Bond Bookbuilding Post-launch

Nigel Owen

20 years: Debt capital markets

In this video, Nigel explains the last two stages of the bond bookbuilding process: deal day and allocation.

In this video, Nigel explains the last two stages of the bond bookbuilding process: deal day and allocation.

Bond Bookbuilding Post-launch

9 mins 58 secs

Key learning objectives:

Outline the next steps in the process, from the initial launch to the allocation of the bonds

Explain the key considerations made by issuers and syndicate managers

Define pot basis, retention basis, and reoffer

Overview:

In this video, the last two stages of the bond book building process are discussed; the deal day, and the allocation of the bonds to investors.

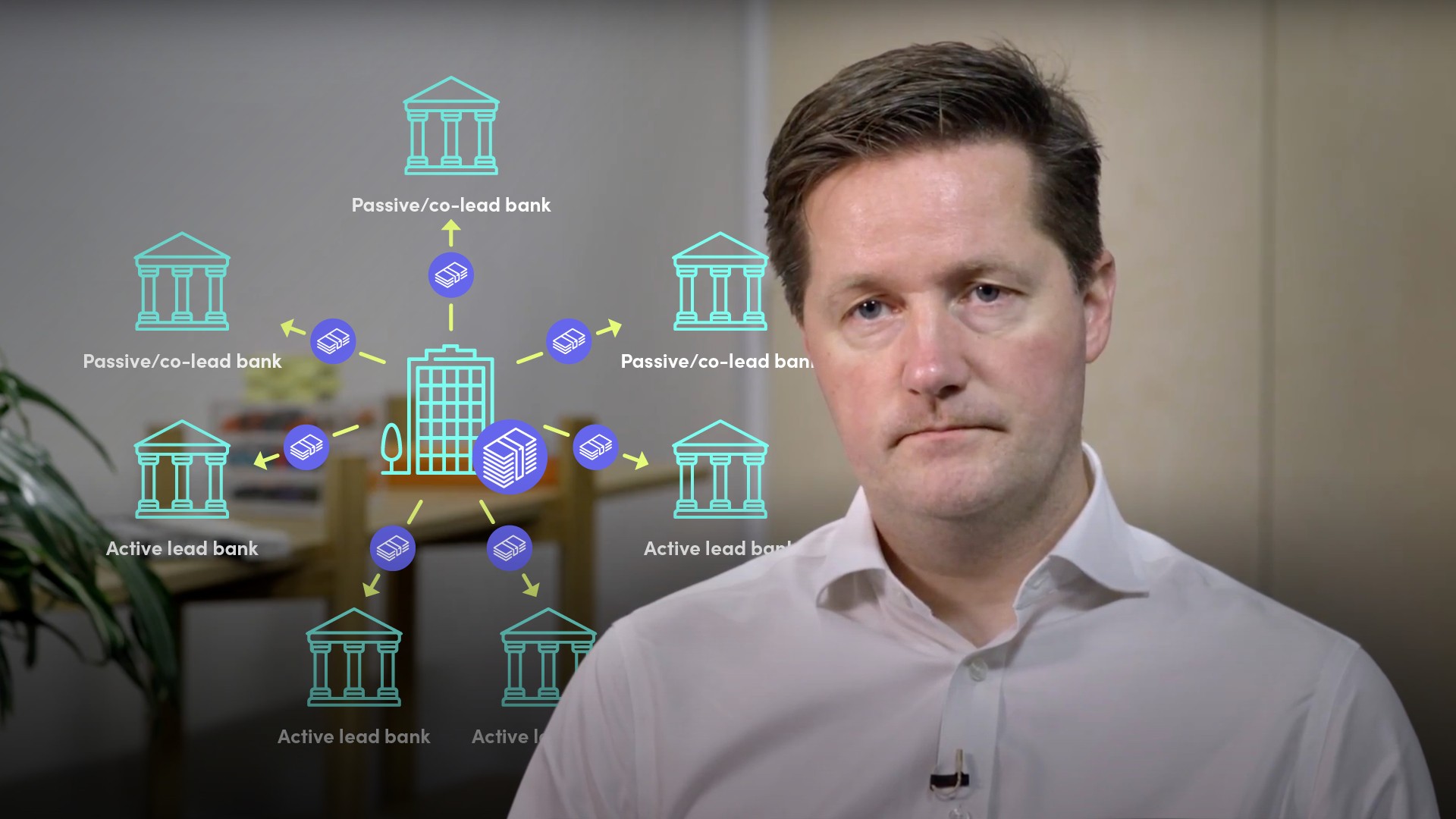

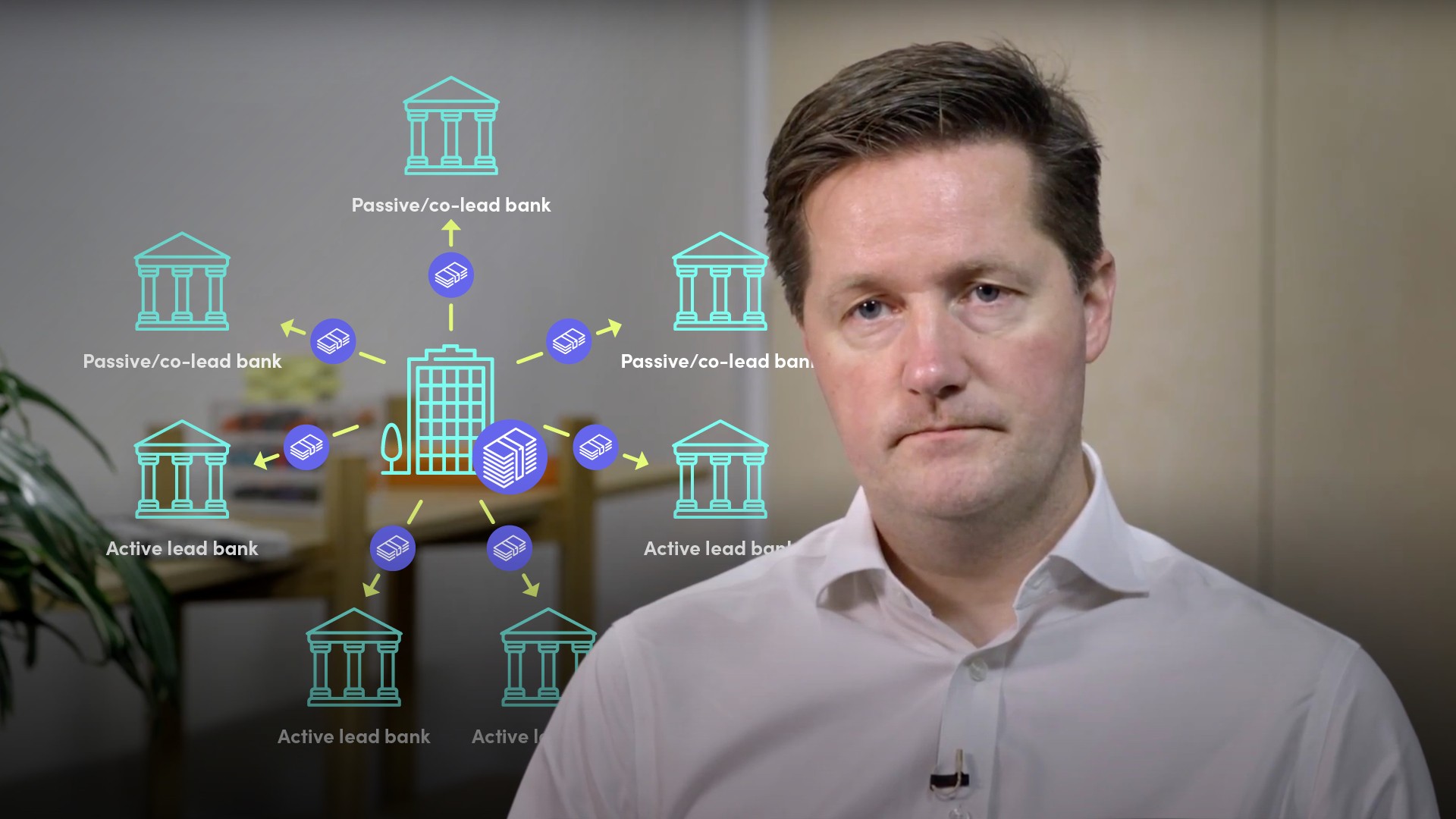

As part of the launch, what different roles are given to different banks?

