Calculating Real Returns

Abdulla Javeri

30 years: Financial markets trader

Chances are when someone quotes a figure for investment returns it’s likely to be on a nominal or gross basis, without taking into account the effects of inflation. Purchasing power only increases if returns outstrip inflation over a given period. Abdulla addresses this fact and explains how to measure real returns for a single period, and over time, to help us understand inflation-adjusted returns.

Chances are when someone quotes a figure for investment returns it’s likely to be on a nominal or gross basis, without taking into account the effects of inflation. Purchasing power only increases if returns outstrip inflation over a given period. Abdulla addresses this fact and explains how to measure real returns for a single period, and over time, to help us understand inflation-adjusted returns.

Calculating Real Returns

4 mins 42 secs

Key learning objectives:

Identify the two methods in calculating real returns

Use the calculation to determine if wealth has increased or decreased

Overview:

Real returns are in other words, inflation adjusted returns. Over the long-term, it’s important to consider the impact of inflation on returns to determine if we are wealthier. We increase our purchasing power or wealth, if our returns outstrip inflation over a given period.

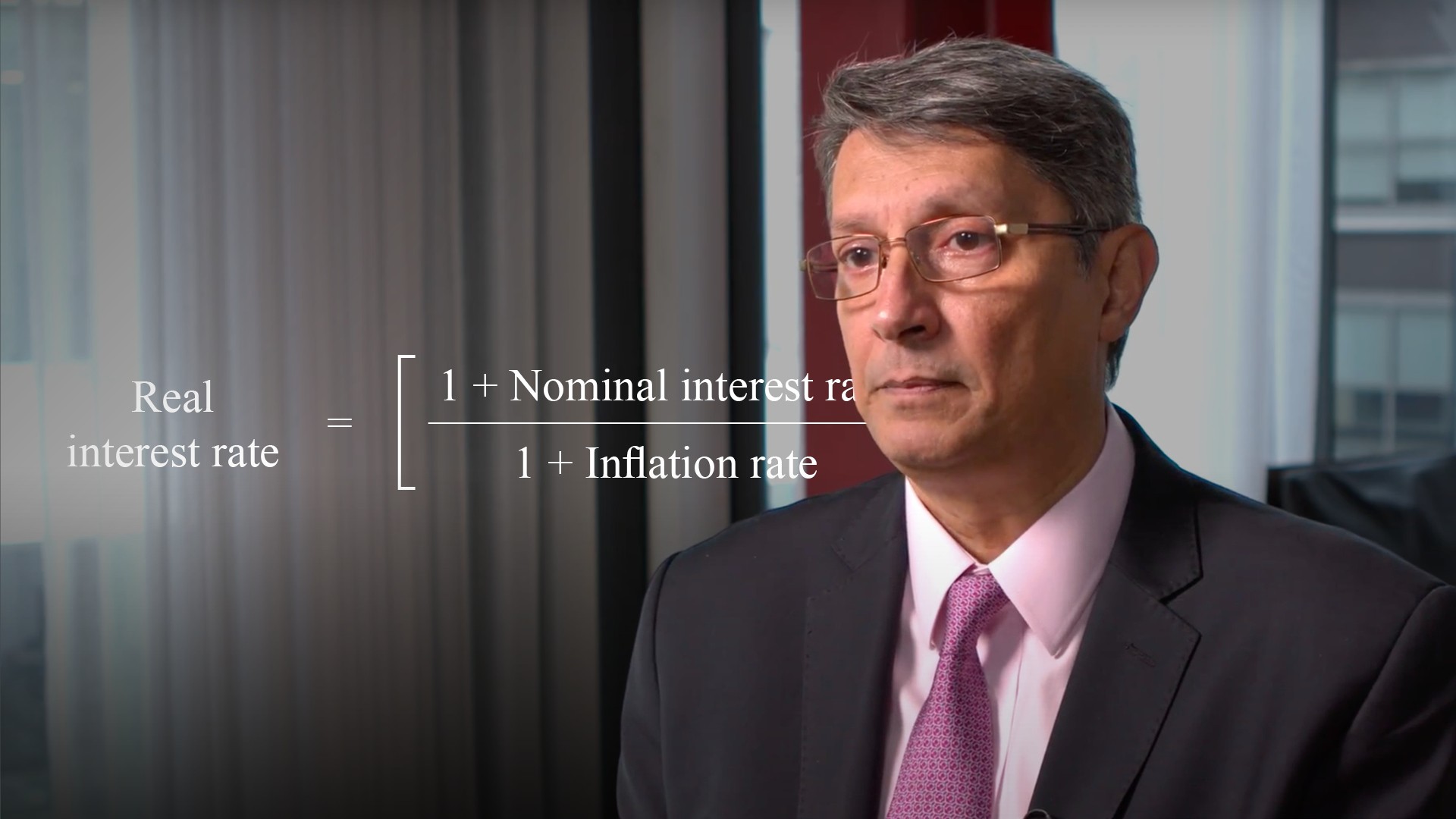

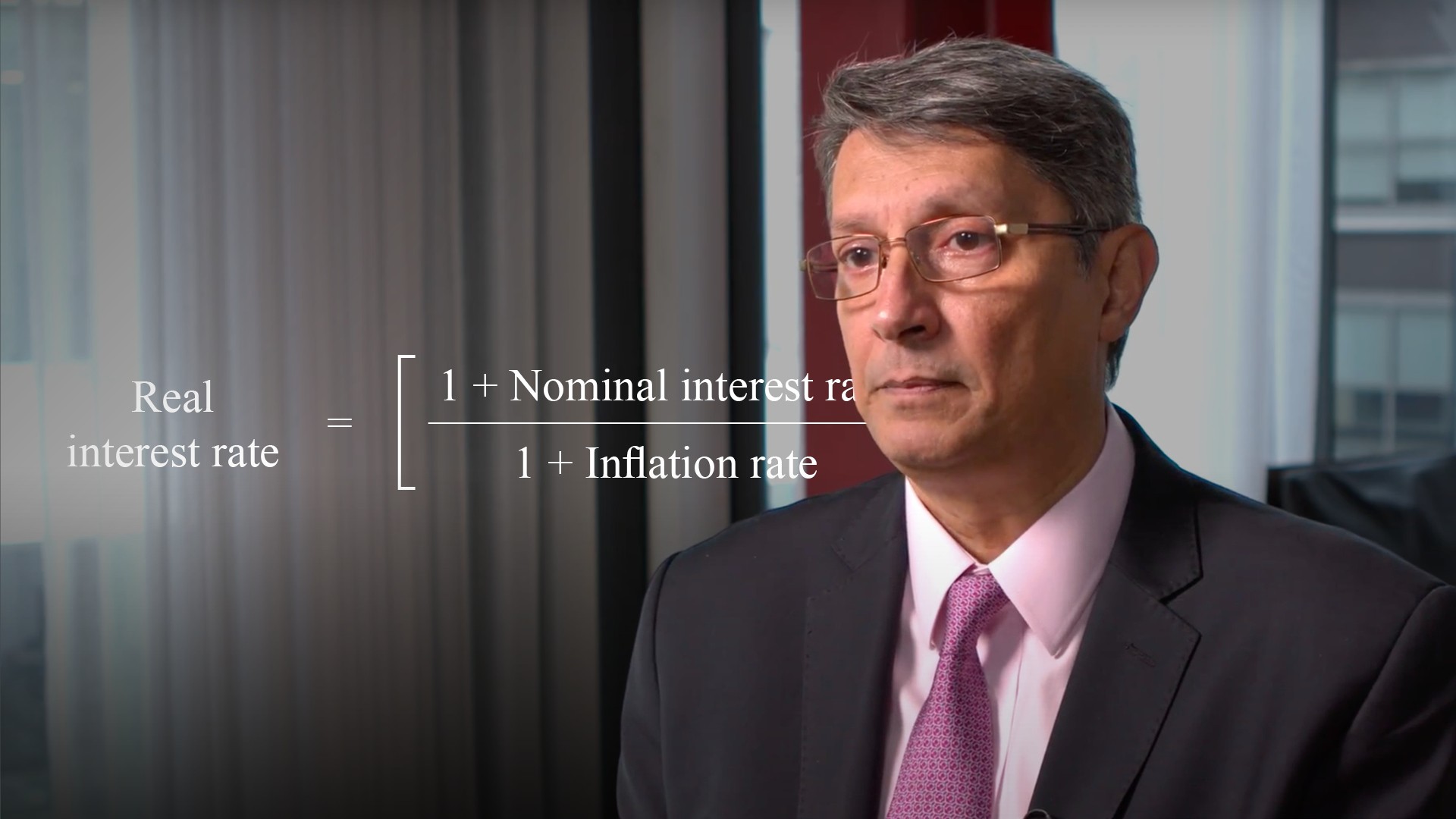

What are the two methods of calculating real returns?

- Fisher Effect Equation: Nominal rate - Inflation Rate. However, this disregards the effect of time

