Accounting Profitability Margin Ratios

Saket Modi

20 years: Chartered accountant & educator

The Profitability Margin Ratios allow users of the financial statements to assess the profits being generated. Within this video, Saket outlines the benefits of using these ratios, and how we calculate; gross profit margin, EBITDA margin, EBIT margin, and the net profit margin.

The Profitability Margin Ratios allow users of the financial statements to assess the profits being generated. Within this video, Saket outlines the benefits of using these ratios, and how we calculate; gross profit margin, EBITDA margin, EBIT margin, and the net profit margin.

Accounting Profitability Margin Ratios

6 mins 20 secs

Key learning objectives:

Outline the benefits of profitability margin ratios

Understand how the different profitability margin ratios are calculated

Overview:

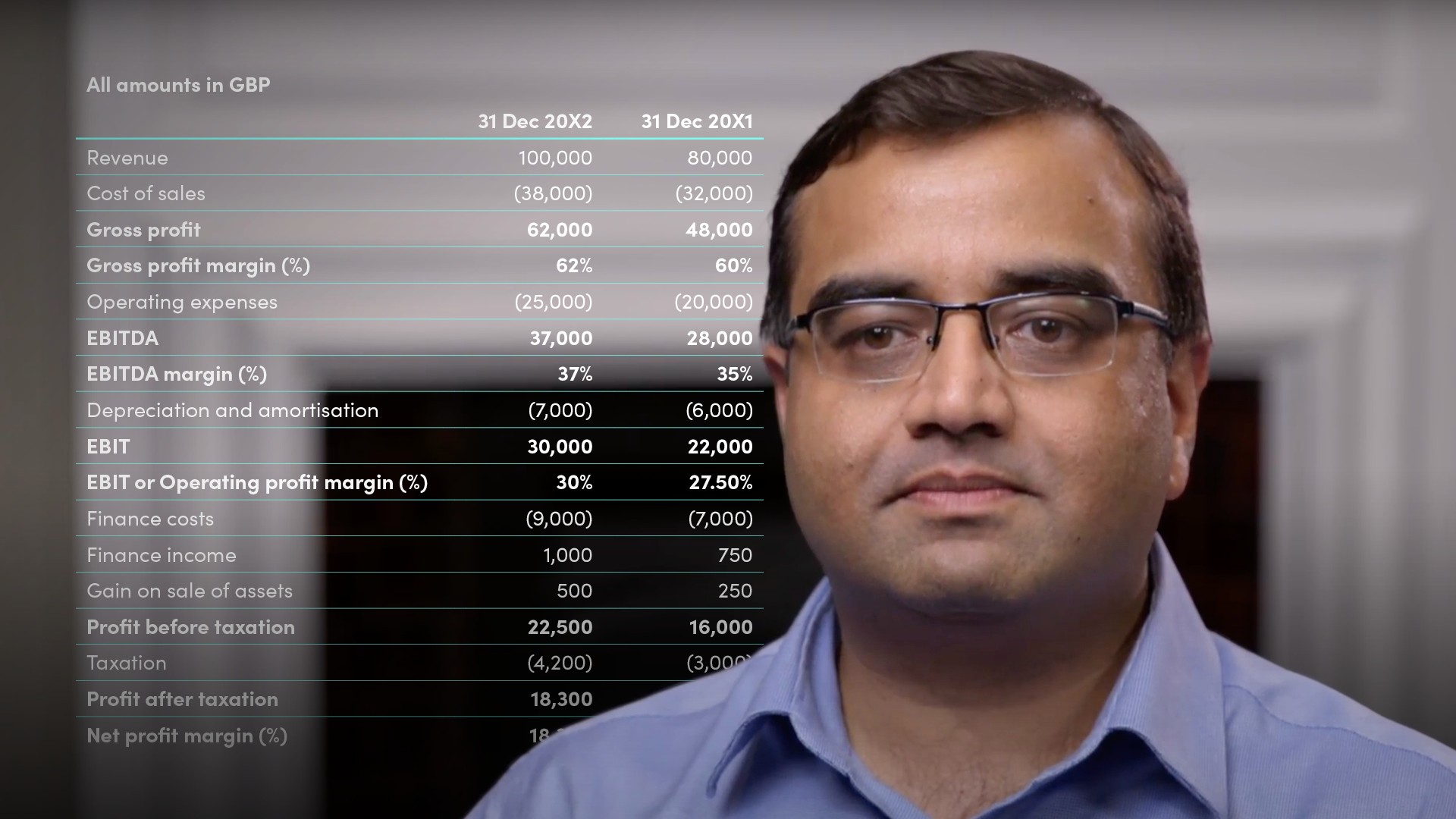

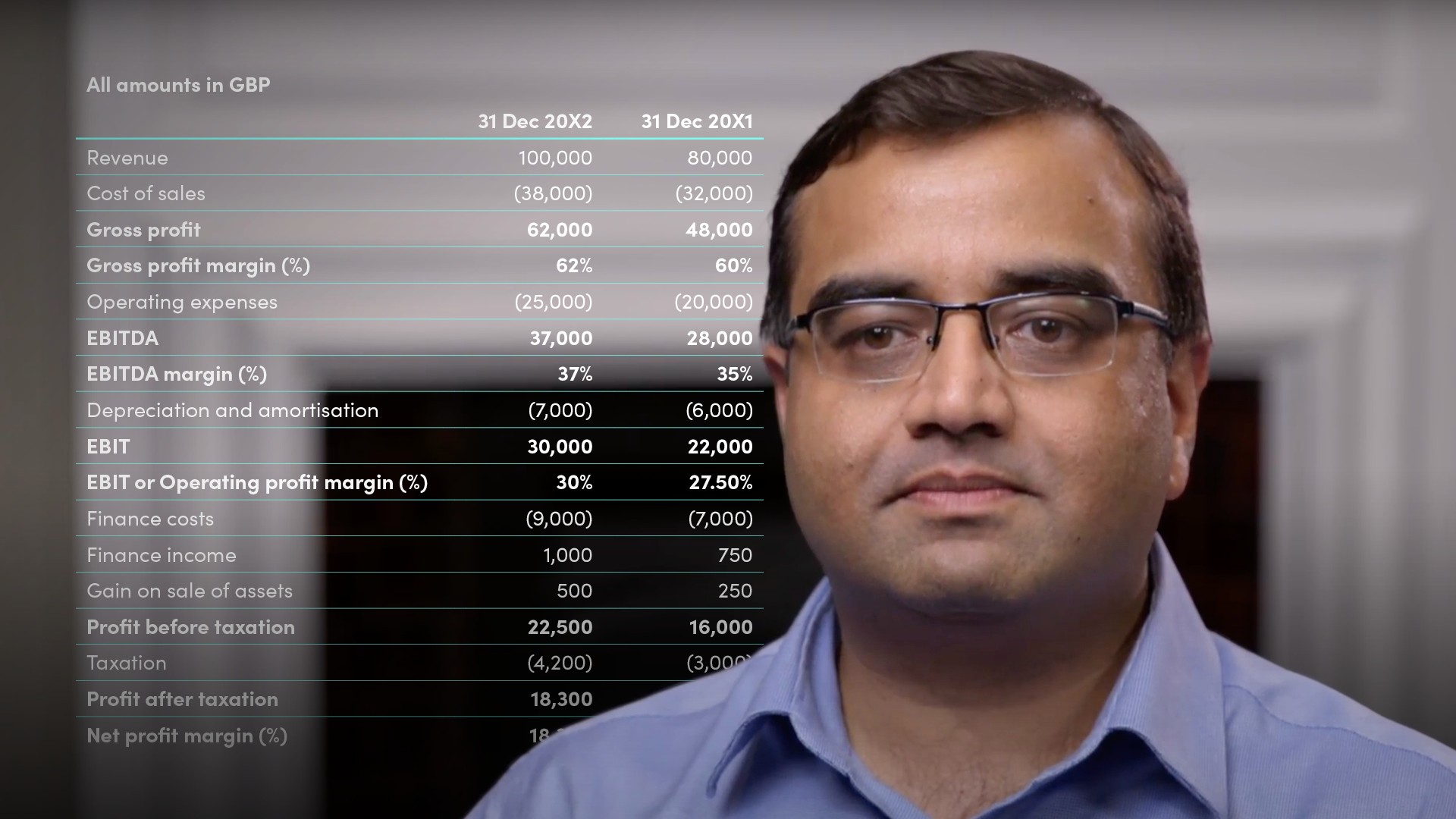

The profitability margin ratios are used to measure profitability relative to the revenue. The ratios help users of the financial statements assess how much profits are generated from use of the resources and the value that is added to the shareholders. There are four profitability margin ratios which can be determined from the financial statements of corporates: the gross profit margin, the EBITDA margin, the EBIT margin and the Net profit margin.

What are the benefits of profitability margin ratios?

The income statement shows an entity’s sources of revenue, expenses and the resulting profit or loss for the period, usually one year. The figures in the income statement for a particular period do not on their own help analysts and investors make economic decisions.

For example, if a company announces that it made a profit of £18,300 in a particular year, looking at that figure alone does not help you. We need to compare the profitability figure to either the previous periods or similar companies to determine whether it has done relatively better or worse. The profitability margin ratios help in this comparison.

