Global Financial Crisis as a Precursor to QE

Trevor Pugh

20 years: Trading & hedge funds

The bursting of the US housing bubble and the subsequent collapse of the sub-prime mortgage market triggered a series of events that led to what we now call the global financial crisis. Trevor discusses the monetary policy response to that crisis, in particular quantitative easing.

The bursting of the US housing bubble and the subsequent collapse of the sub-prime mortgage market triggered a series of events that led to what we now call the global financial crisis. Trevor discusses the monetary policy response to that crisis, in particular quantitative easing.

Global Financial Crisis as a Precursor to QE

6 mins 40 secs

Key learning objectives:

Identify the role of the sub-prime mortgage market

Explain the impact of banks via securitisation

Describe the approaches of the FR, ECB and the BOE

Overview:

The bursting of the US house bubble, and the subsequent collapse of the sub-prime mortgage market, triggered a series of events that led to the global Financial Crisis. With these unprecedented impacts on the economy, a swift approach was needed - this came in the form of QE.

What was one of the factors that led to the Financial Crisis?

The sub-prime mortgage market - This involved lending to borrowers with a low credit score and so, in a downturn, it was the most exposed to increased risks of defaults. Sub-prime loans were popular with borrowers who gained access to credit they might not otherwise have been able to obtain.Why did lenders get involved if it was risky?