- Real Rate = (1+ Nominal rate) / (1+ Inflation rate) - 1

Real returns impact which parties?

Real returns are good for savers and investors. However, if you’re a borrower, you would prefer negative real rates, because it means you’re paying back devalued money.Using the information in the table, how do we calculate the inflation index, inflation rate, fisher, real rates and investment?

| Years | Inflation Index | Nominal Rates/Returns | Inflation Rate | Fisher | Real Rates | Investment |

| 0 | 100.00 | 100.00 | ||||

| 1 | 102.00 | 5.00% | 2.00% | 3.00% | 2.94% | 105.00 |

| 2 | 104.50 | 3.00% | 2.45% | 0.55% | 0.54% | 108.15 |

| 3 | 107.00 | 6.00% | 2.39% | 3.61% | 3.52% | 114.64 |

| 4 | 109.20 | 2.00% | 2.06% | -0.06% | -0.05% | 116.93 |

| 5 | 113.00 | 7.00% | 3.48% | 3.52% | 3.40% | 125.12 |

- Inflation Rate

- Year 1: (102/100) -1 = 2%

- Year 2: (104.5/102) -1 = 2.45%

- Fisher: (Nominal rate - Inflation rate)

- Year 1: (5% - 3%) = 2%

- Year 2: (3%-2.45%) = 0.55%

- Real Rate

- Year 1: (1+ 0.05) / (1 + 0.02) - 1 = 2.94%

- Year 2: (1+0.03) / (1+ 0.0245) - 1 = 0.54%

- Investment

- Year 1: 100 x (1+0.05) = 105

- Year 2: 105 x (1+ 0.03) = 108.15

Have we increased our wealth over this 5-year period?

- Nominal Return (5Yrs): (125.12/100) - 1 = 25.12%

- Inflation (5Yrs): (113.00/100.00) - 1 = 13%

- Annualised 5-Year Real Return: (1+0.2512) / (1+ 0.13)⅕ -1 = 2.0581%

Given those returns and those inflation rates, we have increased our wealth, on average, by 2.0581% above inflation.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"