Tackling the Cost of Living Crisis

In this video, Max discusses the cost-of-living crisis currently enveloping the UK. He examines its impact on households as well as the overall economy. Max also outlines why traditional policy tools may not be enough to bring us out of the crisis and discusses some unconventional policies which may help.

Max Mosley • 10:39

Diversity and Inclusion in Financial Services

In this two-part series, Nisrin shares her insight into diversity and inclusion in the workplace, with a particular focus on the financial services industry in the UK. She also talks us through her experience as a woman in the banking sector, as gender equality, or the lack thereof, is a key issue among many others when it comes to matters of diversity and inclusion.

Nisrin Abouelezz • 06:25

CSR and Sustainability in Financial Services

In the first video of this two-part video series, Elisa introduces us to sustainability. She begins by looking at the difference between sustainability and corporate social responsibility, two terms that can be easily confused.

Elisa Moscolin • 07:01

Alternative Data in Finance

Alternative data is the new gold in finance. Every time that we like, dislike, or post something online, we are creating this new breed of data. In fact, some companies are now using this to predict quarterly earnings and performance. Join Carlos Salas in this video as he explores the benefits and challenges of alternative data.

Carlos Salas • 09:09

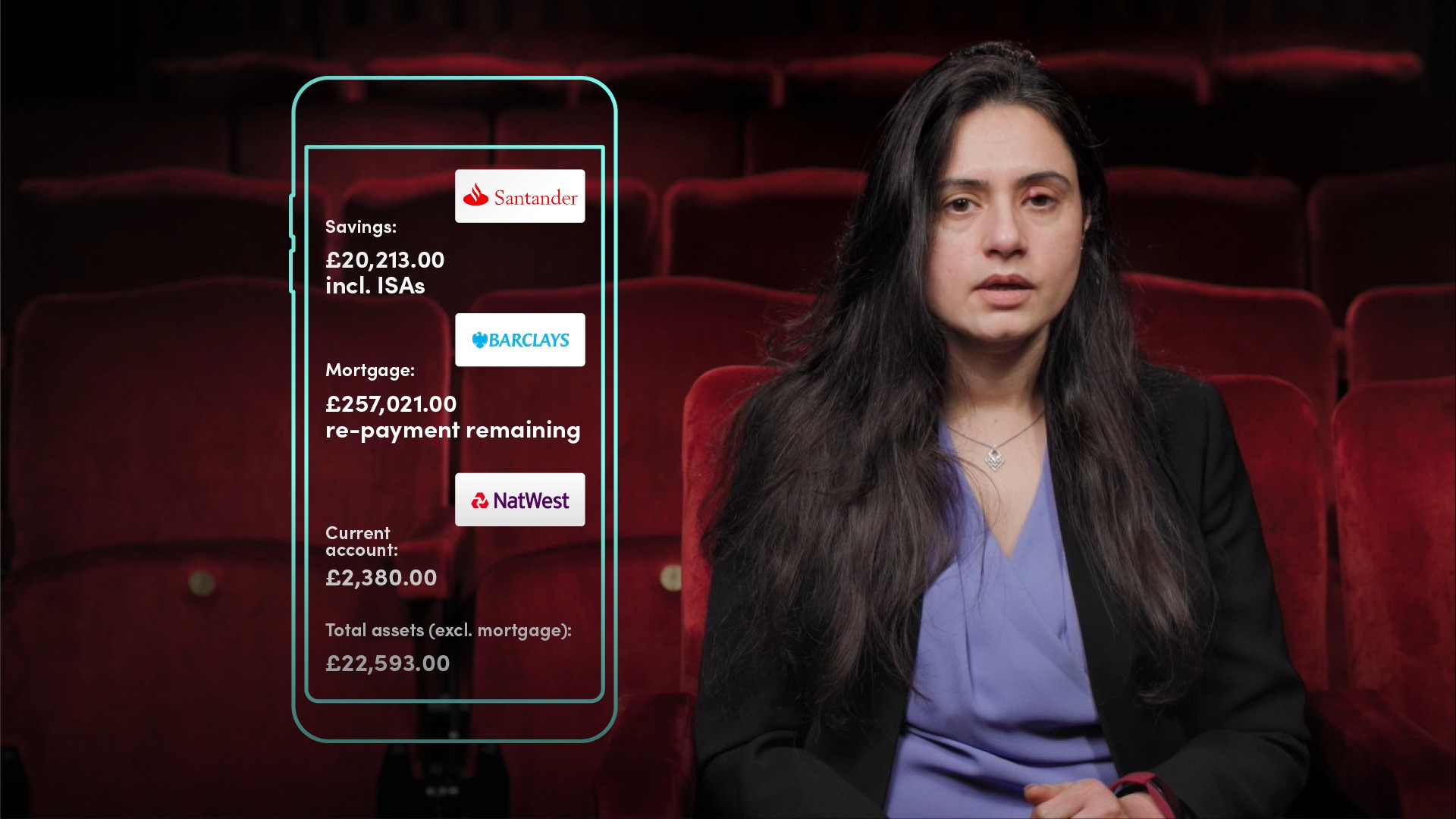

What are the Benefits of Open Banking?

