Bank Capital Post 2008 Financial Crisis

January Carmalt

20 years: Research & banking

In this video, January examines the new regime for bank solvency subsequent to the financial crisis of 2008, taking a closer look at the ever evolving regulatory landscape for bank capital and hybrid instruments.

In this video, January examines the new regime for bank solvency subsequent to the financial crisis of 2008, taking a closer look at the ever evolving regulatory landscape for bank capital and hybrid instruments.

Bank Capital Post 2008 Financial Crisis

11 mins 17 secs

Key learning objectives:

Define a bank’s basic capital structure today

Define bank solvency and understand why low solvency levels are a problem

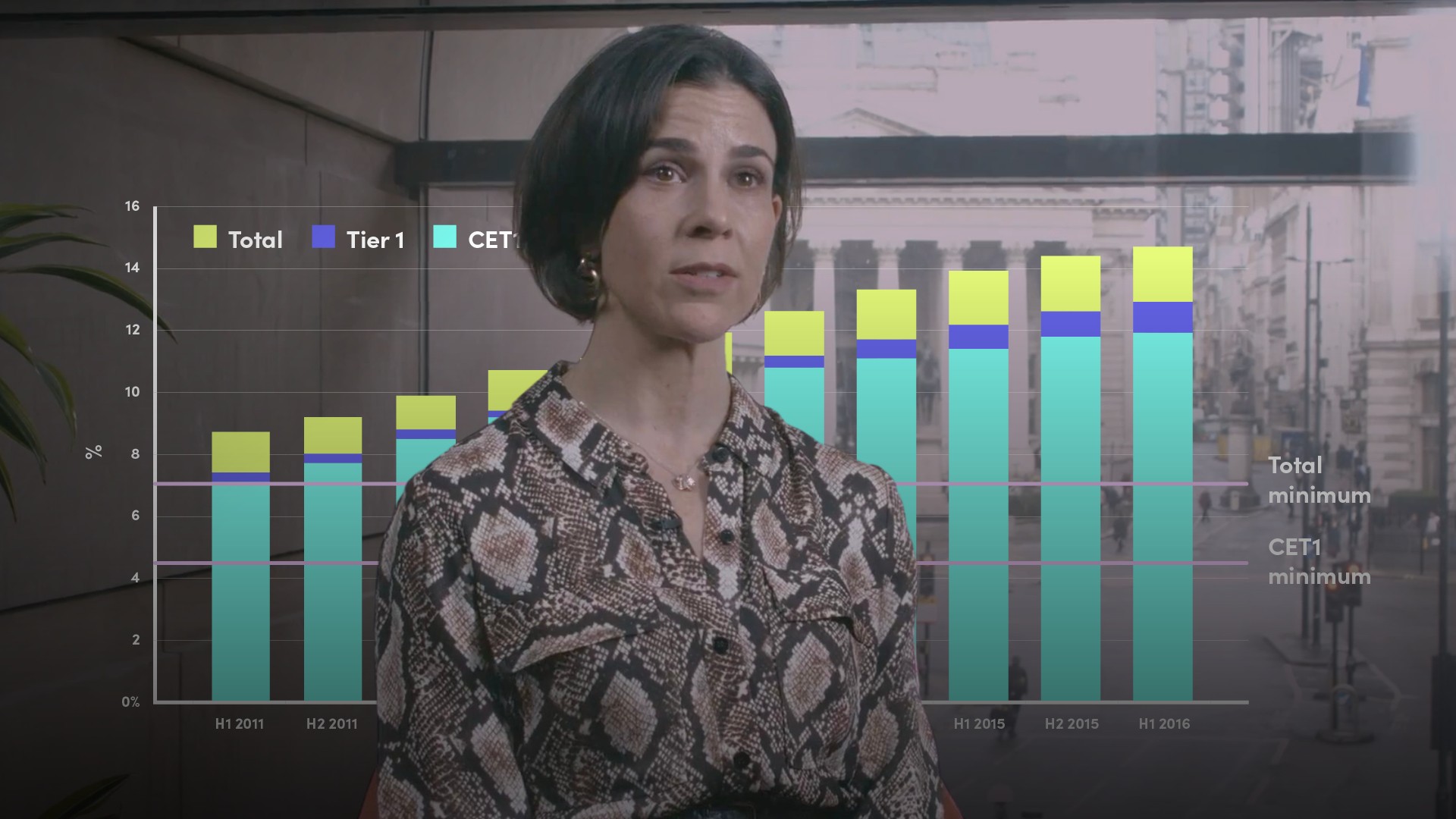

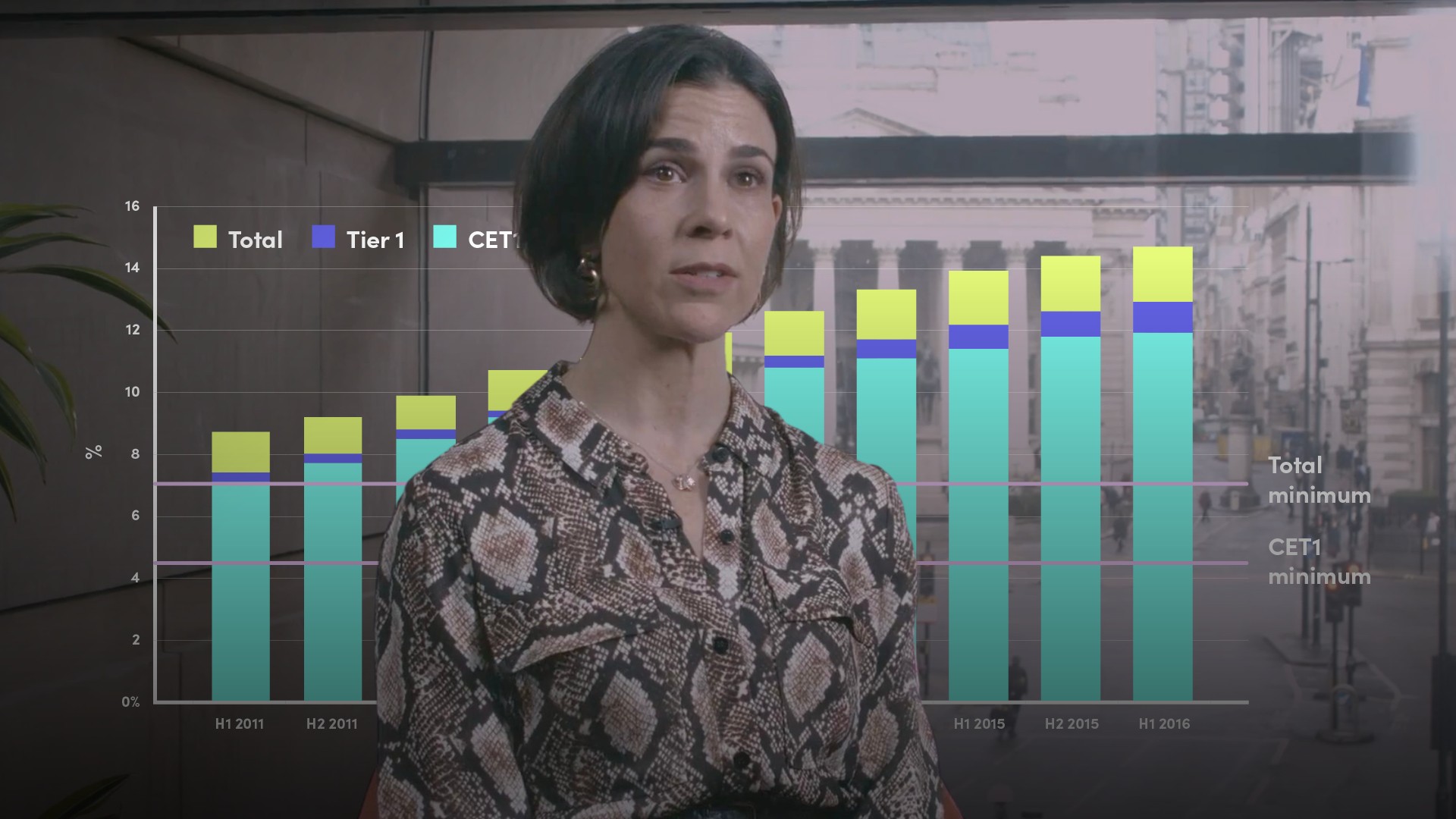

Outline improvements that have been made to capital standards in recent years

Overview:

The 2008 global financial crisis led to material changes in the way bank capital is defined and calculated, and to more stringent capital adequacy regulations to ensure banks have sufficient capital to remain solvent without any need for taxpayer bail-outs. The specific trigger for the bankruptcy of Lehman Brothers in 2008 was an acute lack of liquidity i.e. an ability to refinance liabilities coming due and fund day-to-day activities. The acute liquidity crisis was directly precipitated by fears about the bank’s solvency.

What is bank solvency and why are low solvency levels a problem?

A bank’s solvency is a measure of its capital; put simply: assets minus liabilities. At the time of the global financial crisis, minimum capital requirements for banks were woefully inadequate. Many systemically-important banks operated very low solvency levels i.e. were woefully under-capitalised.

They had very slim capital buffers to absorb potential future losses from hundreds of billions in assets, and capital ratios were easy to manipulate using a variety of preference shares and structured hybrid securities. Old-style hybrid long-term securities (which had characteristics of both debt and equity) included now-defunct Upper Tier II bonds as well as a class of subordinated debt known as Lower Tier II bonds. The primary problem with these instruments was that they could only absorb losses in the event of a liquidation or when the bank had become a gone-concern.

