EU Asset Management Regulation Introduction

Giles Swan

15 years: Asset management

In this introductory episode to European Regulation, Giles helps us understand what EU regulation is, what the different types of regulation are, how they are determined and how they apply across different fund types.

In this introductory episode to European Regulation, Giles helps us understand what EU regulation is, what the different types of regulation are, how they are determined and how they apply across different fund types.

EU Asset Management Regulation Introduction

14 mins 18 secs

Key learning objectives:

What does the future cover?

Explain EU regulation and how it is made

Identify which EU regulations apply to funds

Describe the UCITS Directive

Overview:

European Union regulation consists of EU wide rules that sit alongside domestic rules to create compliance obligations for funds.

What are the different types of EU regulation?

- Legislation - regulation and directives

- Implementing measures - technical standards and delegated acts

- Supervisory implementation - guidelines, opinions and Q&A

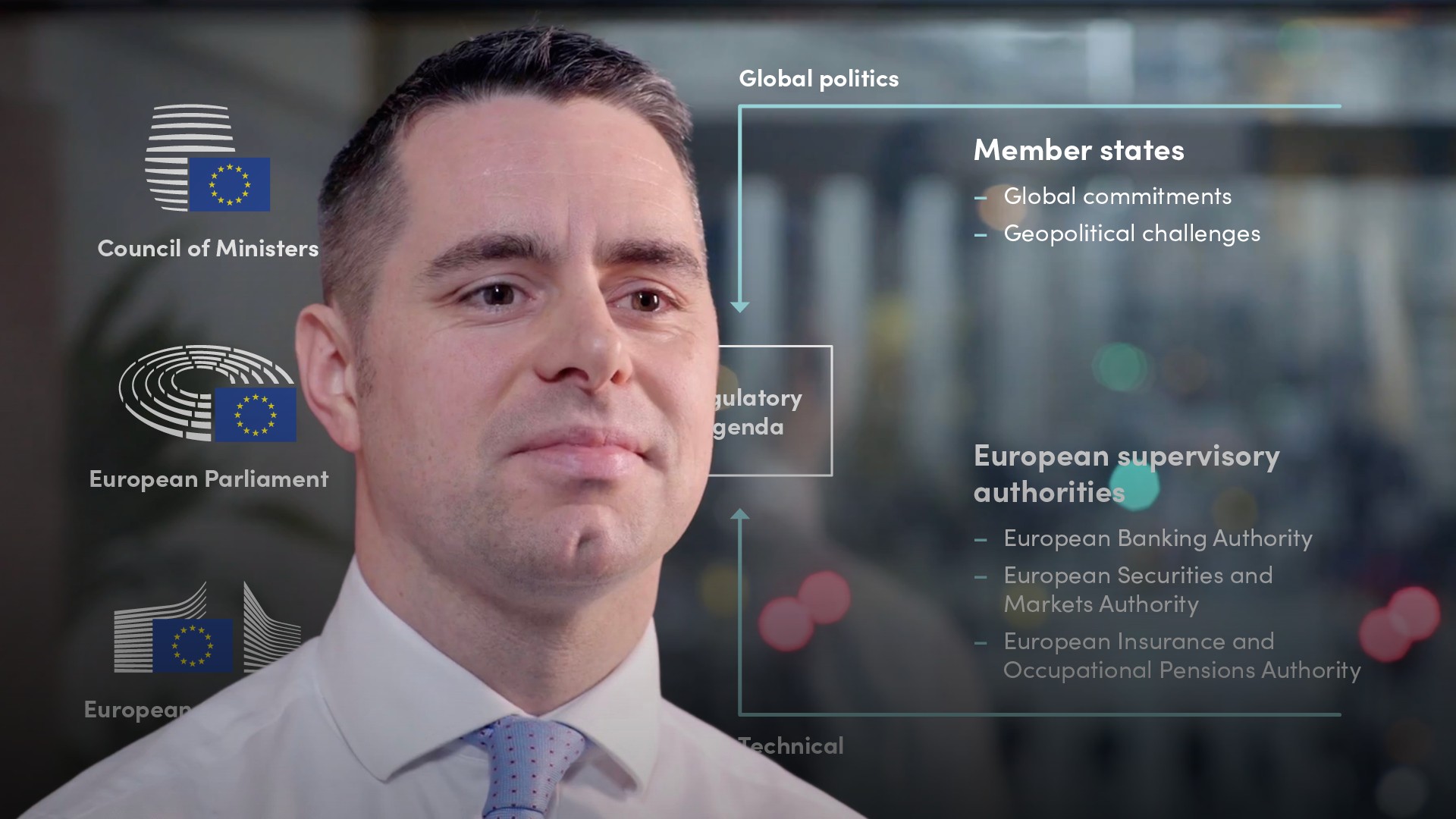

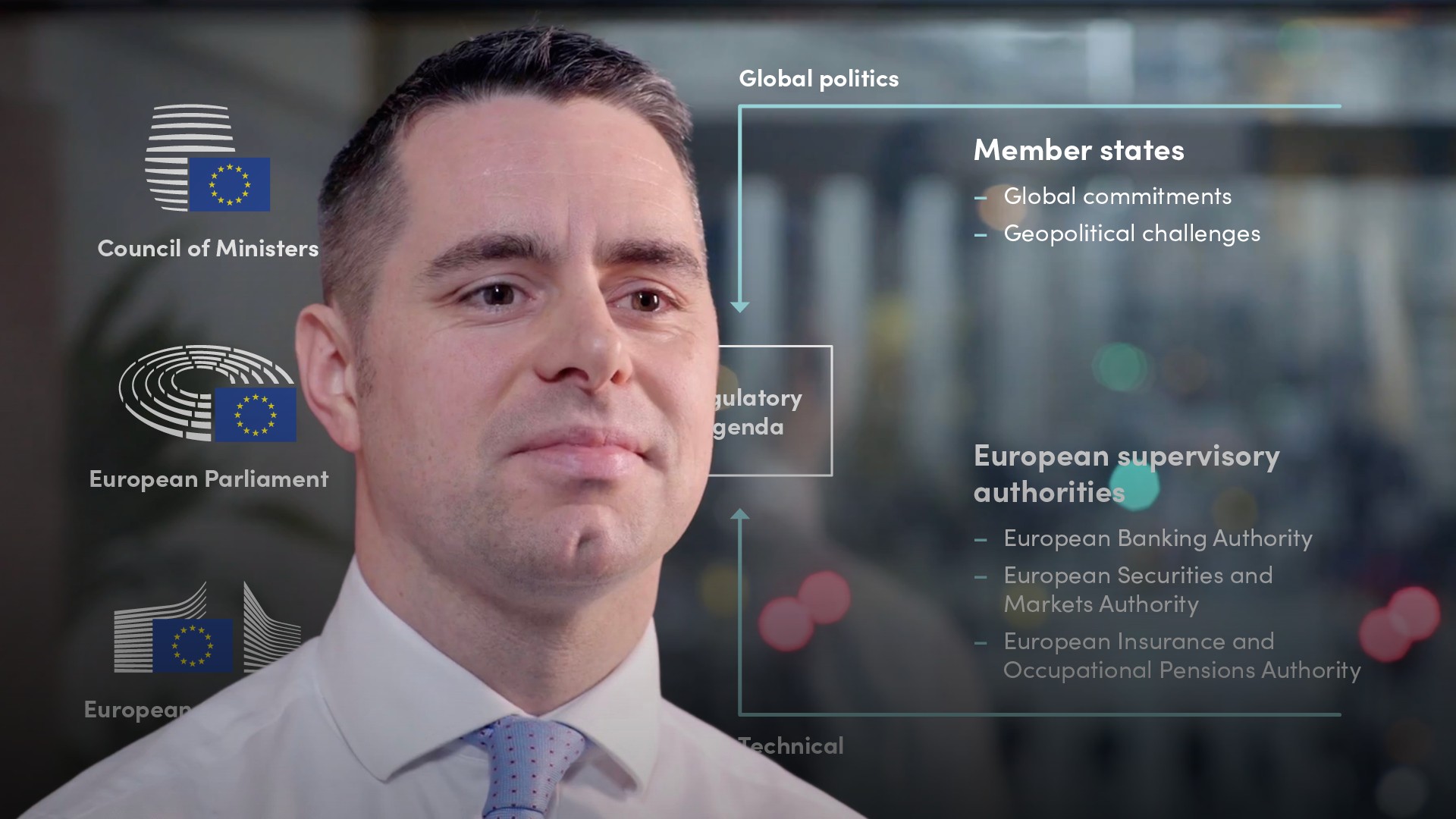

Who makes regulation in the EU?

- European Commission - This is the executive body of the EU, and has power to propose new legislation

- European Parliament - This is made up of elected representatives, and negotiates new legislation with the Council of Ministers

- Council of Ministers - These are government representatives from member states, and negotiates new legislation with the European Parliament