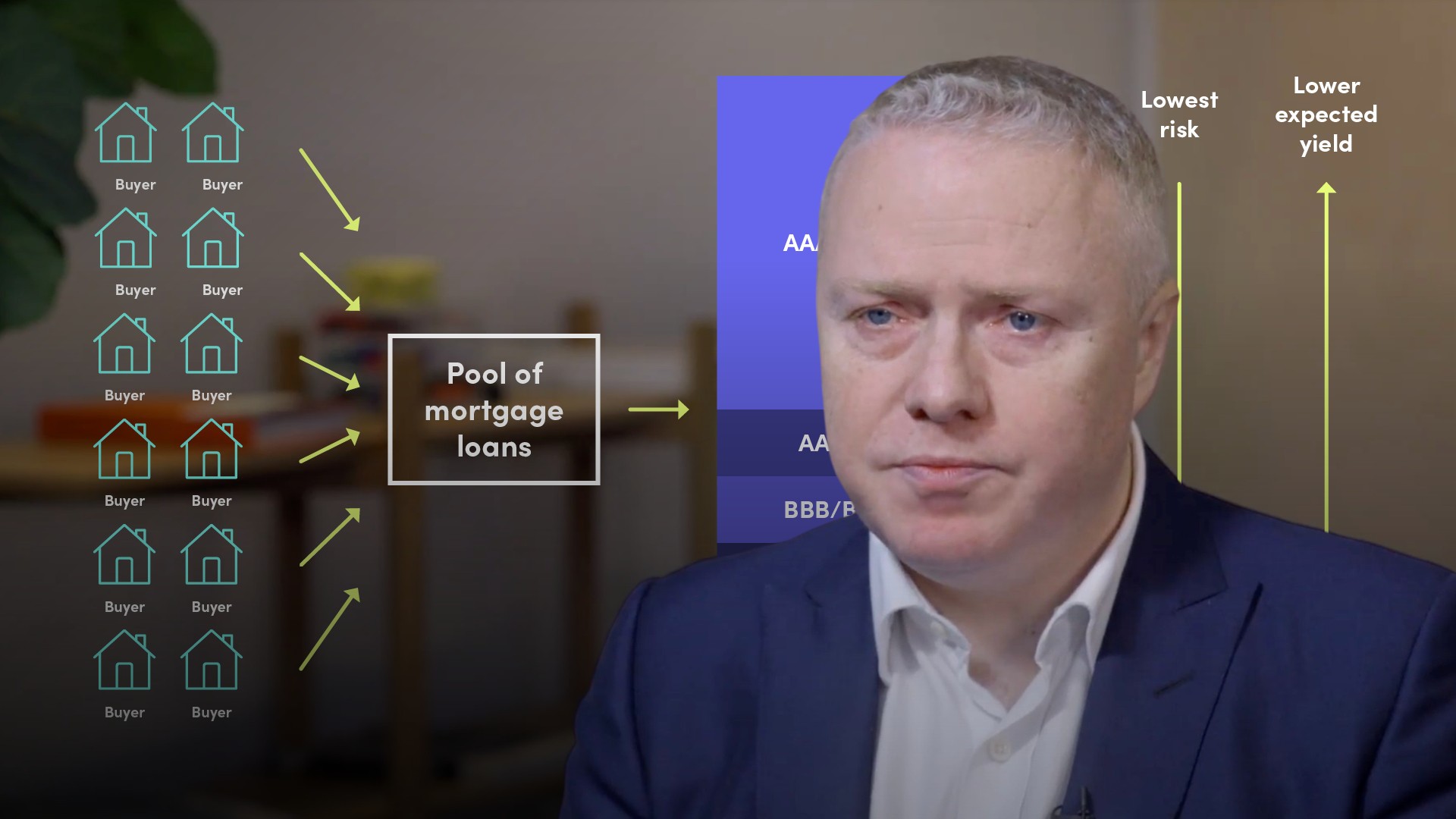

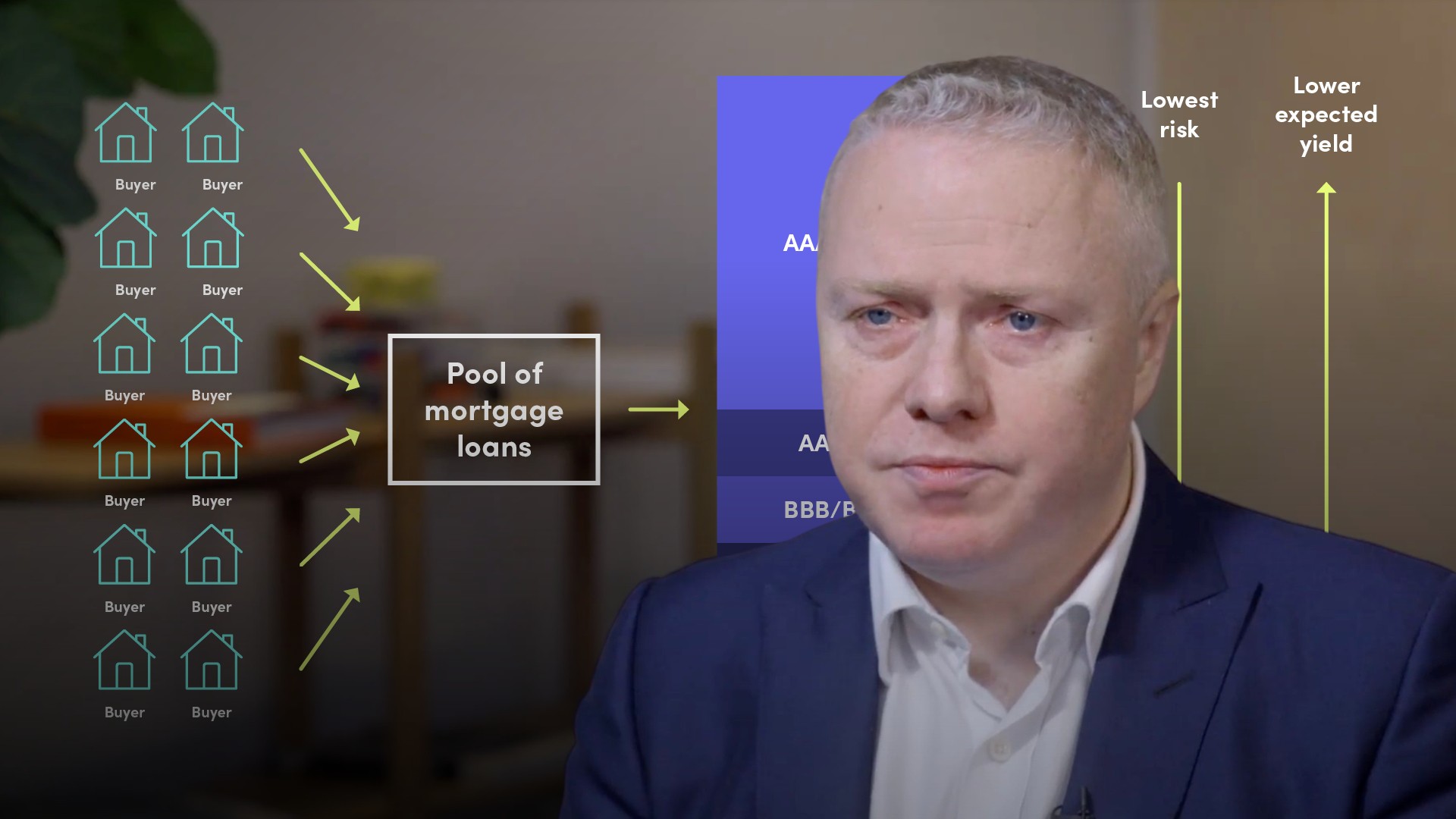

Securitisation - This is where a bank or other entity packages up a large number of receivables such as mortgages, into a single security that is then sub-divided into several tranches with different levels of risk and return that investors can buy depending on their risk tolerances and what best suits their requirements.What were the proposed benefits of securitisation?

Diversification benefits; a small percentage of the mortgages might not repay, but in the aggregate, the vast majority do. The whole process was aided by the knowledge that if the portfolios were back-tested, the probability of a large number of defaults would be extremely low. It was thought by many, that this securitisation of risk would diversify risk, and make the system safer as risk was held by those choosing to hold it and capable of doing so. However, this proved to be incorrect.What amplified the impact of the fall in US house prices?

A large number of sub-prime securitisation and CDO investors were in Europe. European banks had struggled with low returns, and thus sought better returns in faster growth areas (US Sub-prime mortgage market). The issue was that they required dollar funding to invest in these products - around two trillion dollars daily.

As credit conditions tightened in the US, European banks struggled to roll over their funding for their US positions and therefore needed to sell their mortgage assets, this in turn created a vicious circle in the market, falling prices and forcing further sales.

What was the role of banks in the collapse?

Banks were creating so many mortgage products that seemed to be performing well they began to build up their own inventories of mortgage backed securities. The issue lay in banks' leverage. As they were highly leveraged, when the market turned, they quickly suffered losses, This ultimately is what led to the downfall of Lehamn Brothers and other banks that collapsed.What were the responses by the ECB, Federal Reserve and the BOE?

- Federal Reserve

- They were always the most aggressive, cutting rates in September 2007, from 5.25% to 4.75%, then continued cutting aggressively until by December 208, the rate had reached a target range of 0-0.25%. This is where the rate stayed until December 2015.

- European Central Bank

- The ECB in contrast started from a lower base but cut less aggressively, taking the deposit rate from 3% in mid-2207 to 2% by December 2008, finally getting to 0.25% by the end of 2009.

- Bank of England

- They cut rates from 5.75% in mid-2007, to 2% by December 208 and 0.5% by March 2009 where they stayed until 2016 when they were cut again in the aftermath of the referendum on EU membership.

Trevor Pugh

There are no available Videos from "Trevor Pugh"