What is the Gross profit margin, and how is it calculated?

The Gross profit margin compares the gross profit to the revenue. The gross profit shows the profits after deducing the direct cost of sales from the revenue earned.

Gross profit margin (%) = (Gross profit / Revenue) x 100

What is EBITDA, and how do we calculate the EBITDA margin?

EBITDA is the earnings before interest, taxation, depreciation and amortisation. It represents the profits before non-cash items such as depreciation and amortisation, and non-operating items such as interest and taxation. EBITDA is often used in corporate valuation.

EBITDA margin (%) = (EBITDA / Revenue) x 100

What is EBIT, and how do we calculate the EBIT margin?

EBIT is the earnings before interest and taxation. It is also referred to as the operating profit margin and represents the profits before non-operating items such as interest and taxation. Generally speaking, it is considered that companies with higher EBIT are better able to service debt and hence have better chances to survive an economic slowdown compared to those with lower EBIT.

EBIT margin (%) = (EBIT / Revenue) x 100

What is Net profit/income, and how do we calculate the Net profit margin?

The Net profit or net income tells us how profitable a company is after deducting all the expenses from the revenue. It is also referred to as the bottom line. If total expenses are greater than the total income, it is referred to as net loss. The net profit margin is based on the bottom line and takes all items, including one-off items of gains or expenses into account. Given the one-off nature of certain events, this may make it difficult to compare a company’s performance with its competitors or even prior years.

Net profit margin (%) = (Net Profit / Revenue) x 100

Saket Modi

There are no available Videos from "Saket Modi"