Internal Credit Risk Monitoring

Belinda Green

30 years: Credit risk specialist

In this video, Belina will continue the discussion on risk mitigation by looking at how effective internal monitoring plans can be a very useful tool in the lender’s suite of risk mitigation strategies.

In this video, Belina will continue the discussion on risk mitigation by looking at how effective internal monitoring plans can be a very useful tool in the lender’s suite of risk mitigation strategies.

Internal Credit Risk Monitoring

4 mins 23 secs

Key learning objectives:

What is the purpose of establishing internal monitoring plans?

Understand how effective internal monitoring plans can be a very useful tool in the lender’s suite of risk mitigation strategies

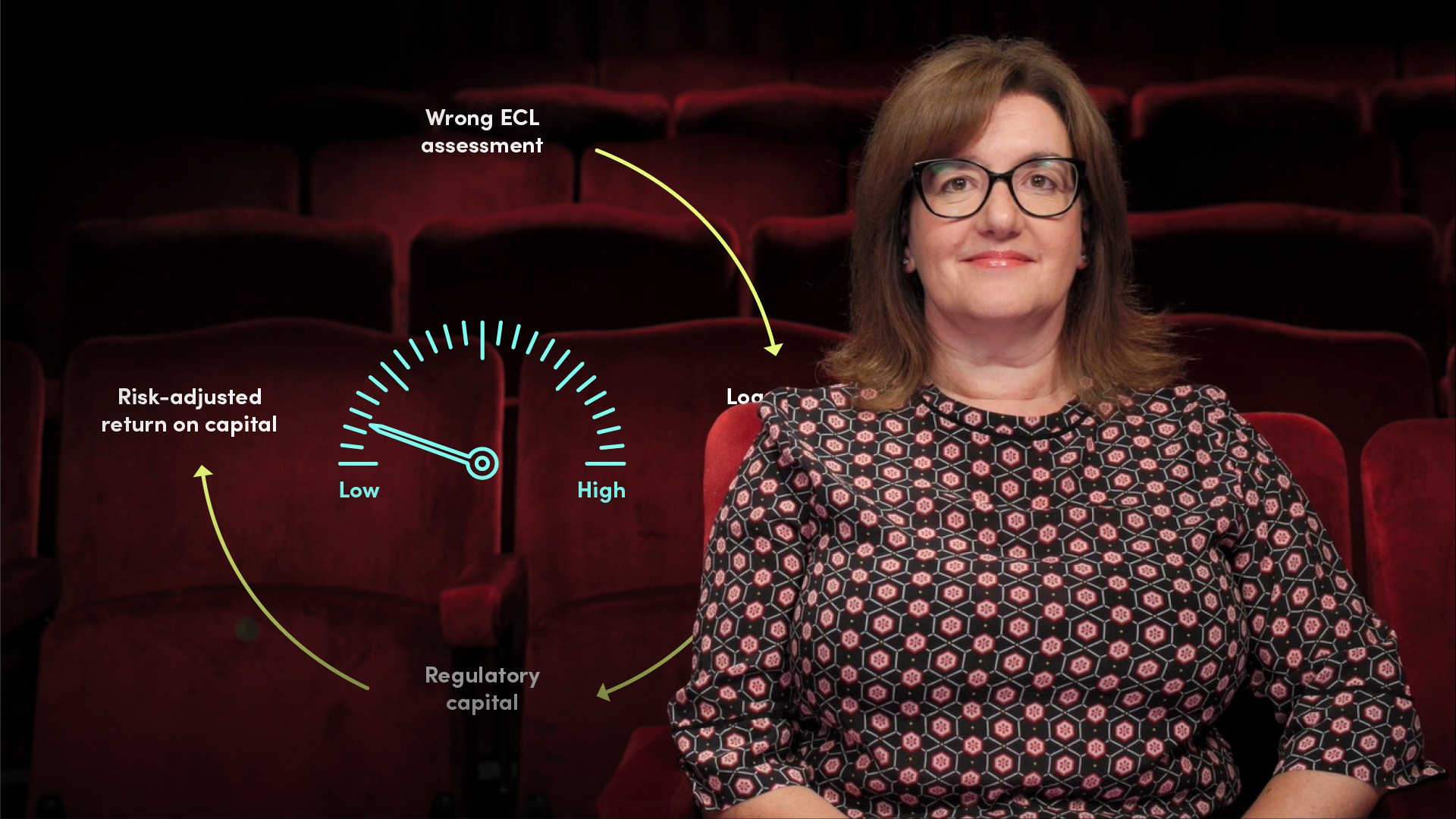

