AXA Machine Learning Case Study

Carlos Salas

Portfolio Manager and Data Scientist

Let’s see how an insurance company used machine learning model training. Join Carlos Salas as he explores how data science and machine learning can be used in finance to enhance insurance underwriting.

Let’s see how an insurance company used machine learning model training. Join Carlos Salas as he explores how data science and machine learning can be used in finance to enhance insurance underwriting.

AXA Machine Learning Case Study

6 mins 36 secs

Key learning objectives:

Understand how AXA use machine learning

Overview:

AXA uses machine learning models to optimise its insurance underwriting operations. They developed internal machine learning models which improve this process by reducing the time allocated to the underwriting process and lead to better risk management policies.

How has AXA used data science?

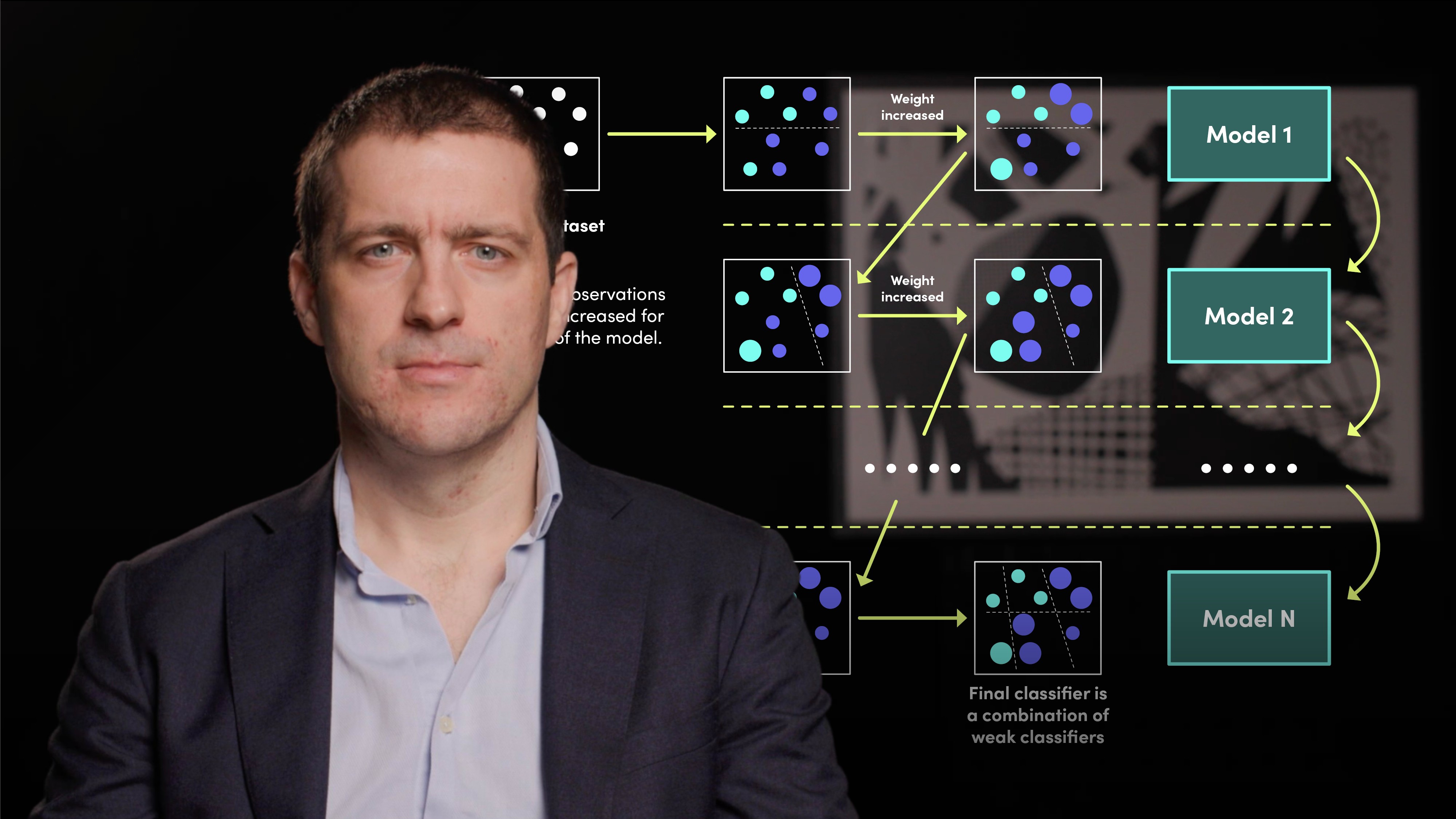

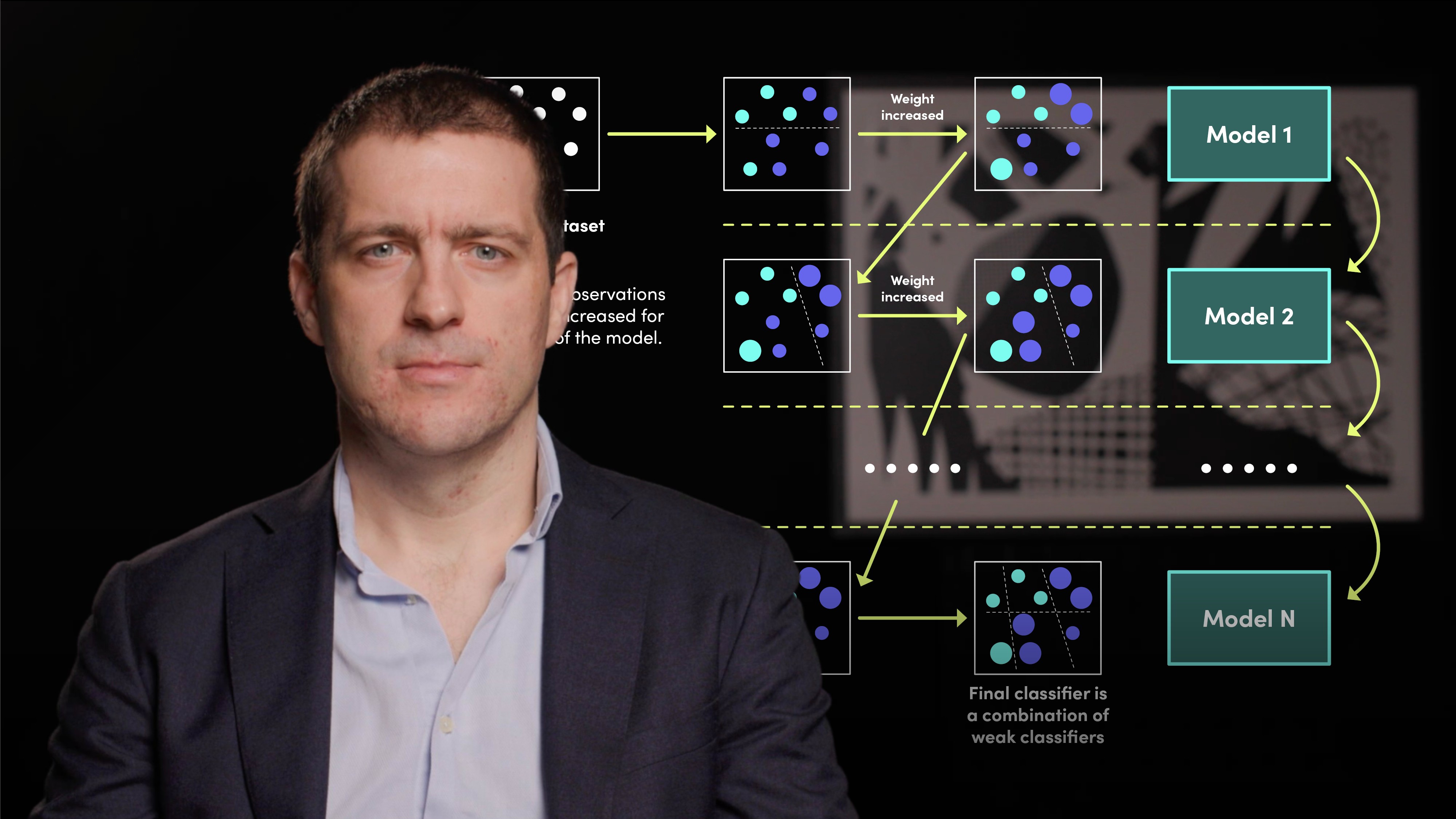

AXA uses machine learning models to optimise its insurance underwriting operations. AXA has been able to develop internal machine learning models which improve this process by reducing the time allocated to the underwriting process and lead to better risk management policies. The data science team uses Python scripts to automate the process of regularly scheduling data requests and ingesting this data into a data science workflow in order to generate features that feed the machine learning algorithm.

42 features are used in the model including information about the policy, such as duration, coverage type and risks insured and company information (e.g. the number of years of operation, industry classification and the company’s track record).

As the model reaches extremely high policy premiums, it starts requiring a higher level of human supervision. In other words, AXA can now optimise the usage of human capital by allowing its employees to focus on its largest clients and at the same time, rely more on automation for its small and medium clients.

Carlos Salas

There are no available Videos from "Carlos Salas"