The Rise and Fall of Archegos Capital Management I

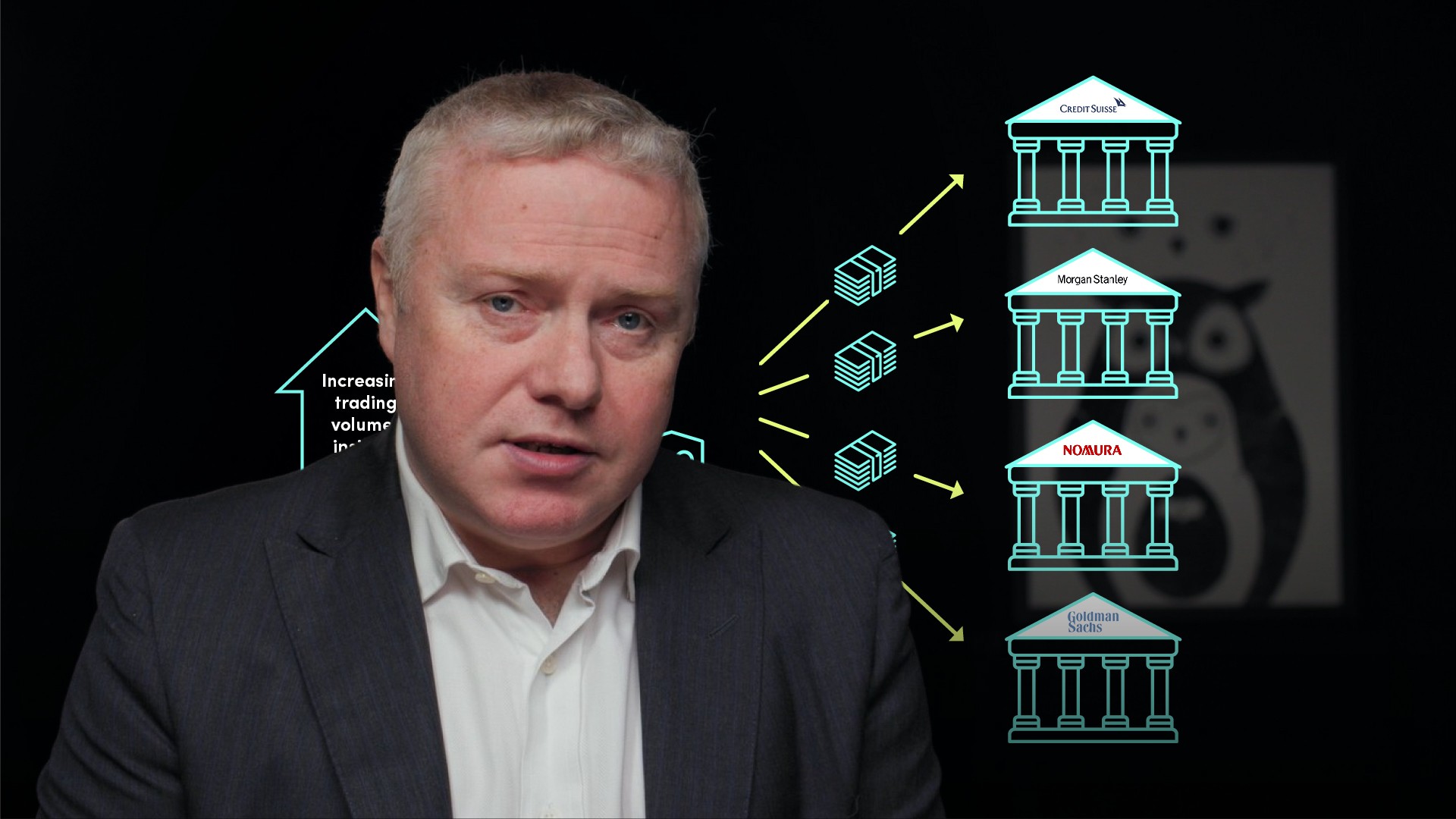

Trevor Pugh

20 years: Trading & hedge funds

In this video, Trevor explains the origins and the rise of Bill Hwang, a former tiger cub and the fund manager of Archegos. He also introduces the trading strategy used by Archegos that ultimately led to their demise.

In this video, Trevor explains the origins and the rise of Bill Hwang, a former tiger cub and the fund manager of Archegos. He also introduces the trading strategy used by Archegos that ultimately led to their demise.

The Rise and Fall of Archegos Capital Management I

10 mins 6 secs

Key learning objectives:

How was Archegos formed?

What three main strategies undertaken by the fund led to disaster?

How did the holding of Viacom lead to catastrophe?

Overview:

Bill Hwang created Archegos Capital Management. It was created as what is known as a family office, only running money from himself and close family. Eight years later, Archegos, a fund that very few in the financial markets had even heard of, would collapse spectacularly, causing $10bn in losses for its investment bank counterparties, and wiping out the entire $10bn of its own Assets Under Management that it held at the start of the year.

Why did the fund Tiger Asia fail and get shut down?

- The fund lost money in the 2008 stock market crash, when Lehman Brothers filed for bankruptcy

- In 2009 the Hong Kong regulators accused it of insider trading. Tiger Asia pleaded guilty in 2012 and returned all investor money

- Bill Hwang was barred from managing public money for at least five years, and this ban was only lifted in 2020

- In 2012, Mr Hwang reached a $44m civil settlement with the US regulator on a separate insider trading investigation. Tiger Asia was shut down

How was Archegos formed?

