Introduction to Commodity Derivatives

Emma Jenkins

30 years: Commodities expert

This video series will examine the relationship between commodity prices and their supply and demand conditions. In this video, Emma discusses how changes in the demand-supply balance affect the price of a commodity.

This video series will examine the relationship between commodity prices and their supply and demand conditions. In this video, Emma discusses how changes in the demand-supply balance affect the price of a commodity.

Introduction to Commodity Derivatives

6 mins 25 secs

Key learning objectives:

Explain what a (i) deficit and (ii) a surplus market is and how commodity prices should move in each market scenario

Why are commodity prices volatile?

Explain what a commodity derivative is

Overview:

Commodity prices move in response to changes in the balance between the supply of and the demand for commodities. Commodity derivatives are contracts whose prices fluctuate in line with movements in commodity prices and which can be used to manage commodity price exposures.

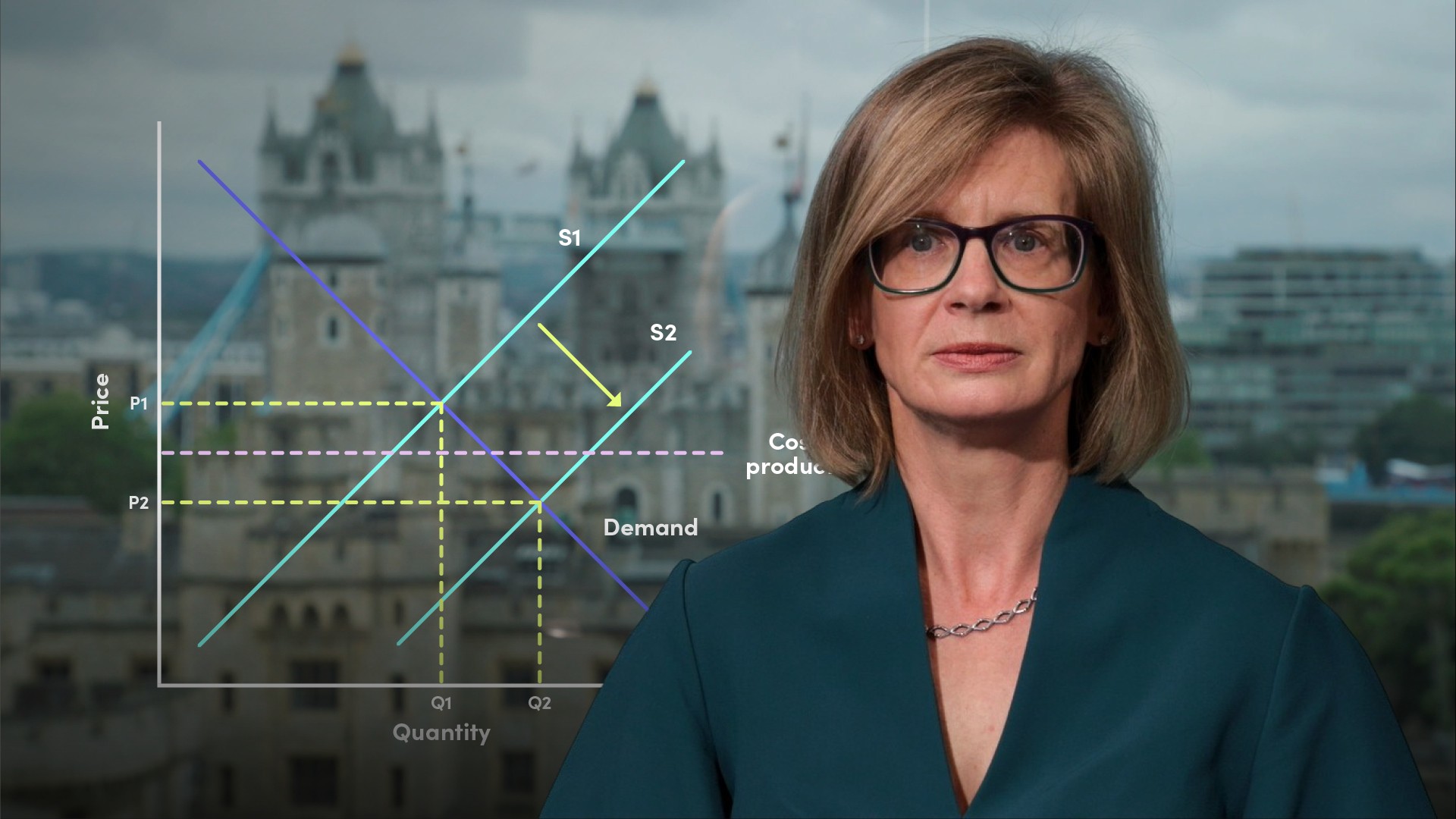

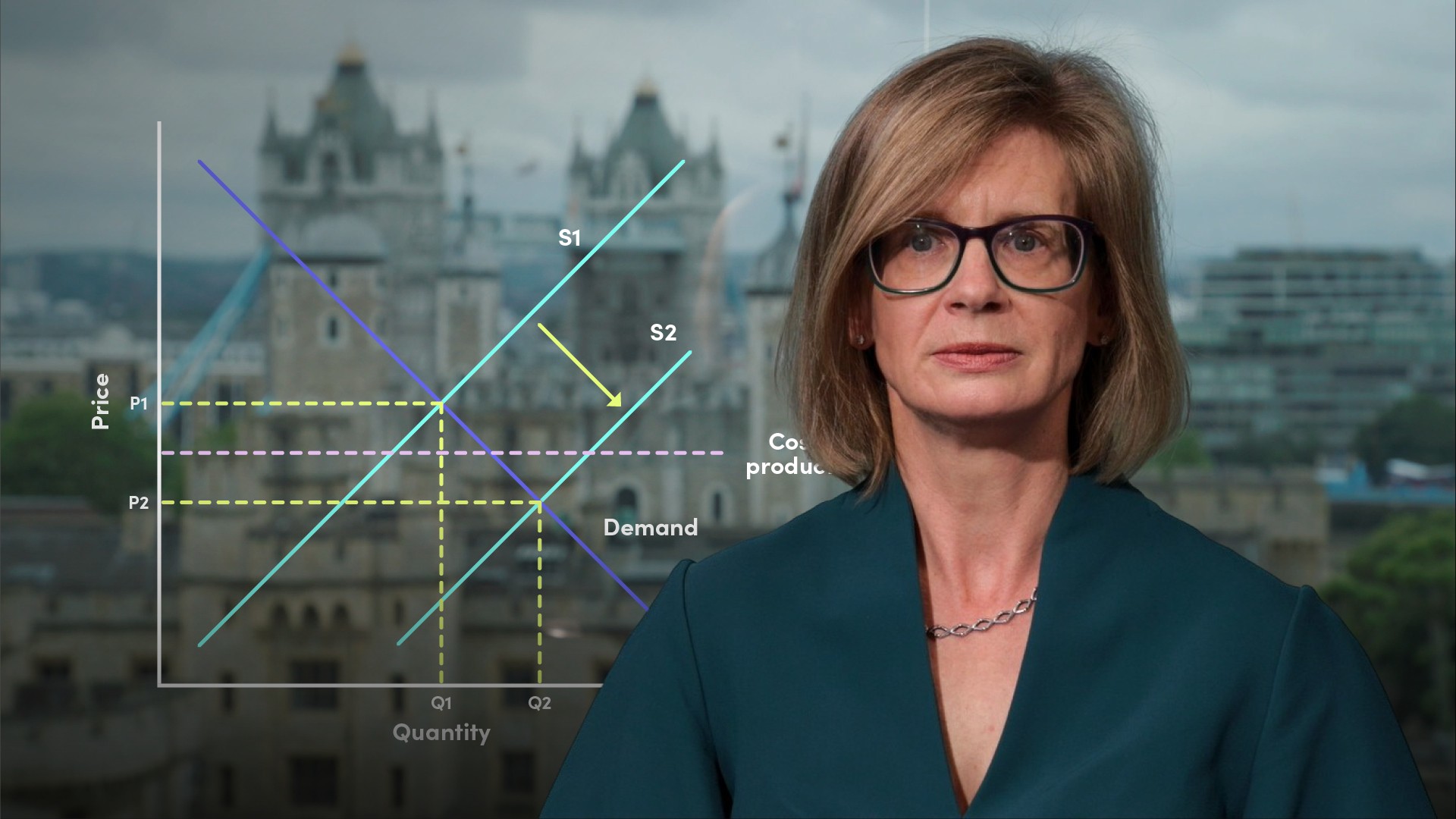

What is a (i) deficit and (ii) a surplus market and how should commodity prices move in each market scenario?

(i) A deficit market is when there is insufficient supply of a commodity to satisfy demand. This generally leads to increasing prices, particularly when there are insufficient stocks to meet the shortfall.

(ii) A surplus, or over-supplied, market is when supply exceeds demand. This generally leads to falling prices and a build-up of stockpiles.

Why are commodity prices volatile?

The demand-side and the supply-side for a commodity often react differently in response to price signals. Frequently the demand-side comprises of many parties each making relatively small decisions on the amount of commodity they will purchase at each price level. By contrast, the supply side often comprises of few parties. When a supplier decides to increase or reduce production it is often in a larger amount relative to the overall market. Thus, commodity price processes typically exhibit sharp movements over short time frames.

What is a commodity derivative?

A commodity derivative is a contract between two willing counterparties whose value is linked to the value of one or more commodities.

Emma Jenkins

There are no available Videos from "Emma Jenkins"