Macroeconomic Implications of QE

Trevor Pugh

20 years: Trading & hedge funds

There were many estimates made as to the potential size of QE before the Bank of England became the first central bank, post crisis, to buy government bonds. In this video, Trevor discloses the actual impact of QE versus expectations.

There were many estimates made as to the potential size of QE before the Bank of England became the first central bank, post crisis, to buy government bonds. In this video, Trevor discloses the actual impact of QE versus expectations.

Macroeconomic Implications of QE

6 mins 25 secs

Key learning objectives:

Identify the impacts on inflation, growth, holdings, balance sheets and total debt

Describe a balance sheet recession

Outline the pros and cons of QE

Overview:

This provides an insight into the impact Quantitative Easing had on inflation, growth, banks’ balance sheets, total debt and net bond holdings.

What was the QE impact on inflation and growth?

The £150bn announced in March 2009 was a great shock to the market and ten-year Gilts rallied 50bp. Analysis suggests that in the UK, GDP growth was 0.25% higher and CPI was 0.32% higher than it would have been for every 1% of GDP worth of bonds purchased in Quantitative Easing. However, growth and inflation are complex issues, not dependent on one monetary policy variable.Who actually sold to the BOE, and what was the net impact on holdings?

The Bank of England bought a total of £375bn worth of bonds, and the treasury issued £737bn. Most major holders of Gilts actually increased their holdings during the period of Q42008 - Q42012:

- Pension funds and Insurance - Increased from £245bn to £349bn

- Overseas - £216bn to £417bn

- Other Financial Institutions - £110bn to £62bn

- Banks - £18bn to £96bn

- Bank of England APF - £0 to £398bn

What was the impact on total debt, and why did it rise?

Total debt rose from £617bn to £1.354tn, a change of +£737bn. This rise can be accredited to; buying large stakes in RBS and Lloyds to prevent them from failing, much of it was simply the impact of a slowing economy with rising unemployment and falling tax receipts, a bad combination for the nation’s Treasury.What is a balance sheet recession?

This is where a firm’s balance sheet has become seriously impaired by the fall in value of its assets. The firm is technically insolvent, but if it can continue to pay its borrowings, then it might be able to stay in business until such a point in time that its asset values recover. The one thing it will not do however, is borrow more money given its impaired asset side of the balance sheet.Why did commercial banks’ balance sheets expand?

