Glossary

Technical FoundationsZero-Volatility Spread

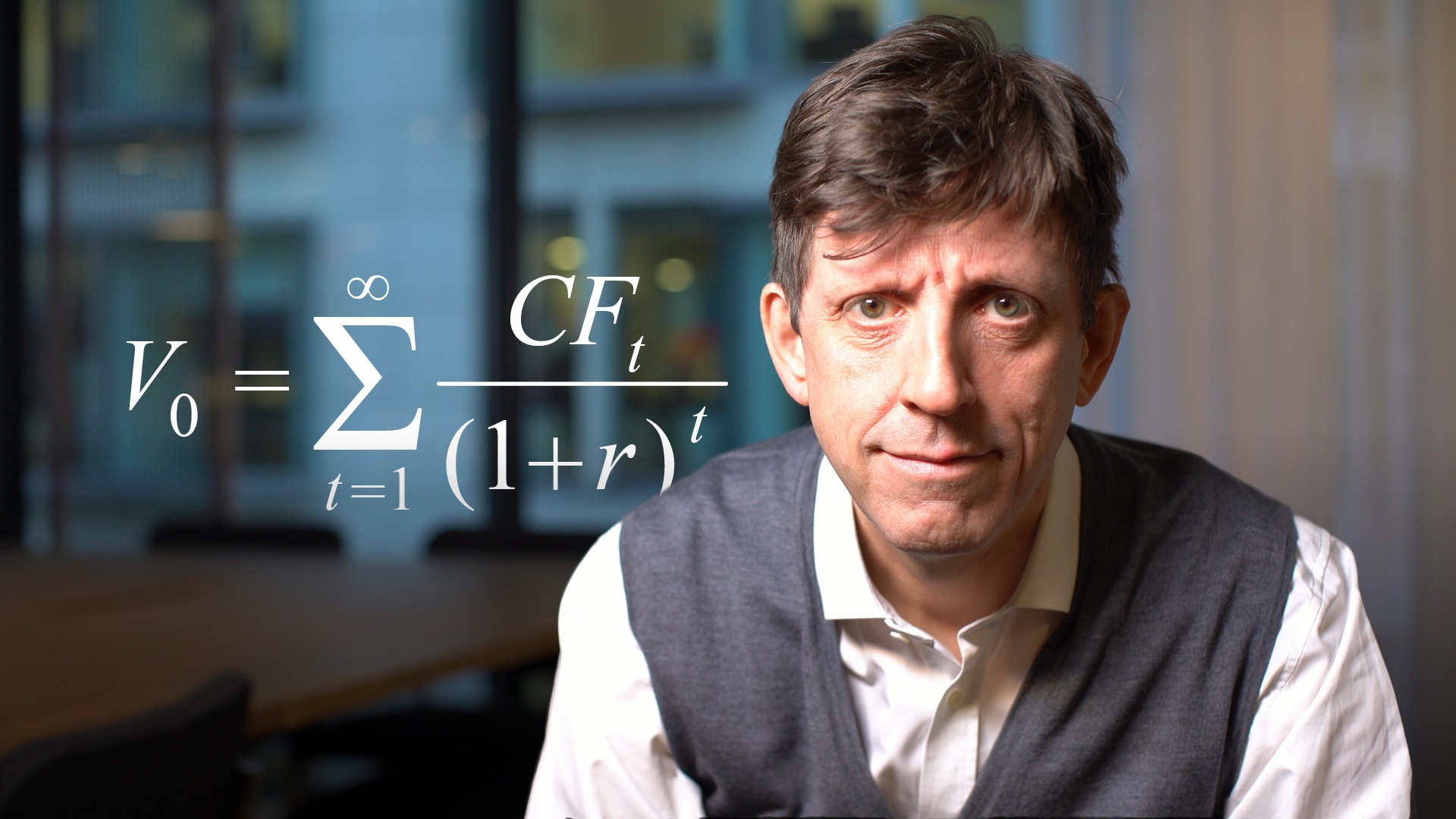

While the nominal spread of a corporate bond is a point-in-time differential at that maturity point between a bond and the underlying government security, the zero-volatility spread (z-spread) is the static spread over the full government yield curve. It is the spread (in basis points) that an investor would need to add to the spot yield such that the discounted cash flows of the bond (using the spot yield plus the z-spread as the discount factor) equal the bond’s current price.