In 2013, shortly after the shutting down of Tiger Asia, Bill Hwang opened Archegos. As he could not accept investor money, Hwang set up what is known as a family office, managing his own money and that of the family. The lack of public investors meant that there was less regulatory scrutiny on the fund, and arguably this lack of external investor scrutiny contributed to the dangerous amounts of leverage that were built up.

Did Archegos have a profitable period?

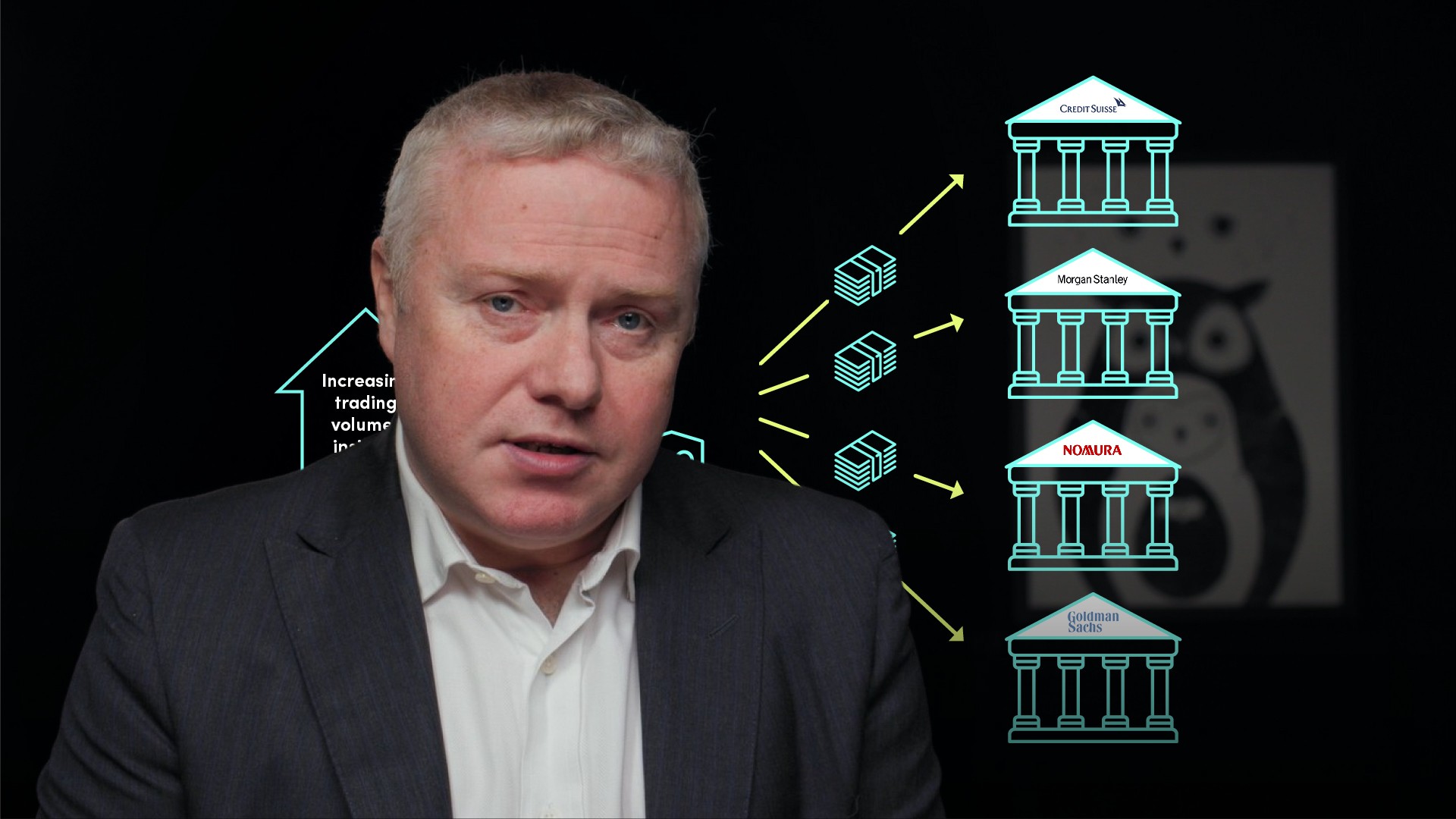

Goldman Sachs relented and joined Credit Suisse, Morgan Stanley and Nomura as the main banking counterparts to Archegos. These banks were responsible for allowing Archegos to build up huge amounts of borrowing. JP Morgan continued to refuse to accept Archegos as a client, but nonetheless, the fund was able to grow rapidly and by late 2020 had around $10bn assets under management.

What three main strategies undertaken by the fund led to disaster?

- Constantly increasing leverage.

- Concentrated buying in a small number of stocks forcing the price higher.

- Investment bank counterparties who were unaware of the full picture.

Archegos was not simply buying shares with borrowed money and leaving the position alone, it was actually increasing leverage as the value of the portfolio increased and putting all profits straight back into the portfolio.

How did the holding of Viacom lead to catastrophe?

A good way to understand this is to take an example of an actual company in which Archegos had a large holding, Viacom. Viacom is a conglomerate producing film and television programmes. The share price was trading below $40 at the start of 2021. It would be possible to lose money despite the fact that Viacom actually increased by over 20% in Q1 2021. A five times leveraged position in Viacom in 2021 should have returned over 100% in Q1... if it was left alone… Archegos managed to blow up an entire $10bn fund by being long of this stock and others, by continually increasing leverage.

Trevor Pugh

There are no available Videos from "Trevor Pugh"