ETF Arbitrage

Gontran de Quillacq

25 years: Derivatives trading & ETFs

This video explains how arbitrageurs gain profits through mismatches between constituent share prices versus ETF prices and the problems with using ETFs to gain arbitrage profits.

This video explains how arbitrageurs gain profits through mismatches between constituent share prices versus ETF prices and the problems with using ETFs to gain arbitrage profits.

ETF Arbitrage

9 mins 3 secs

Key learning objectives:

Understand how arbitrageurs gain profits through mismatches between constituent share prices versus ETF prices

Understand the influence of arbitrageurs

Understand the problems with using ETFs to gain arbitrage profits

Overview:

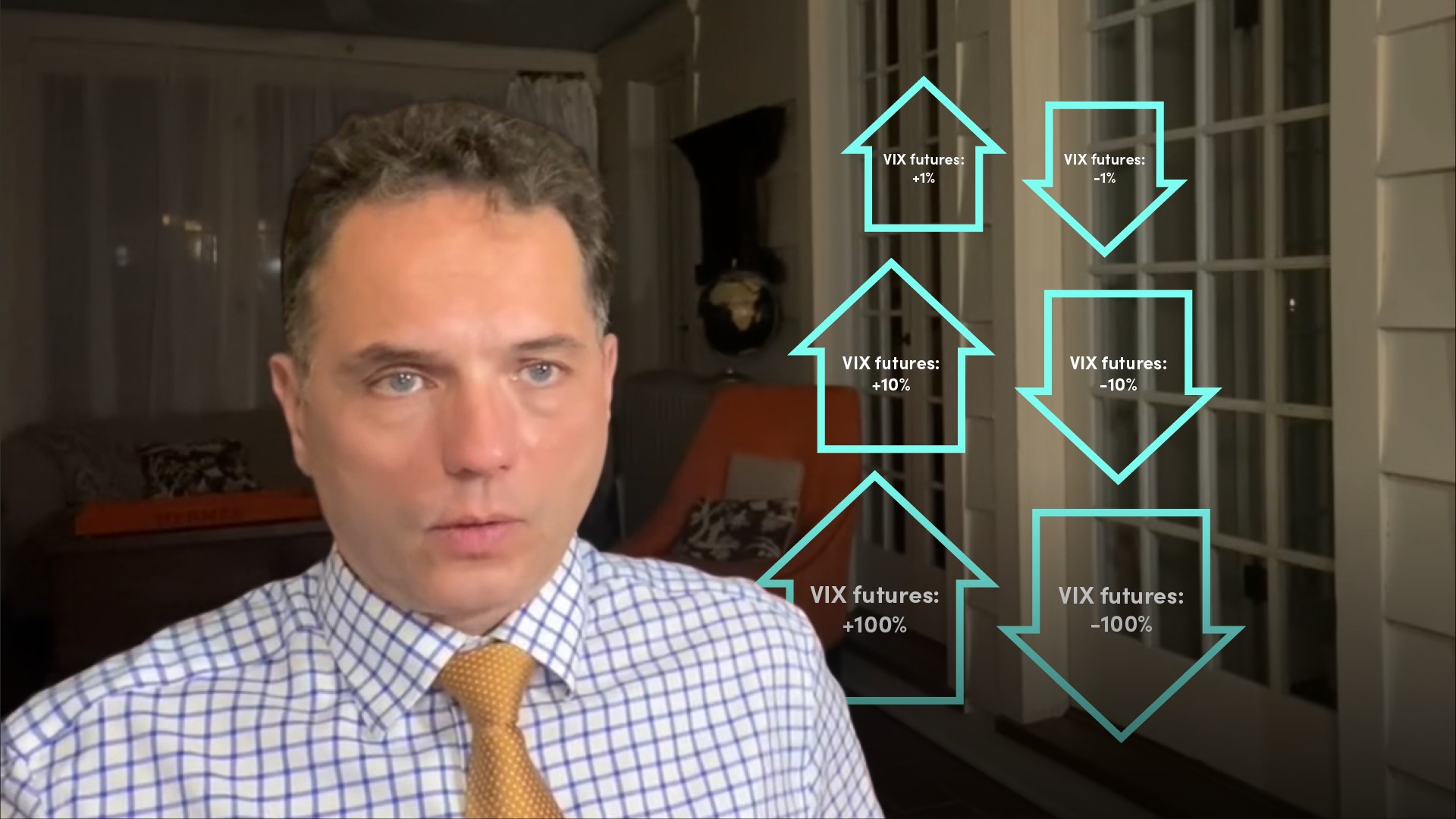

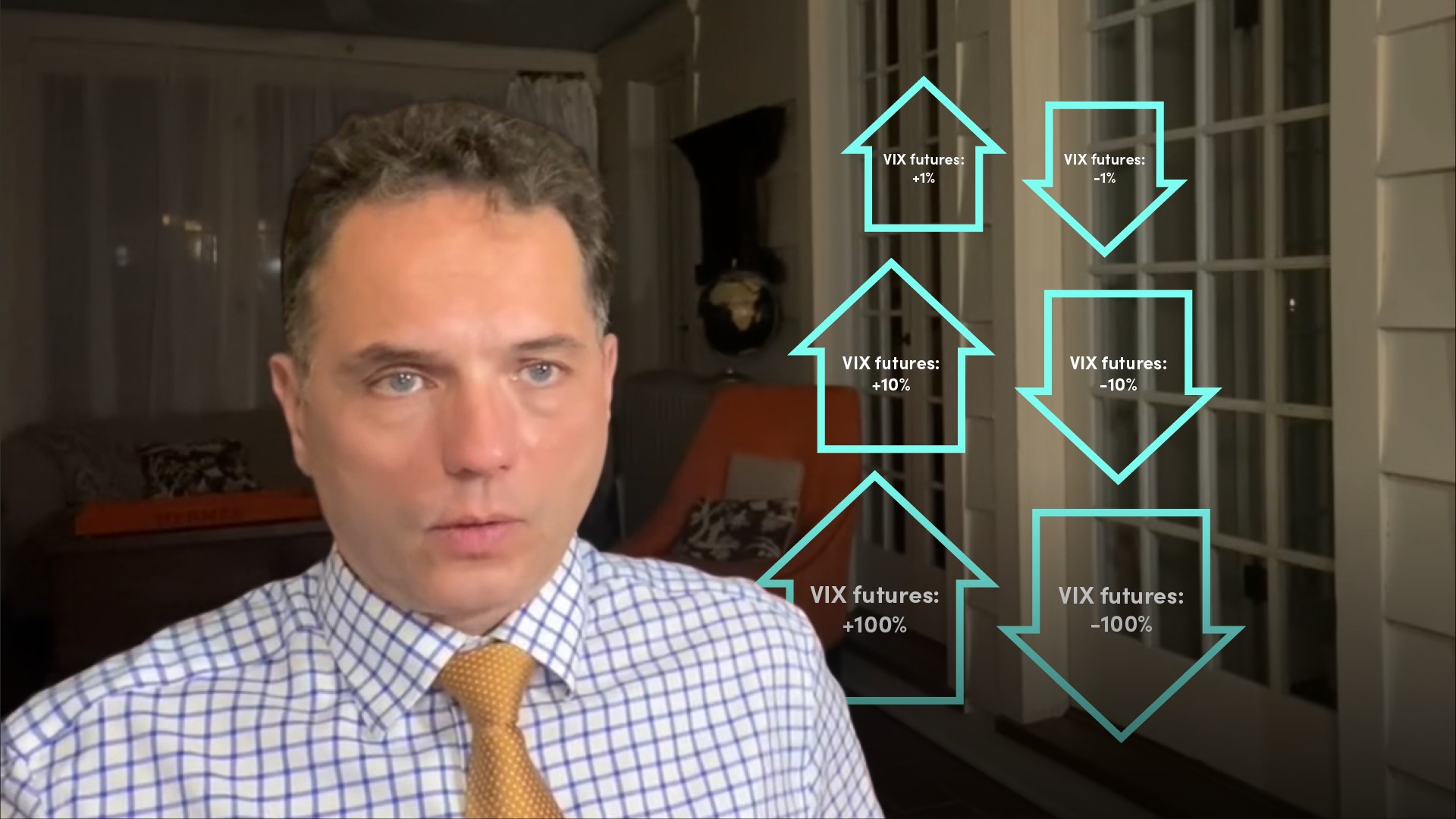

The fact that you can create and redeem ETFs easily and at virtually no cost, means you can create ETF inventory very easily. Arbitrageurs therefore will monitor the ETF price, and recalculate the real-time value of the constituent shares, and they will jump in whenever the prices deviate.

When do arbitrageurs jump in?

The constituent shares and the ETF have their own supply and demand, meaning the prices can go up and down independently. They tend to remain in sync, but sometimes they don’t. Arbitrageurs will be constantly monitoring the price of both the ETF and the constituent shares, as soon as there is a deviation in the price they will jump in.

Assuming the bid of an ETF is higher than the offer on the basket, the arbitrageurs will sell the ETF and buy the basket of shares.

What influence do the arbitrageurs have?

Due to the fact that arbitrageurs will jump in and buy or sell whenever there is a price discrepancy, means that ETF prices rarely deviate from the theoretical value of its basket of shares.

Gontran de Quillacq

There are no available Videos from "Gontran de Quillacq"