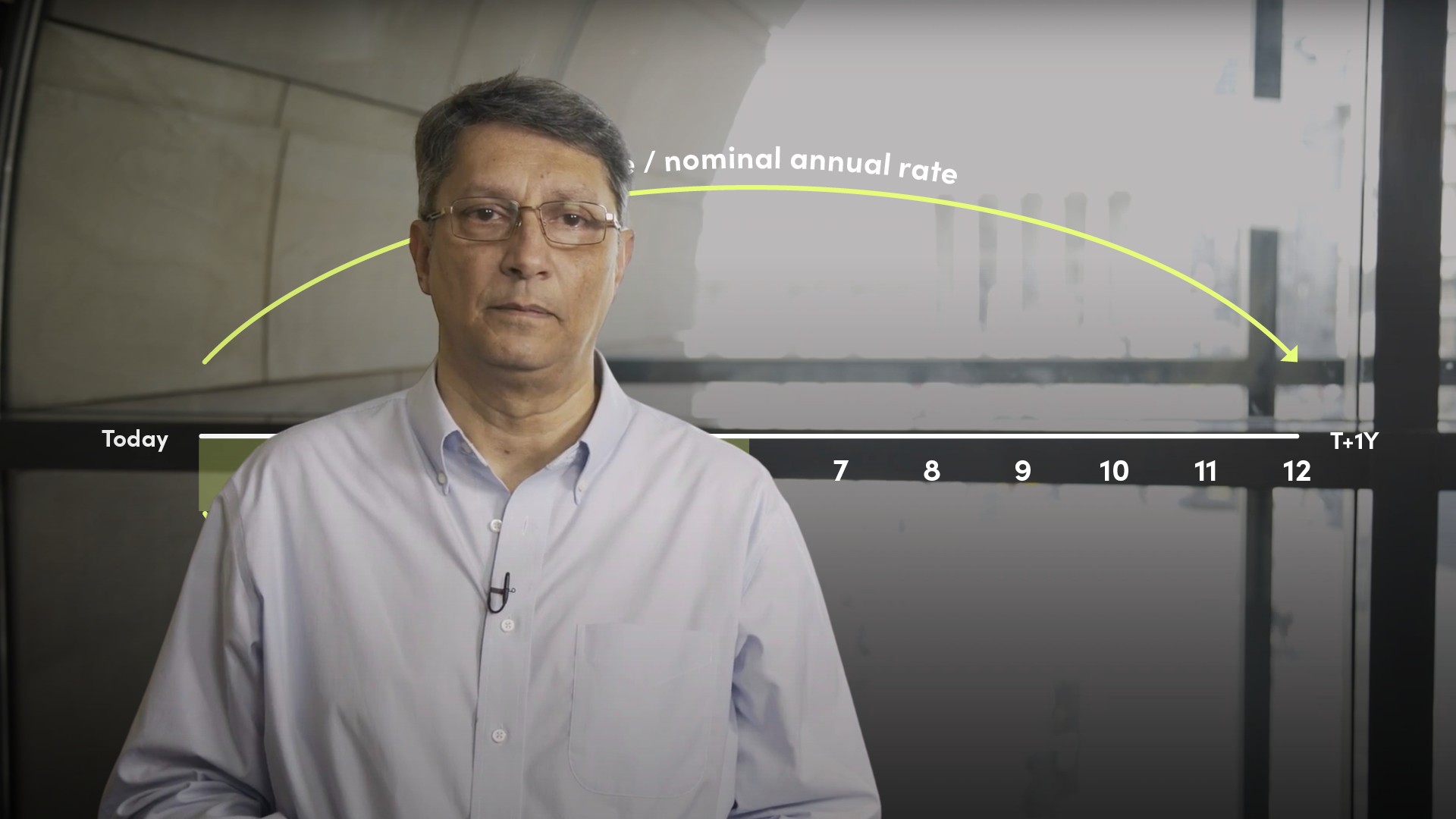

Periodic Interest Rate

The periodic interest rate is the annual interest rate on outstanding debt divided by how often interest compounds. Lenders can apply compounding periods of one month or one day. The periodic interest rate of a credit card balance bearing an annual percentage rate (APR) of 18.25% compounded daily is 0.05% on a 365-day calculation basis. Knowing what the periodic interest rate and compounding periods are enables borrowers to calculate how much interest will accrue on debt outstandings over a set period of time. Credit card companies take a daily periodic rate to calculate interest owed on credit card balances at the end of each day. This amount is added to the balance of the previous day and so on.