Open banking refers to the idea that customers have a right to see, and utilise their entire portfolio of account information across all financial institutions with whom they have a relationship. In this video Ritu gives us an overview of Open banking and further highlights the expected practical implications of open banking for the customer.

Ritu Sehgal • 04:20

Macroeconomic Simulation of a Global Carbon Tax Shock I

In this video, Kemar explores the effects of a rise in carbon tax accompanied by a temporary rise in global credit constraints. Kemar will guide you through the two key aspects of a carbon tax shock and the anticipated economic knock-on effects.

Kemar Whyte • 09:43

The Need for Global Insurance Regulation

In the first video of this series, Sukhy emphasises the importance of regulating insurance companies with reference to the infamous collapse of AIG during the financial crisis. Sukhy discusses the international role of the Financial Stability Board (FSB) in insurance regulation post-financial crisis.

Sukhy Kaur • 09:19

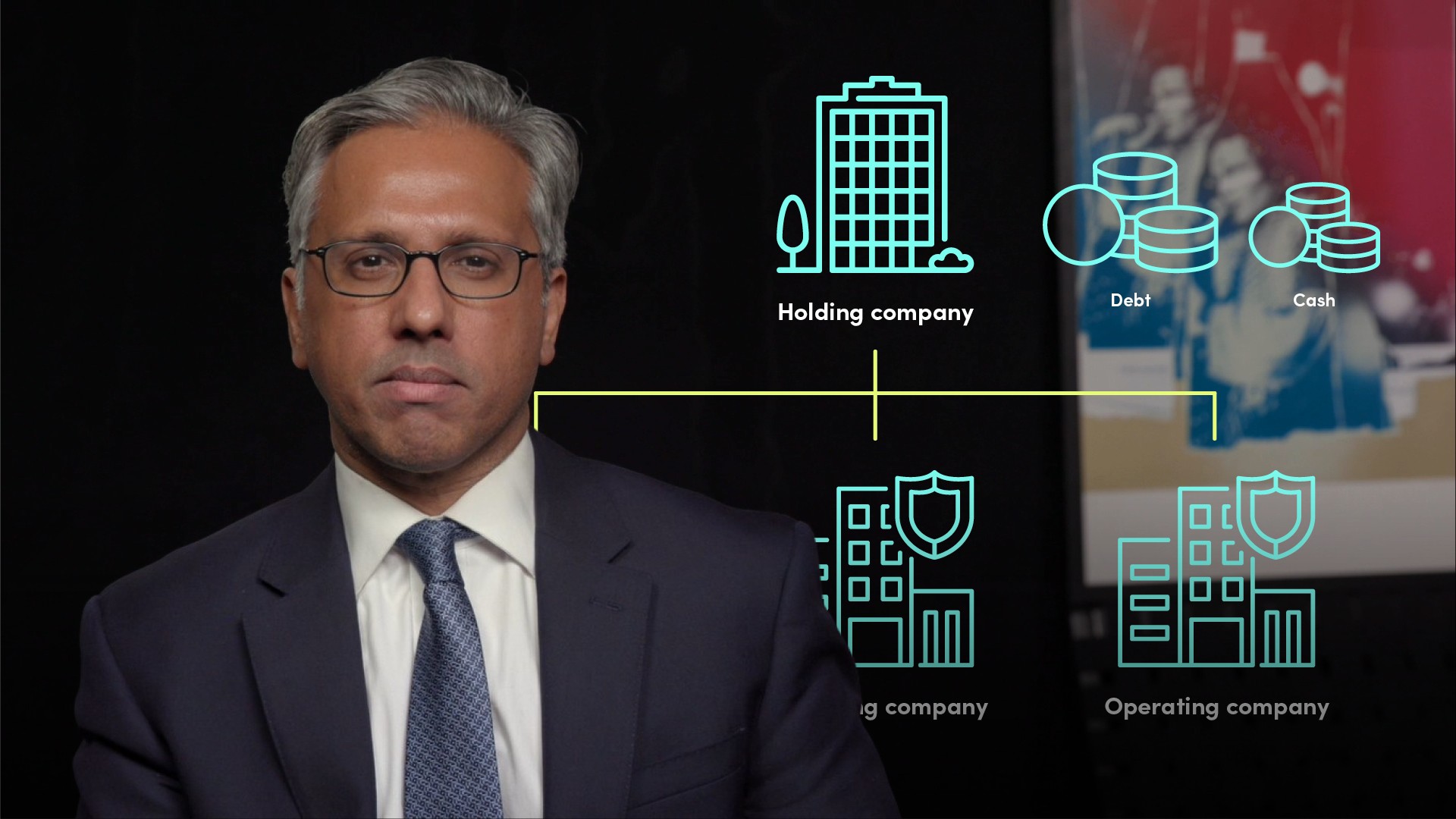

Introduction to Insurance Funding and Capital Ratings I

In this video, Gurdip describes how the Financial Strength Rating is used as an anchor rating and why there is often a rating differential between the holding company and its subsidiaries.

Gurdip Dhami • 12:46