Controlling vs Non-Controlling Interest

Saket Modi

20 years: Chartered accountant & educator

In this video, Saket defines and compares the terms controlling and non-controlling interest, and discusses under which circumstances they may arise.

In this video, Saket defines and compares the terms controlling and non-controlling interest, and discusses under which circumstances they may arise.

Controlling vs Non-Controlling Interest

4 mins 16 secs

Key learning objectives:

What is controlling interest?

What is non-controlling interest?

Overview:

In the financial statements, we often see references to “Group” Income Statement or a “Group” Balance Sheet. A “Group” means that the financial statements comprise of more than one entity and these are often referred to as consolidated financial statements. Controlling and non-controlling interest are different groups of investors. Non-controlling interest arises when one or more subsidiary companies are not fully owned by the parent company. The net income for the period, and the equity is split between controlling and non-controlling interest.

What is controlling interest?

Controlling interest represents the portion of the net income, and equity of the group that is attributable to the parent company’s shareholders. The parent company is one that controls one or more companies in the group.

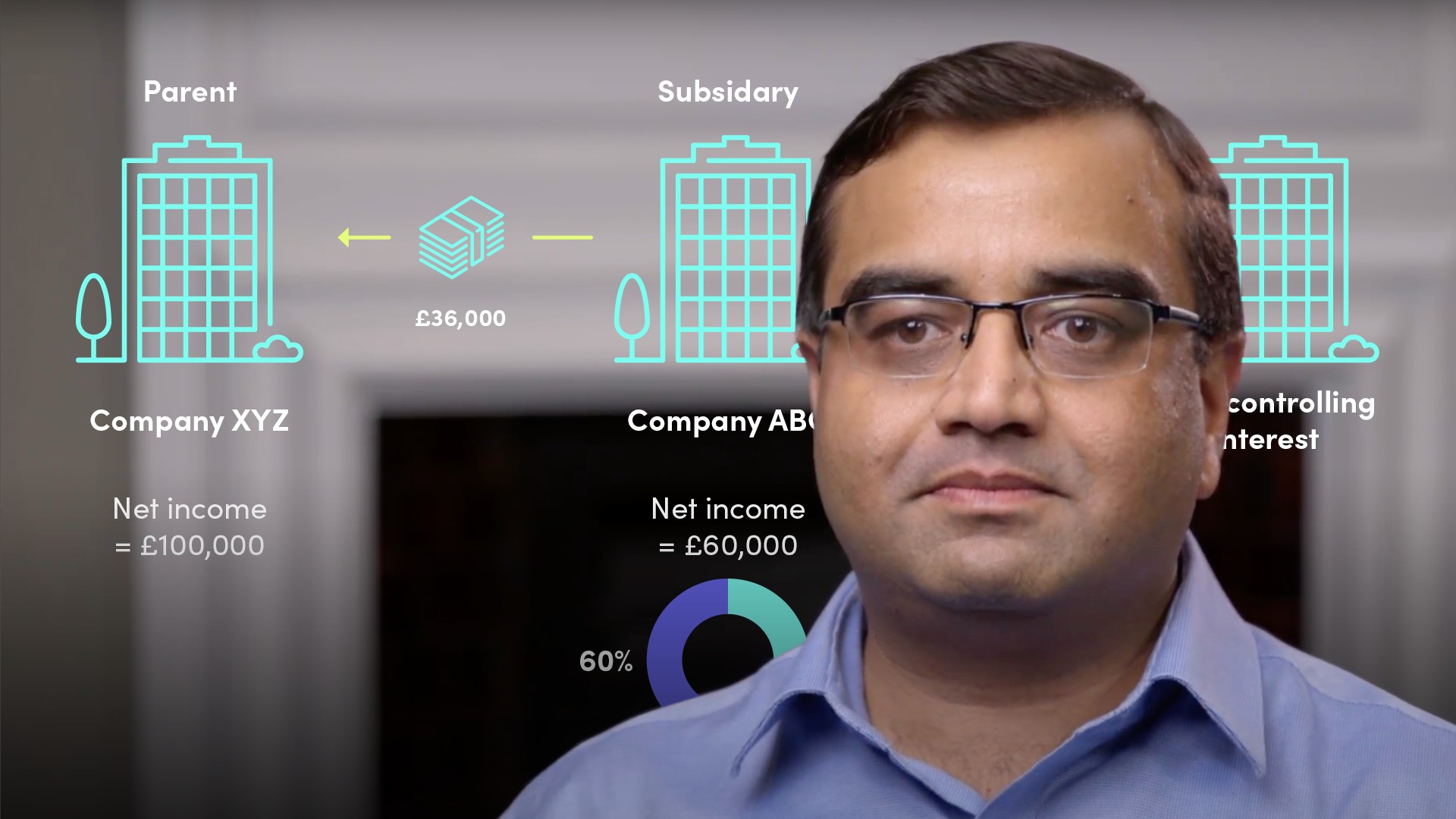

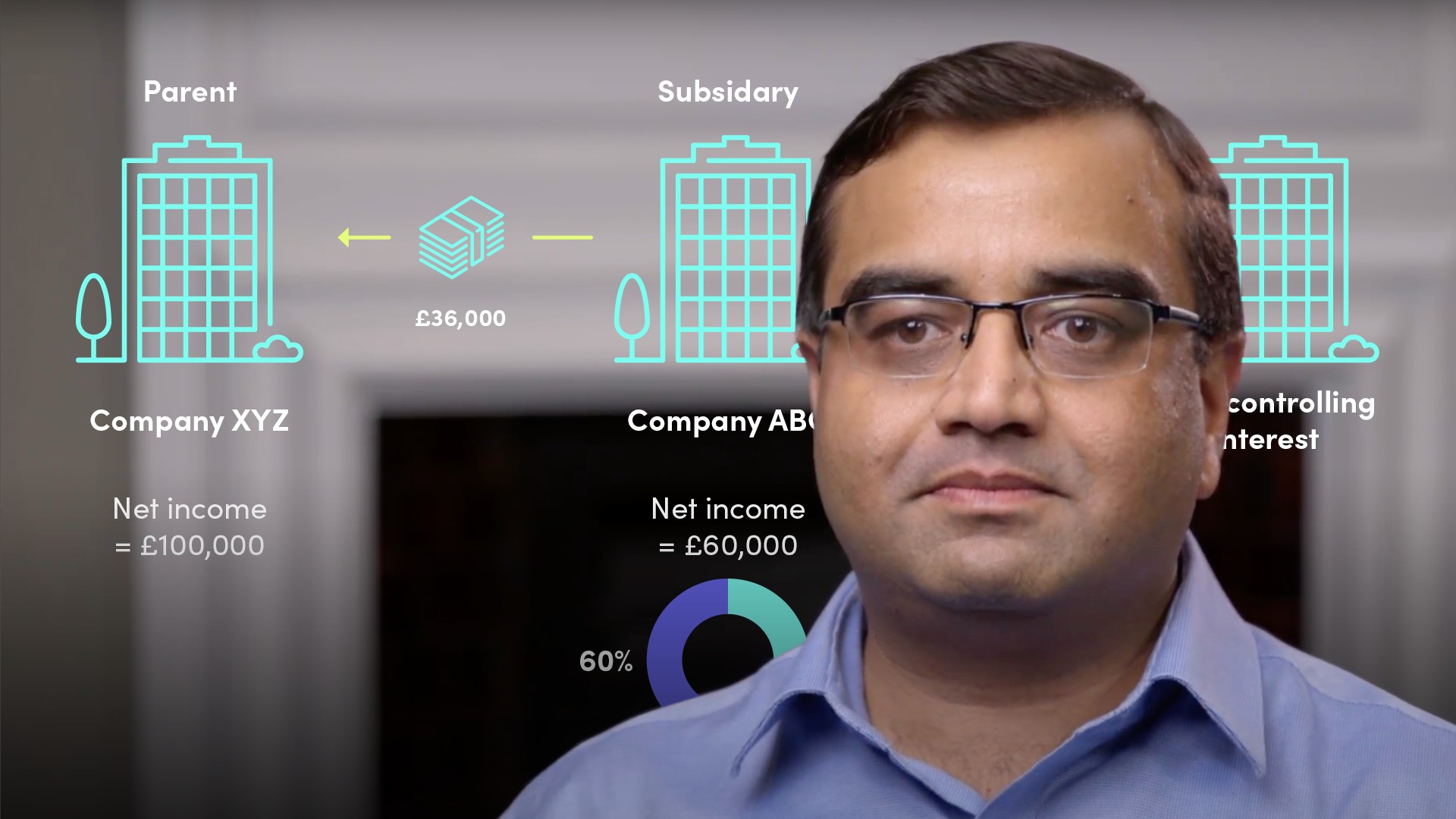

If Company XYZ holds 60% of the ordinary shares of Company ABC, XYZ is the parent company and ABC is the subsidiary company. The group net income is shown as being attributable to the shareholders of XYZ and the 40% of ABC’s investors who do not form part of the group. When you add 60% of the net income of ABC to the entire net income of XYZ, the resulting figure reflects the share of the controlling interest in the group’s net income.

What is non-controlling interest?

Non-controlling interest is also referred to as minority interest. It represents the share of the net income of the subsidiary company that is attributable to the investors who do not form part of the group (40% of ABC’s investors in our example above).

The presentation of the net income split between controlling and non-controlling interests provides useful information since it tells us how much of the profits are attributable to each of these groups of investors.

Similar to net income, the total net assets or equity is split between controlling interests and non-controlling interests.

Saket Modi

There are no available Videos from "Saket Modi"