What is the process through which regulation is made?

- European Commission proposes new legislation

- The Council of Ministers and the European Parliament consider and debate this new legislation

- The three trialogue together to produce legislation

How does the EU decide what to regulate?

- EU political and technical input

- Parliament influences agenda through engagement including their own initiative reports and recommendations

- Council of Members, Member States and the EU Commission set out their agendas

How does EU regulation apply to funds?

- The different European Union Directives and regulations apply at EU level

- Member States transposition rules and regulations

- Local regulation

How does EU regulation apply across the value chain?

- Product - regulation touches prd, specification of product features

- Management and admin - governance

- Depositary - custody and safekeeping

- Distribution - The selling of funds to investors, disclosure, intermediary remuneration etc.

What is the UCITS Directive?

The Undertakings for Collective Investment in Transferable Securities (UCITS) - Objective is to facilitate cross-border offerings of investment funds to retail investors.Which rules apply to UCITS?

- EU Level rules

- Local Member State rules

Product Rules:

- Investment and risk-spending rules

- Valuation and pricing

- Subscription and redemption

- Master/feeder structure and mergers

- Investor disclosure

Management Rules:

- Governance

- Delegation and outsourcing

- Capital requirements

- Administration

- Risk management

Investment Rules:

- Eligible Assets

- Transferable securities

- Money market instruments