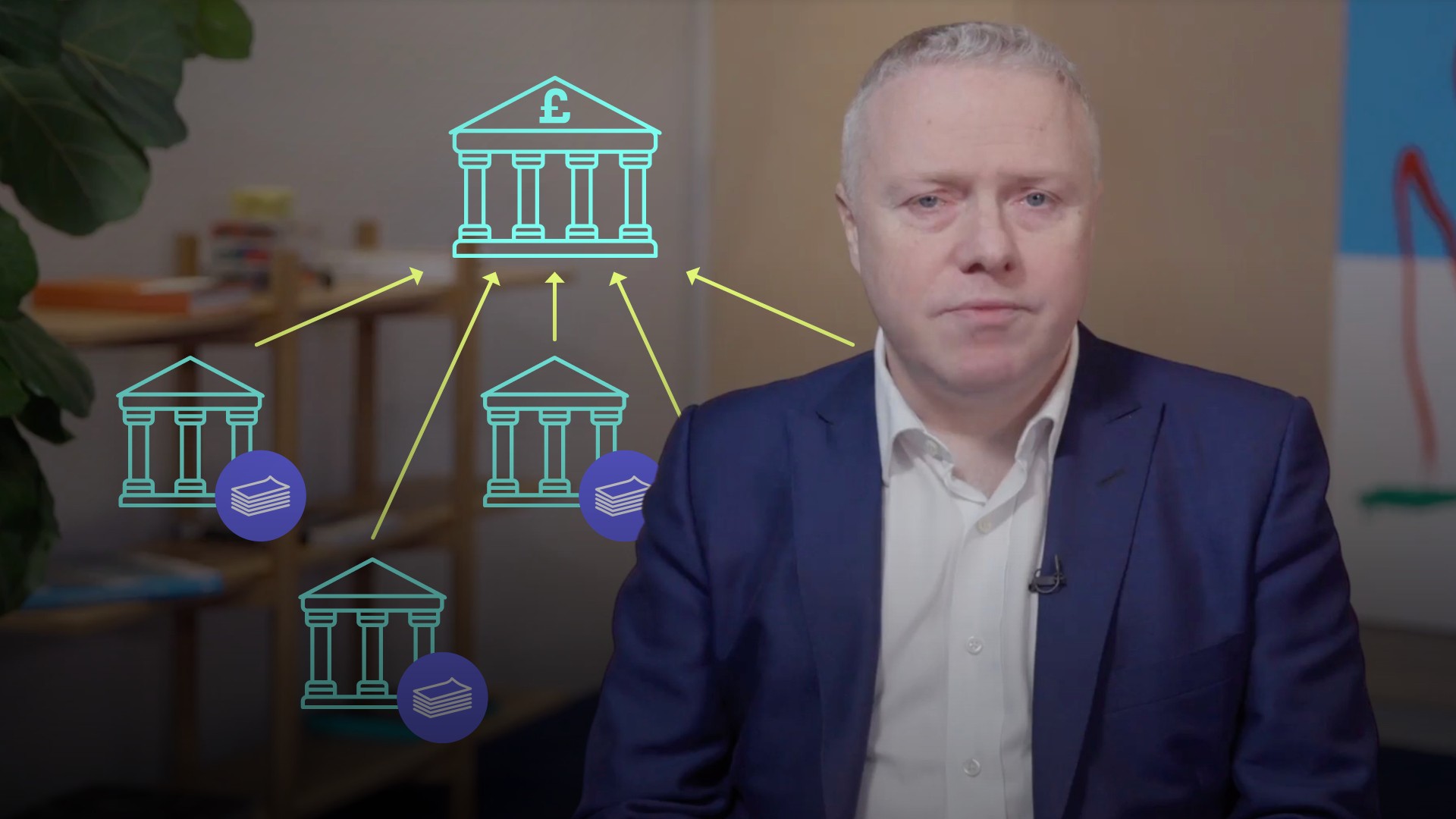

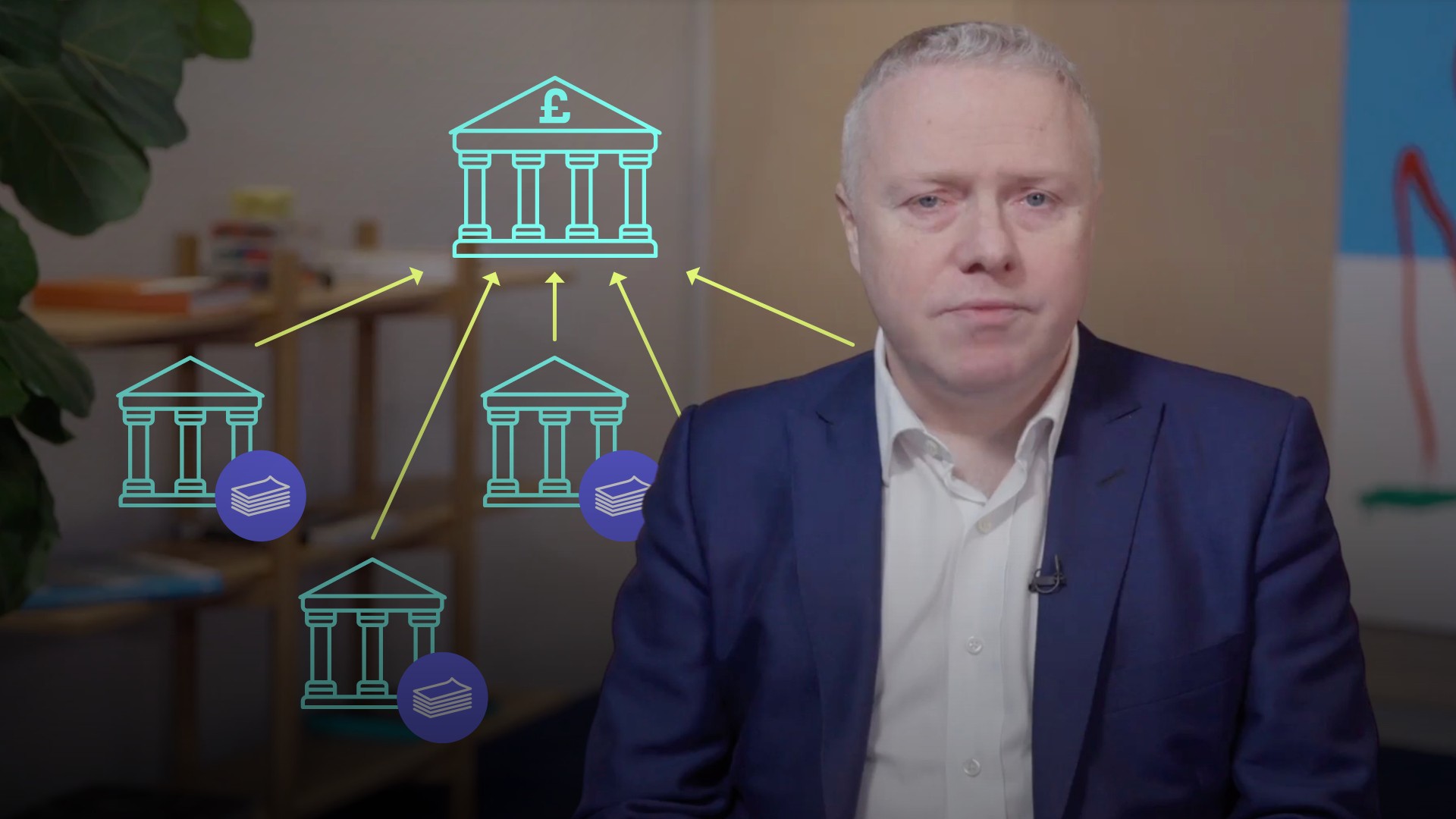

Their balance sheets expanded because non-bank holders of Gilts do not have reserve accounts at the central bank. When a pension fund wishes to sell bonds to the BOE for example, it must sell them to a primary dealer who then sells on to the central bank. The primary dealer, generally a part of the commercial bank, has its account at the central bank credited with the proceeds of the sale, and the bank credits the account of the pension fund with that same amount. The commercial bank now has increased assets (central bank reserves) and increased liabilities (the pension fun’s account it has credited).What were the benefits of QE?

- Had an impact on inflation and growth

- Added to the confidence in the financial system and by extension the economy

What were the disadvantages of QE?

- Impact on inflation was considerably less than originally anticipated

- Drove up asset prices

- Led to increased inequality - this has led to widespread dissatisfaction with the ruling classes in many countries

Trevor Pugh

There are no available Videos from "Trevor Pugh"