Reverse Takeover

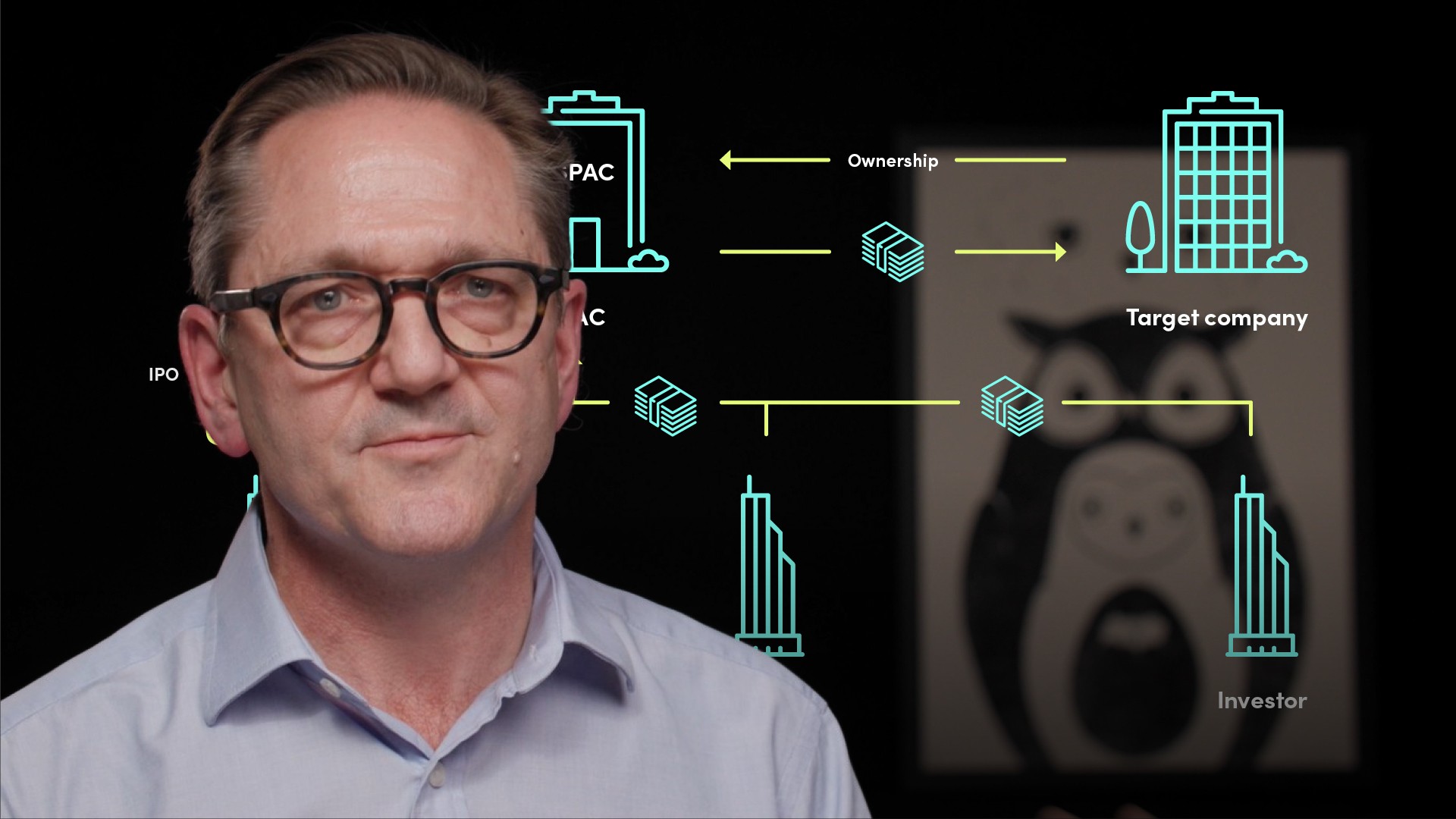

Where a bidder in an acquisition is substantially smaller than the takeover target to the extent that the acquisition terms give shareholders in the target company a majority ownership of the combined company, this is referred to as a reverse takeover. The UK Takeover Code considers a takeover a reverse takeover “if an offeror might as a result need to increase its existing issued voting equity share capital by more than 100%”. Alternatively, the process whereby a private company goes public by acquiring an existing shell company (or a majority stake) is also a reverse merger. Special Purpose Acquisition Companies (SPACs) essentially conduct reverse takeovers, raising money through IPOs and investing the capital raised to acquire companies, which are reversed into the public SPAC entity; the SPAC changing its name to the acquired company