What improvements have been made to capital standards in recent years?

Over the past decade governments, regulators and financial institutions themselves have made a number of game-changing strides to strengthen bank solvency levels: increasing minimum capital requirements and introducing stricter rules on what constitutes bank capital. Improvements include:

- The Basel III global capital standard, which outlined stricter regulations on capital and risk-weighted asset calculations

- An alphabet soup of new capital regulations, including Total Loss-Absorbing Capacity (TLAC) at a global level and its European iteration: the Minimum Requirement for Own Funds and Eligible Liabilities (MREL)

- Myriad government-led stress tests.

Bank capital structures today are much simpler. They ensure that institutions are adequately equipped to continue critical functions without threatening financial market stability. And there is a clear hierarchy of loss absorption and capital subordination that ensures the burden of losses in any financial crisis situation is transferred from taxpayers to stakeholders. This is referred to as a bail-in regime.

Define a bank’s basic capital structure today

- Going-concern capital

- Common Equity Tier 1: the bedrock layer of loss-absorbing capacity that includes shareholders’ equity and retained earnings (less goodwill, other intangibles and dividend distributions)

- Additional Tier 1 (AT1) a.k.a. contingent convertibles (CoCos): perpetual debt securities that absorb losses when a predetermined regulatory capital level is breached. Embedded contractual provisions impose either principal write-downs or conversion into equity

- Gone-concern capital

- Supplementary capital (Tier 2 capital): consists of revaluation reserves (i.e. the surplus created by the upward revaluation of an asset e.g. real estate owned), general loan loss provisions and subordinated Tier 2 bonds. Supplementary capital is senior to CET1 and AT1 but subordinate to other senior unsecured bondholders, senior preferred bondholders and deposits.

January Carmalt

There are no available Videos from "January Carmalt"