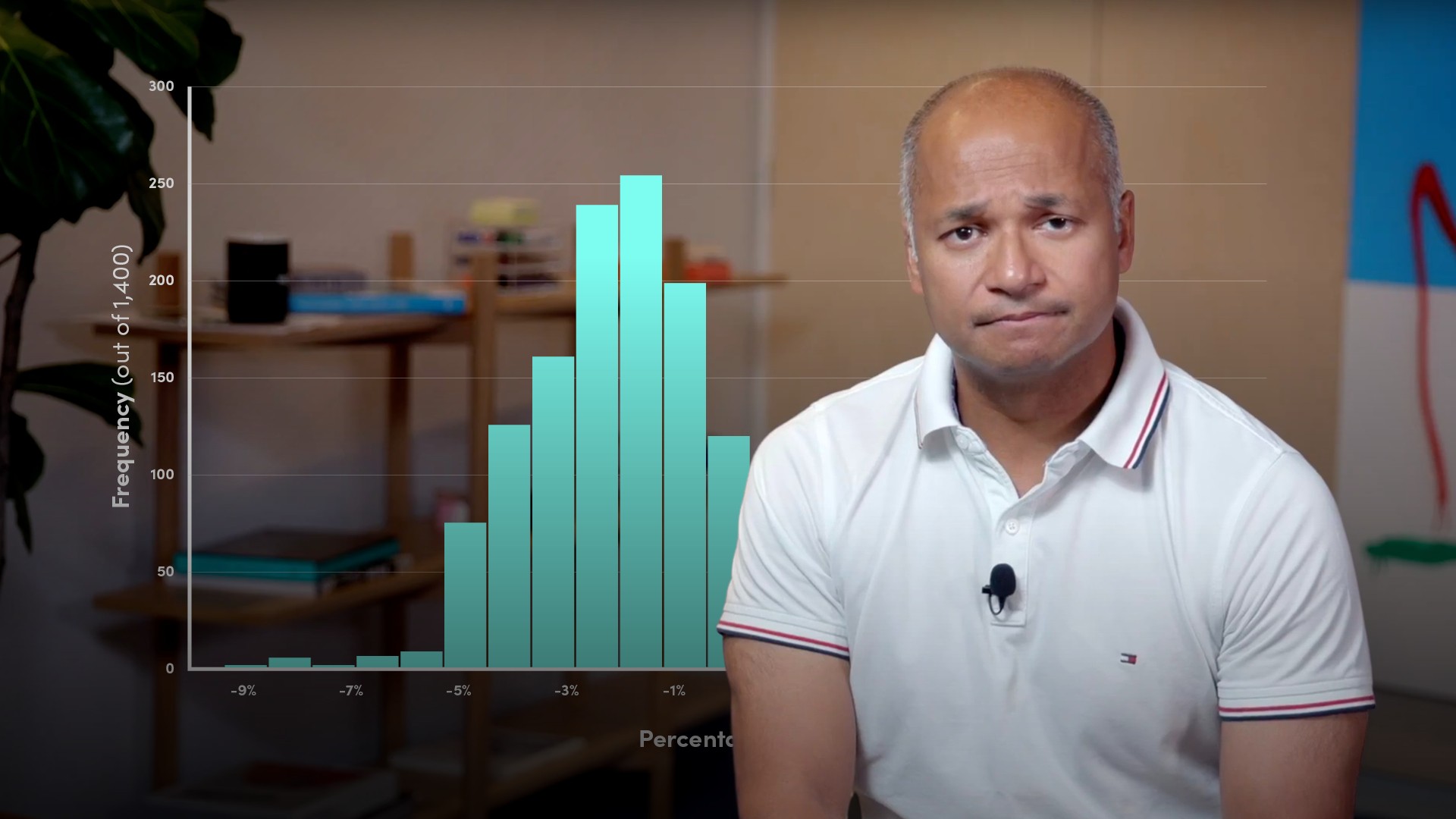

A Monte Carlo simulation is a mathematical/statistical technique that attempts to predict the outcome of events that are uncertain and might include some degree of randomness in the outcome. For example, the current stock price is 100 and we want to know what the price could be tomorrow. We can input our assumptions into the model and run a simulation that would produce an outcome for tomorrow. Running the simulation numerous times will produce a range of outcomes and its associated probability distribution. In the world of finance it has numerous potential uses in areas such as risk management, portfolio management, forecasting, asset and project valuation and in pricing derivatives. It is widely used in the pricing of path-dependent options such as barrier options.