Volatility

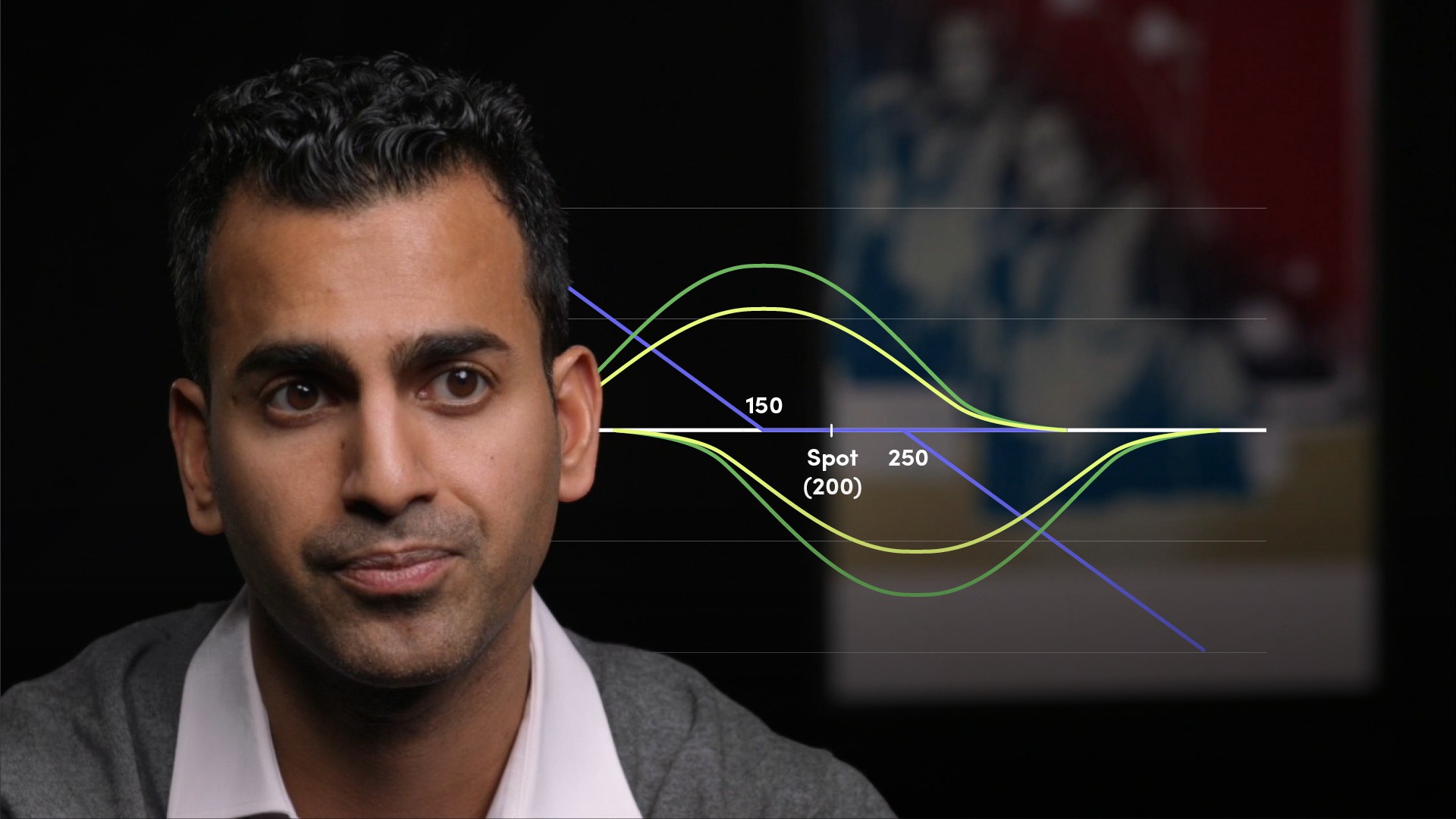

Volatility in the area of financial markets refers to the extent to which prices rise and fall. Risky securities and financial products tend to have more volatile prices. Volatility can be measured mathematically by calculating variance or the standard deviation of returns. In financial options, traders use the notion of implied volatility – potential future volatility – to determine options prices. Implied volatility uses as a baseline historical (or realised) volatility. While higher volatility comes with higher risk, investors will be compensated by the prospect of higher returns. Volatility lies at the heart of the Capital Asset Pricing Model. Here, the volatility of a stock relative to the stock index determines the return an investor should demand over the risk-free rate.