Tight Monetary Policy

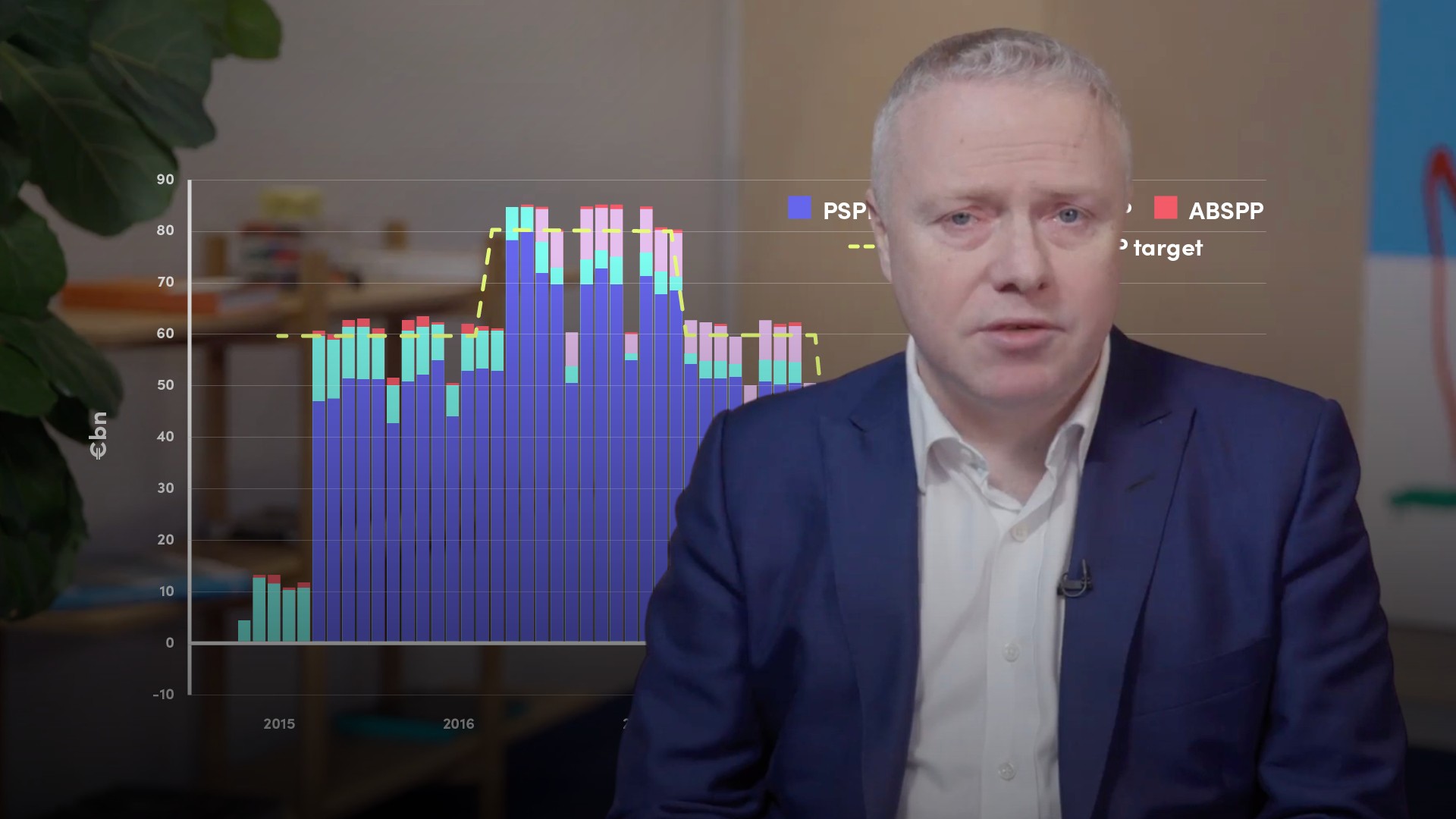

A central bank’s monetary policy refers to the stance it adopts and tools it uses to manage the economy to achieve its inflation targets and to create its desired conditions. Central banks have a variety of tools at their disposal, particularly since the onset of the long-run phase of quantitative easing. As well as unconventional QE tools such as asset-purchasing, central banks have traditionally used interest rates and/or bank reserve requirements to encourage desired monetary outcomes. Other tools include so-called macroprudential measures. In late 2021, for example, some central banks started raising bank’s countercyclical capital buffers and introducing borrower-based limits on house purchases (capping LTVs and debt-to-income) to cool credit growth in excess of GDP growth. Monetary policy can be referred to as loose or tight. In a period of tight (a.k.a. hawkish) monetary policy, a central bank might increase interest rates and/or reserve requirements to decrease the money supply, discourage lending and consumer spending in order to curb inflation.