Bond Names Around the World

Nigel Owen

20 years: Debt capital markets

Bonds are a serious business, but there is a lighter side to the market which can be seen in the names given to bonds issued in certain jurisdictions under certain conditions. In this video, Nigel runs us through different types of bonds that are named after food, animals, people and plants.

Bonds are a serious business, but there is a lighter side to the market which can be seen in the names given to bonds issued in certain jurisdictions under certain conditions. In this video, Nigel runs us through different types of bonds that are named after food, animals, people and plants.

Bond Names Around the World

10 mins 34 secs

Key learning objectives:

Identify the bonds named after people

Identify the bonds named after animals

Identify the bonds named after foods and plants

Define IFC and outline the market building benefits of IFC programmes

Overview:

Every day, billions of dollars in new bonds are sold into the world's various debt markets. Bonds are a serious business, but there is a lighter side to the market, as shown by the names given to bonds issued in specific jurisdictions under specific conditions. They are named after foods, animals, people, and even plants in some cases.

What are the bonds named after people?

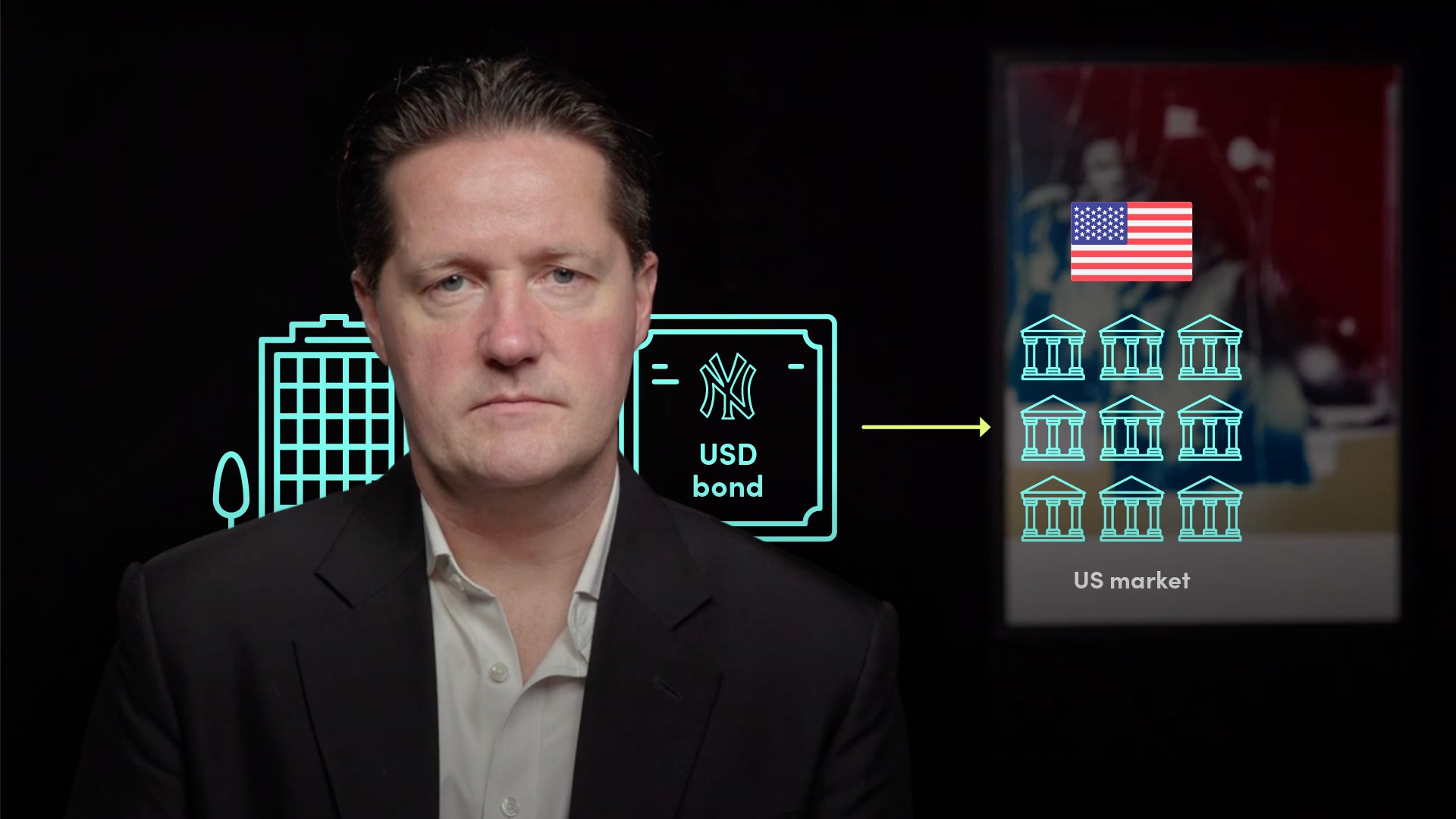

- Yankee Bonds - Bonds denominated in US dollars and issued in the US domestic bond market by issuers not based in the US. These bonds must confirm to the US securities Act and be registered with the Securities and Exchange Commission.

- Reverse Yankee bonds - Bonds issued by US companies outside of the US and denominated in a currency other than the US dollar. Reverse Yankee bonds accounted for a higher volume of bonds issued in euros than bonds sold by issuers from any other single country.

- Samurai bonds - Bonds denominated in Japanese Yen and sold in Japan by issuers not based in the country.

- Matador bonds - Bonds denominated in Pesetas, sold in Spain by non-Spanish companies.

- Rembrandt bonds - Bonds denominated in Guilders, and sold in the Netherlands by non-Dutch companies.

What are the bonds named after animals?

- Bulldog bonds - Bond issued in sterling and sold in the UK by non-UK based issuers.

- Kangaroo bonds - Australian dollar denominated bonds sold in Australia by non-Australian issuers.

- Kiwi bonds - Bonds issued in New Zealand dollars sold in the country to New Zealand residents.

- Dragon bonds - Bonds issued by Asian issuers (ex Japan) into foreign bond markets.

- Panda bonds - Bonds denominated in Chinese renminbi, sold in China by non-Chinese issuers.

What are the bonds named after foods and plants?

Food seems to be a favourite source of bond naming, with at least six different types of bonds referring to calories of one sort or another.

- Dim sum bonds - Renminbi bonds issued outside of China. Dim Sum bonds were initially issued only in Hong Kong, but have since expanded to be sold internationally, and many corporations choose to use this path to gain access to ren-min-bi investors and raise funds in the currency.

- Maple bonds - Maple bonds are the bonds issued in Canada.

- Baklava bonds - Baklava bonds are the bonds issued in Turkey.

- Masala bonds - Indian rupee denominated bonds sold outside of India by Indian issuers.

- Kimchi bonds - A non-won denominated bond issued in the South Korean market.

- Formosa bonds - Non-Taiwanese dollar denominated bonds issued in Taiwan by Taiwanese branches of international financial institutions.

What are IFC and market building benefits of IFC programmes?

The International Finance Corporation is the private sector arm of the World Bank Group. In recent years, the IFC has developed a number of local currency bond issuance programs, most of which have been given formal names based on symbols associated with the country or region in order to increase visibility. One of the missions of IFC is to develop local capital markets in emerging markets.

A key mission is to set bond benchmarks that act as a catalyst for domestic corporates to follow. Local currency IFC bonds also create best-practice operational blueprints intended to improve existing issuing processes and improve regulatory frameworks.

Nigel Owen

There are no available Videos from "Nigel Owen"