Residential Mortgage-Backed Security (RMBS)

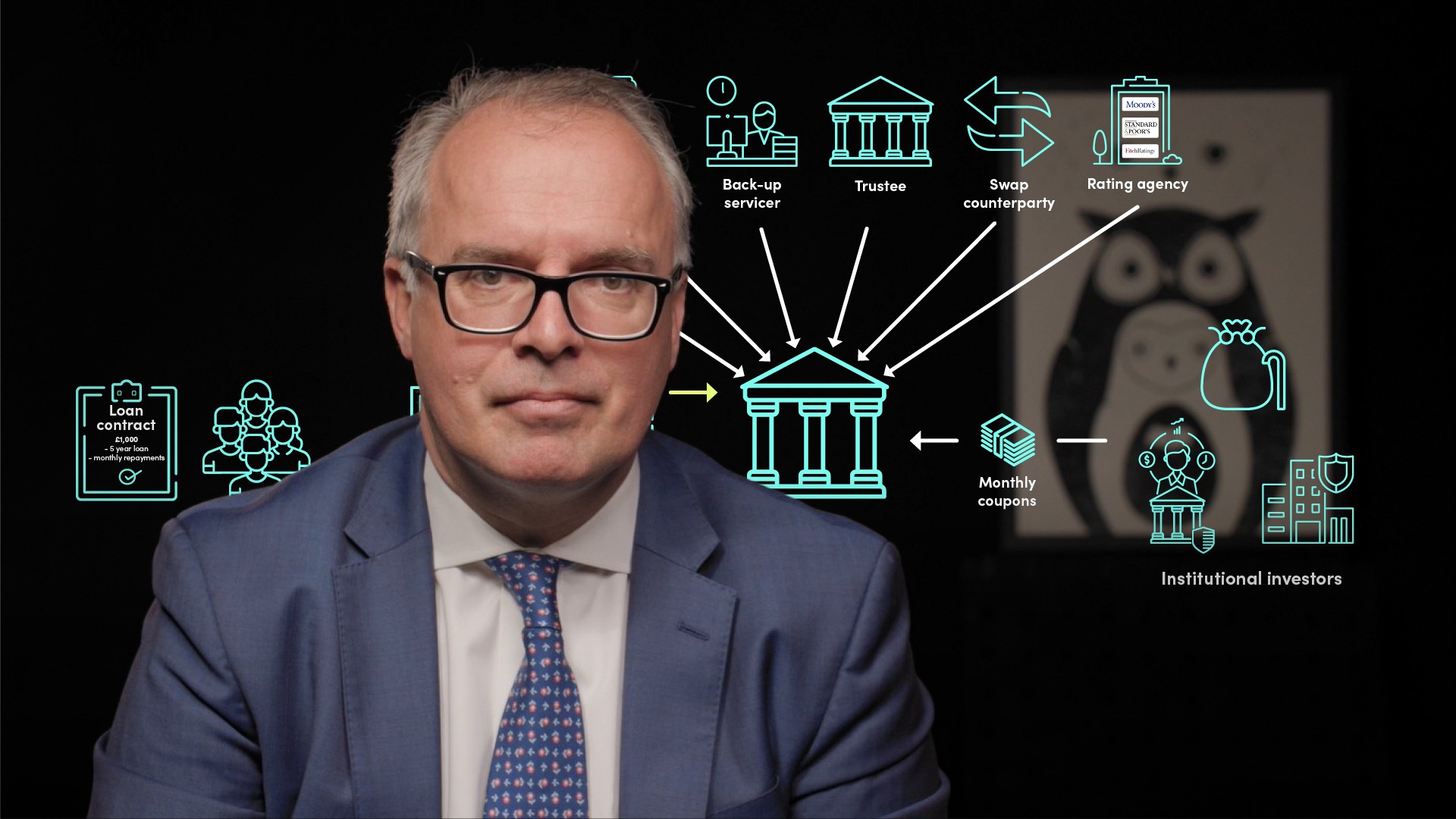

A residential mortgage-backed security (RMBS) is a securitised bond whose cash flows are paid from the mortgage payments and redemptions of hundreds or thousands (depending on the transaction) of underlying residential mortgages. In a typical RMBS transaction, the mortgage originator or the owner of a portfolio of residential mortgages sells a portfolio to a non-recourse special purpose vehicle (SPV) whose only assets are the mortgages. To finance the acquisition of the mortgages, the SPV issues a series of bonds (RMBS) that are split into tranches, each reflecting a different level of risk. Cash flows from the underlying mortgages are automatically passed from the seller of the mortgages to the SPV, which then passes the cash flow to buyers of the RMBS. Holders of the senior RMBS notes are first in line to be paid, followed by intermediate-risk investors (known as mezzanine holders) and finally by holders of so-called first-loss, junior or equity tranches. Cash from the mortgages is passed down the line from senior to junior noteholders. If the cash received in a given period is insufficient to pay all RMBS noteholders (say because a certain proportion of mortgage borrowers has failed to make their mortgage payments), the mezzanine or junior holders may not get paid. This risk is reflected in the returns paid to the various classes of noteholders: senior noteholders are paid the lowest return; junior noteholders the highest return.