Application of Commodity Derivatives

Emma Jenkins

30 years: Commodities expert

When there is good price convergence between a commodity derivative and the underlying physical, then the derivative is an excellent proxy for the underlying. In this video, Emma explains us how companies and investors deploy commodity forwards in their businesses.

When there is good price convergence between a commodity derivative and the underlying physical, then the derivative is an excellent proxy for the underlying. In this video, Emma explains us how companies and investors deploy commodity forwards in their businesses.

Application of Commodity Derivatives

7 mins 39 secs

Key learning objectives:

Describe how an investor can use a commodity derivative to create an exposure which (a) generates a profit if the price of a commodity increases and (b) avoids taking delivery of the commodity

When would a physical market participant consider going through to physical settlement under a commodity derivative?

Describe how a physical market participant can use a commodity forward to transform the price of a floating (i.e. unknown) price physical contract to a fixed price

Overview:

Commodity derivatives can be used to create an exposure to a commodity or to hedge an existing commodity exposure. Examples illustrate how commodity derivatives can be used to profit from commodity price movements and transform the pricing characteristics of contracts for the purchase or sale of physical goods.

Describe how an investor can use a commodity derivative to create an exposure which (a) generates a profit if the price of a commodity increases and (b) avoids taking delivery of the commodity.

- The investor should purchase a commodity forward. This opens a risk position (or exposure) to the commodity.

- If the forward is physically-settled, the risk position must be closed before the settlement date to avoid taking delivery of the commodity.

- The risk position is closed by selling a commodity forward for the same settlement date as the purchased commodity forward.

- When the risk position is closed, the investor realises the difference between the forward prices. The investors pays the price agreed on the purchased commodity forward, and receives the forward price agreed on the sold commodity forward.

- If the price of the underlying commodity increased, the investor would have made a profit.

When would a physical market participant consider going through to physical settlement under a commodity derivative?

A physical market participant could go through to physical settlement if the format and delivery location of the physical commodity and the commodity derivative are identical.

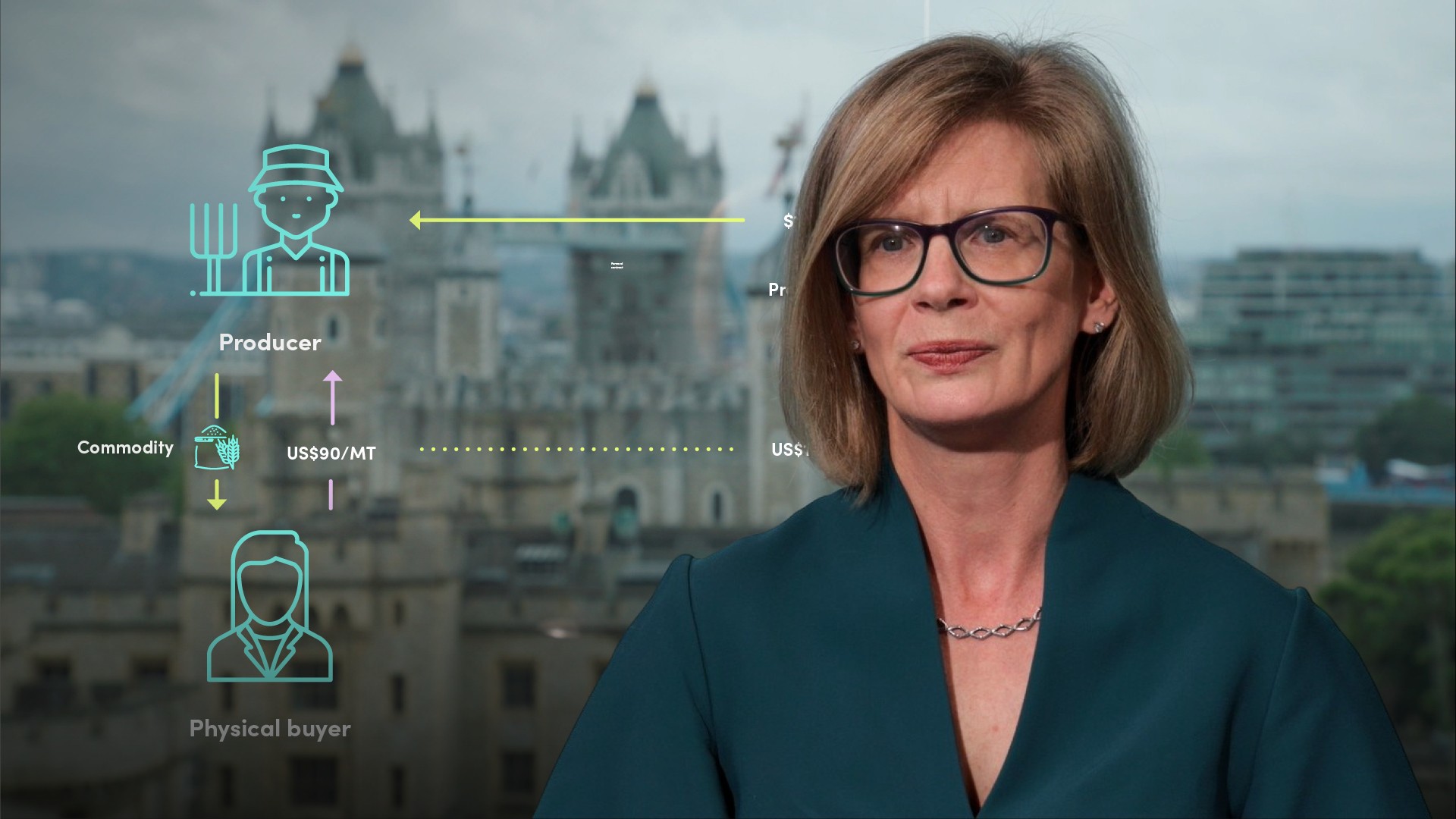

Describe how a physical market participant can use a commodity forward to transform the price of a floating (i.e. unknown) price shipment to a fixed price.

- The physical market participant should enter into a commodity forward whose underlying is as close a match to the shipment as possible, and for a time period which coincides with the pricing period (or quotational period) of the shipment.

- If the commodity formats and delivery locations are identical, the participant can go through to physical settlement, thereby realising the forward price for shipment.

- If not, the commodity forward should be closed at the same time as the shipment prices. Closing the forward at this point in time captures the change in the forward price for the derivative which should completely offset the change in price of the shipment (as long as the derivative has good price convergence with the underlying commodity).

Emma Jenkins

There are no available Videos from "Emma Jenkins"