- Risk Spreading

- Diversification rules

- Counterparty concentration limits

- Risk Management

- Global exposure

- Risk measurement

What else does the UCITS Directive regulate?

Distribution:- Key investor document

- Marketing notifications and communications

Depositary:

- Safekeeping and custody of portfolio investments

- Cash management

- Oversight of management company

Which additional rules do local regulators in the EU apply?

- Marketing communications

- Tax rules

- Regulatory reporting

- Local investor facilities, ie. paying agents

- Supplementary disclosure arrangements

How does UCITS regulate distribution cross-border?

Marketing passport - Allows a UCITS fund that is domiciled in one EU country to be sold across other EU countries. Local distribution rules apply as well as a common set of rules that are contained within the UCITS directive. The management company is subject to the UCITS management rules and any local rules that exist in its jurisdiction.What rules apply to ETFs and MMFs?

- Money market funds are subject to specialist fund regulations that supplement the UCITS Directive.

- ETFs are subject to ESMA guidelines

What changes may be in the next iteration of UCITS?

2012 Commission UCITS consultation:- Eligible assets and derivative use

- Efficient portfolio management techniques

- Liquidity management

- Depositary passport

- UCITS IV improvements

- ETFs

- Leverage calculation

- Liquidity management

- Financial stability

- Substance requirements

- Delegation rules

- Formalising ESMA measures

Giles Swan

There are no available Videos from "Giles Swan"