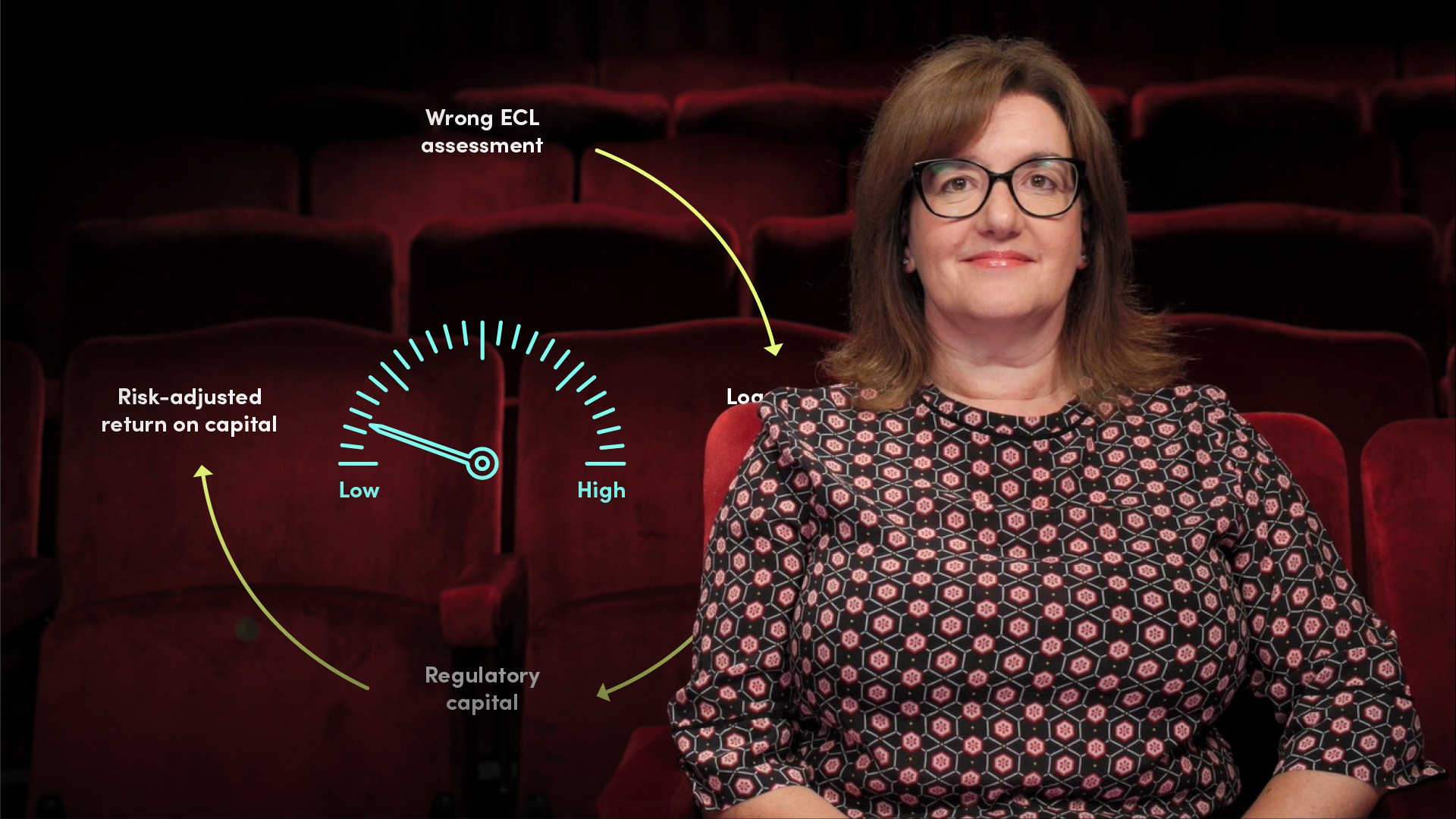

Establishing internal monitoring plans

Internal monitoring plans often monitor risk factors that are difficult to covenant, such as macro-economic indicators, industry fundamentals, financial markets’ performance, the regulatory environment, account performance and force majeure events. The factors that a lender chooses to monitor are driven by its risk strategy and appetite, its internal credit risk policy and procedures and regulatory requirements.

What is the purpose of establishing internal monitoring plans?

- Trigger an early review of the facility

- Compensate for a weak deal structure

- Focus internal discussion on problem-solving

- Remove the temptation for non-action

Belinda Green

There are no available Videos from "Belinda Green"