Glossary

Investment ManagementZero Cost Collar

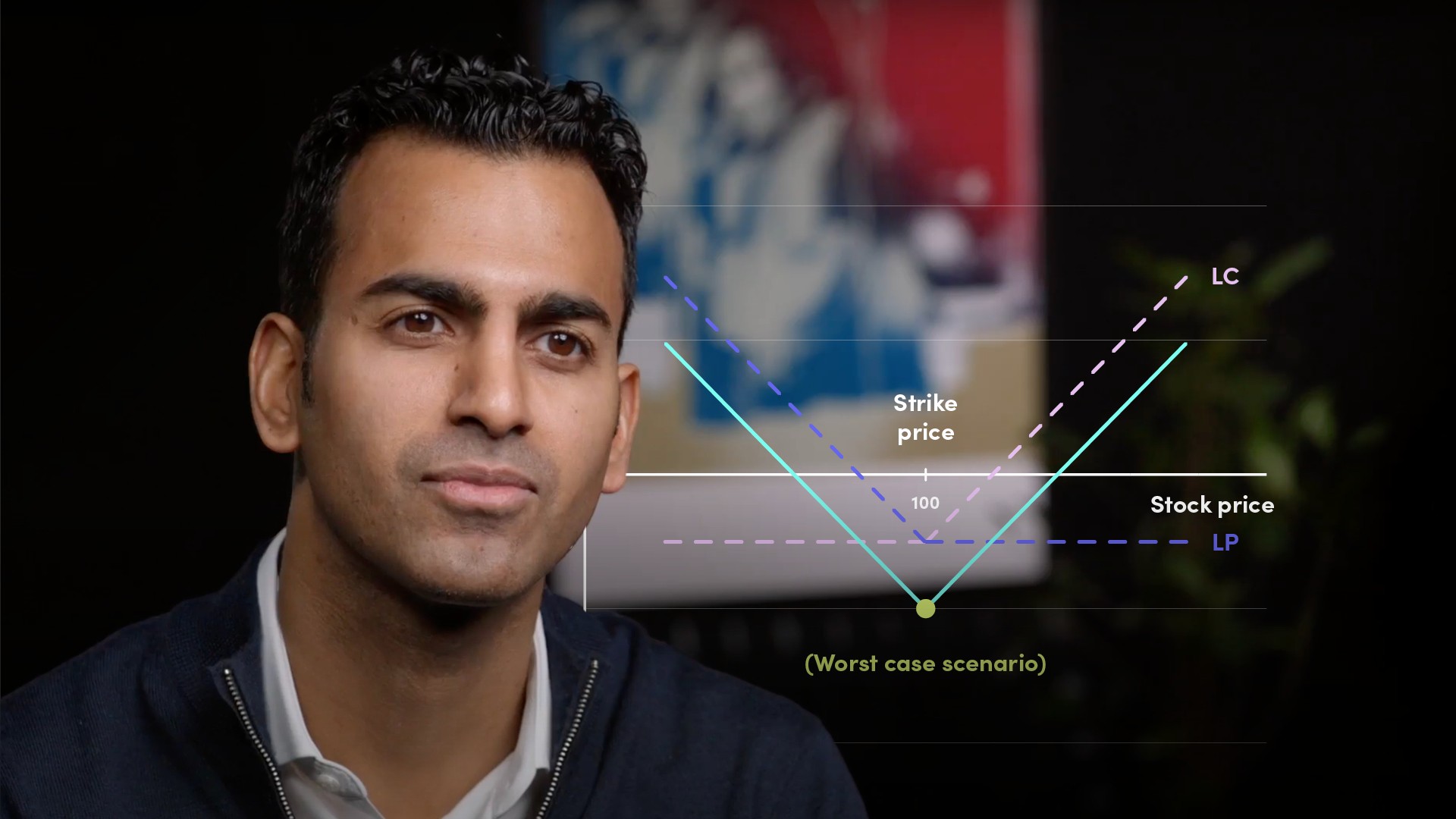

A zero-cost collar is a derivatives hedging position in which a trader buys a put and sells a call on an underlying owned security such that the premium paid on the sale of the put is equal to the premium received on the sale of the call hence it has zero cost. The put leg of the trade protects the downside to the put strike while profit on the upside is capped at the call strike.