The launch of the deal is a hectic time for syndicate bankers, You want the deal to be in front of every possible investor as soon as possible, and therefore different bankers are given different roles:

- One bank will be in charge of announcements, making sure that the deal is published on Bloomberg, Reuters and other relevant news feeds

- Another will be in charge of hosting the order book, which today tends to be on an online solution

- All banks will be trying to get the message they have launched the new deal at the same time to all their clients who might buy funds

What must syndicate bankers agree on prior to launch?

- They must agree on a standardised launch message

- Agreeing to launch a set time

What other steps are completed prior to launch?

- At this point, the syndicate managers send the launch message to their sales teams, which then distributes it to all their clients. The details of the deal will be on that message, including the Initial Price Thoughts.

- At the same time, the bank in charge of hosting the electronic order book will turn that to ‘live’ and the process of building investor orders is underway.

What is pot basis and retention basis?

- Pot basis - That means that the fees are paid equally to all bookrunners, irrespective of how many orders each brings in. Generally, an order is given to one bank to enter into the order book, but it is designated as all banks being responsible for it. This means banks are not competing against each other to book investor orders

- The Swiss Franc market still operates on a Retention basis - A bank only gets paid for the orders it brings in

What is ‘reoffer’?

The orders given by investors are for a specific size order, and either “at reoffer”, which means they will take the price the deal prices at, or with a limit, a spread below which they will not buy the bonds. Sometimes an investor may reduce their order if the spread tightens, or cancel it completely.What typically happens 1-2hrs after the order books open?

This will normally schedule a call between the syndicate and the issuer - where the orders in the order book and what the next step regarding pricing is discussed.

- If the order book is more than the targeted size of the deal, and all orders are at ‘reoffer’, the syndicate will recommend a sizeable reduction in the spread being marketed to investors

- If the order book is heavily oversubscribed, some reduction in the size of the order book is not a bad thing, as long as it is not material

What is ‘price guidance’?

Once the revised spread is agreed by the syndicate, an update message is sent out to investors providing more precise ‘price guidance’. This will be much closer to the expected final spread, and often at this stage, the syndicate will share revised information on the size of the deal and/or an indication of the book size. This information allows investors who have already placed orders to reconsider size etc.What are the next steps in the book building process?

- Once the orders are revised, the syndicate has a good view of what the final book will look like in terms of size and what limits investors have placed

- The syndicate will then have a final discussion with the issuer to decide if they can tighten the spread any further and what the final deal size will be

- Once the final spread and deal size are agreed, this will be conveyed to investors, and they are usually given a short time to make final amendments before the order book closes

- When the order book closes, no further orders can be added, however, orders can still be reduced or removed

What happens if the order book isn’t full?

Either:- The issuer has to agree to reduce the size of the deal

- The issuer has to pull the size of the deal

- The syndicate bankers agree to make up the difference by buying the bonds themselves

Let's assume the issuer has a targeted size of €500m, but the orderbook totals €2bn. The syndicate group now has to propose to the issuer how they plan to allocate the €500m of bond, explaining which accounts they plan to scale back and by how much.

What allocation considerations are made by all parties?

- The issuer’s objective and expectations under normal market conditions - This normally involves the bonds being allocated more generously to investors who have previously demonstrated a long-term commitment to the company in previous bond issues

- Aftermarket price stability - An excess amount of secondary trading can cause pricing volatility in the initial days of trading. Thus, syndicates will allocate more generously to buy-to-hold investors

What considerations must the syndicate make?

- An investor’s geographical location; if the issuer has intentions to sell bonds int a certain jurisdiction

- Investor engagement and support, helping the syndicate to understand the size and shape of the order book sooner

- The type of investor - previous behaviour and investment horizon

- Order sizing as a percentage of the deal

Once the allocations are agreed, investors are informed of their allocation by the banks, and the next step is for the bonds to be priced.

Nigel Owen

There are no available Videos from "Nigel Owen"