ETF Creation process

Gontran de Quillacq

25 years: Derivatives trading & ETFs

Market-makers are the only market participants authorised to create units with ETF fund managers, but they have to get the ETF shares from the fund manager. The way they do this is through a creation/redemption process. This video helps you understand the creation/redemption processes, along with their benefits and disadvantages.

Market-makers are the only market participants authorised to create units with ETF fund managers, but they have to get the ETF shares from the fund manager. The way they do this is through a creation/redemption process. This video helps you understand the creation/redemption processes, along with their benefits and disadvantages.

ETF Creation process

12 mins 49 secs

Key learning objectives:

Understand the creation/redemption process

Understand the benefits and disadvantages of the creation/redemption process

Overview:

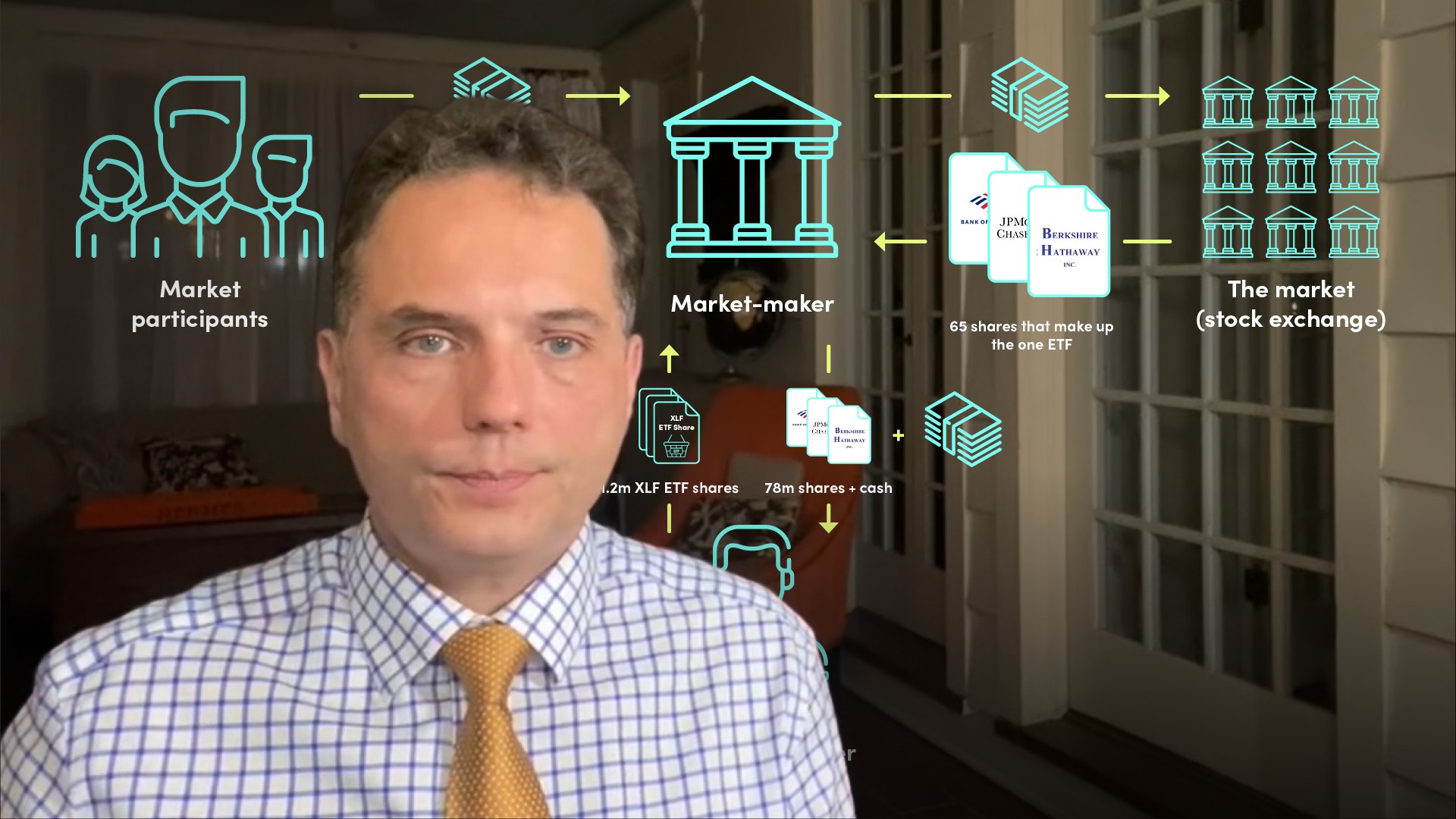

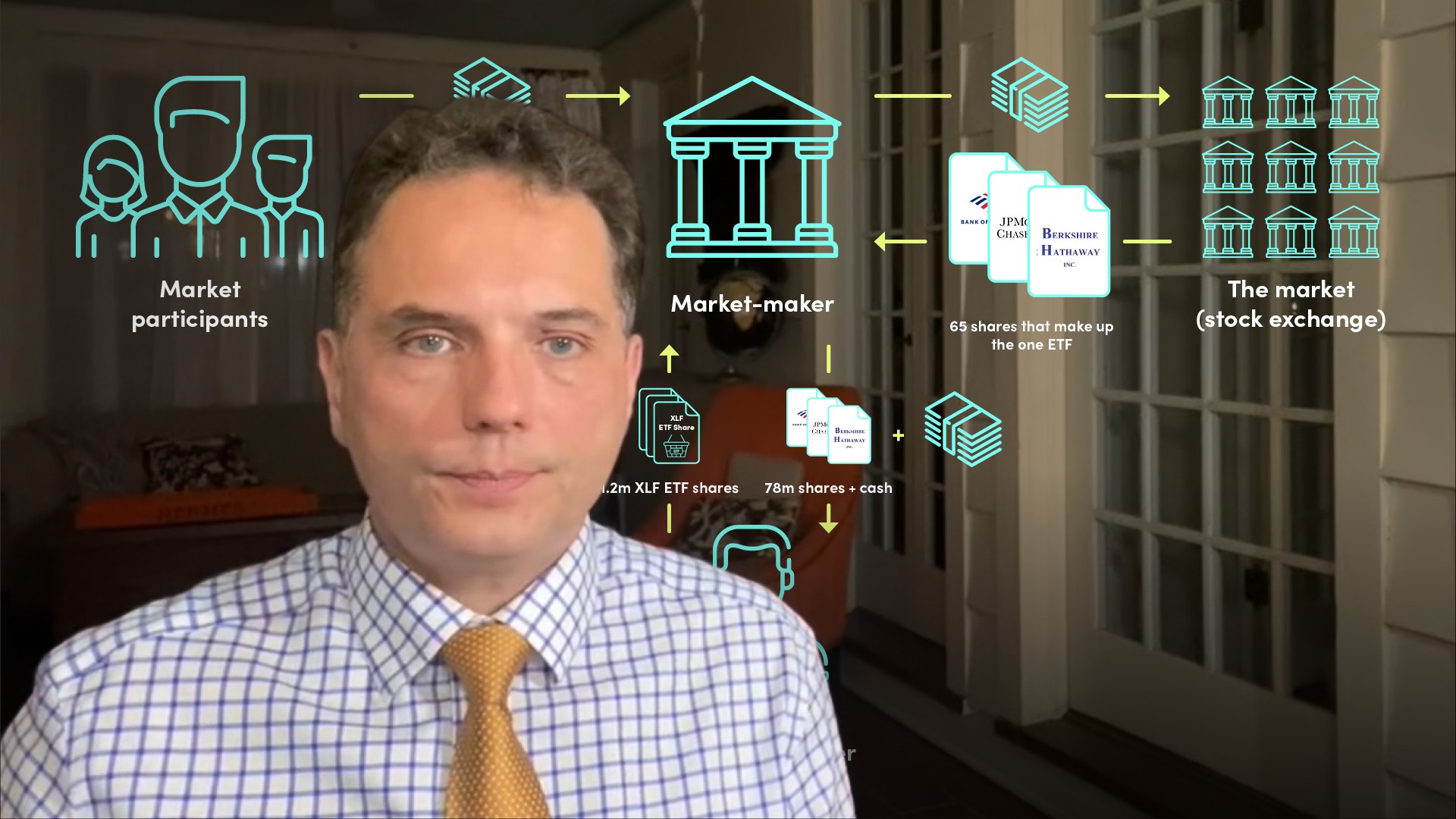

Market-makers are the only market participants authorised to create units with ETF fund managers, but they have to get the ETF shares from the fund manager. The way they do this is through a creation/redemption process that involves the market-maker exchanging the equivalent ETF securities, rather than cash, to the fund manager in exchange for ETF shares.

How does the creation/redemption process work?

During the day a market-maker (authorised participant) will sell ETF shares to investors, and buy the equivalent basket of securities from the market to hedge themselves. At the end of the day, they will have a residual position, they have shares, and require the ETF shares to deliver to the investors.

An ETF fund manager will then exchange that residual position of shares for the required number of ETF shares.

It is an ‘in-kind’ creation, meaning that the market-maker delivers the shares, not money.

What are the benefits of the creation/redemption process?

- No execution risk

- Can give the creation instruction after the market has closed

- Fund manager doesn’t have to hold cash to buy extra stocks

- In the redemption process, the sale (delivery) of the stock components from the ETF fund manager to the market-maker is not a taxable event

- It is virtually cost-free

What are the disadvantages of the creation/redemption process?

- As shares and ETFs are delivered in-kind (for free), with global ETFs you need to modify settlement systems to adjust for different currencies

- There are shorting restrictions on certain shares and currencies

- There are trading restrictions for certain market-makers

- There are FX hedging considerations required for global ETFs with multiple currencies

- There are issues calculating the value of global ETFs when half the market is closed and the other half is open

Gontran de Quillacq

There are no available Videos from "Gontran de Quillacq"