Fixed Rate Bond Make-Whole Calculation and Manifest Errors

Mark Dalton

20 years: Equity capital markets

In the first part of this two part series, Mark talked about the way a calculation agent helps the issuer of a convertible to deal with anti-dilution adjustments and settlement calculations. In this video he talks about the two examples of situations in which he as a calculation agent, help issuers deal with complex calculations on their transactions.

In the first part of this two part series, Mark talked about the way a calculation agent helps the issuer of a convertible to deal with anti-dilution adjustments and settlement calculations. In this video he talks about the two examples of situations in which he as a calculation agent, help issuers deal with complex calculations on their transactions.

Fixed Rate Bond Make-Whole Calculation and Manifest Errors

7 mins 15 secs

Key learning objectives:

Understand how the formula works for fixed rate bonds that include make-whole calls at the time they are called for redemption

Understand how an issuance error is corrected

Overview:

The role of a good calculation agent is much more than typing numbers into a calculator to find the result of a formula. The role requires a thorough understanding of the transaction documents, the market activities that affect transactions, the hedging of transactions, and the processes – both formal and informal – that are needed to make the transaction work and to know how to help the issuer manage all of these items.

How does the formula work for fixed rate bonds which include make-whole calls at the time they are called for redemption?

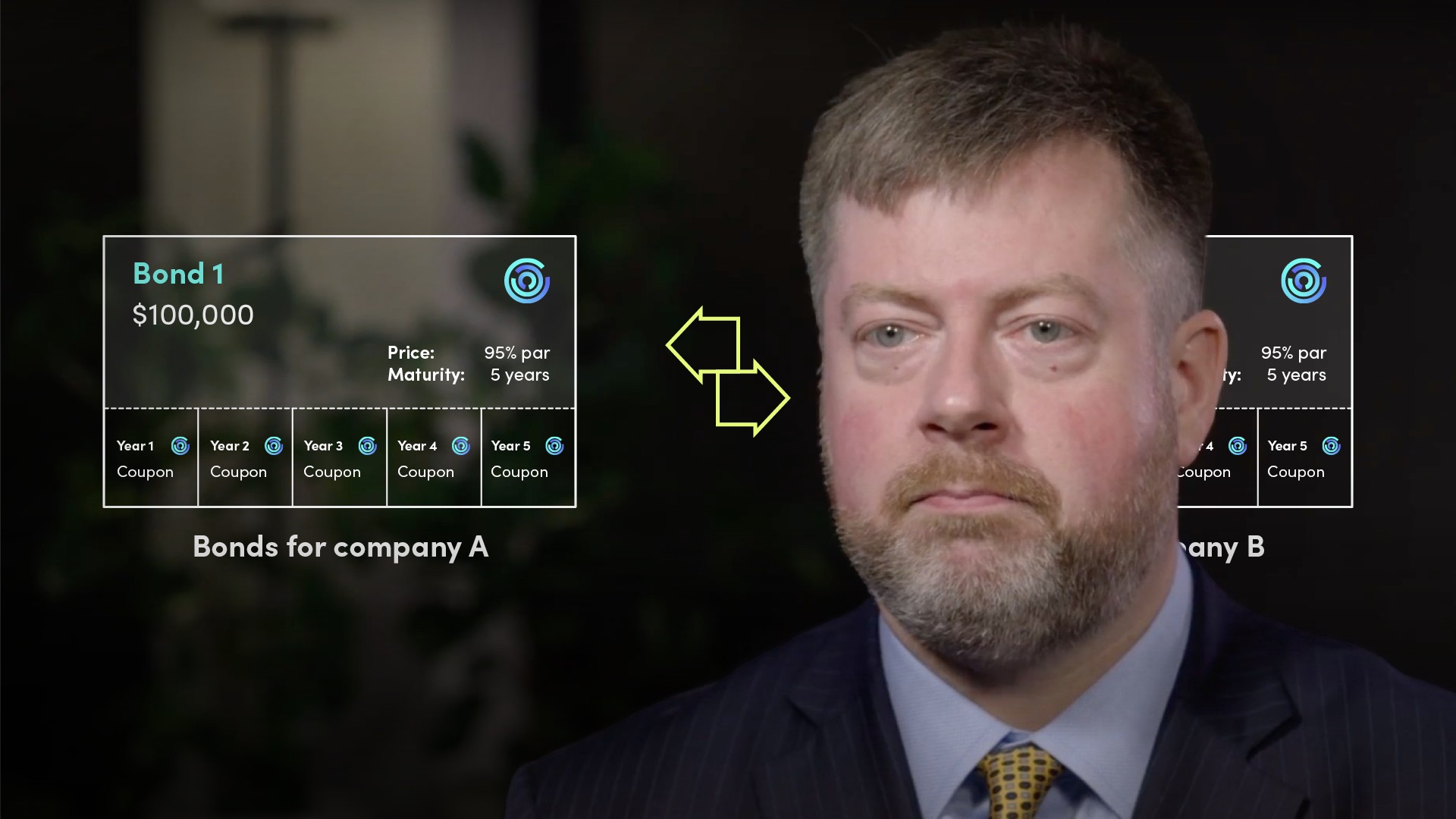

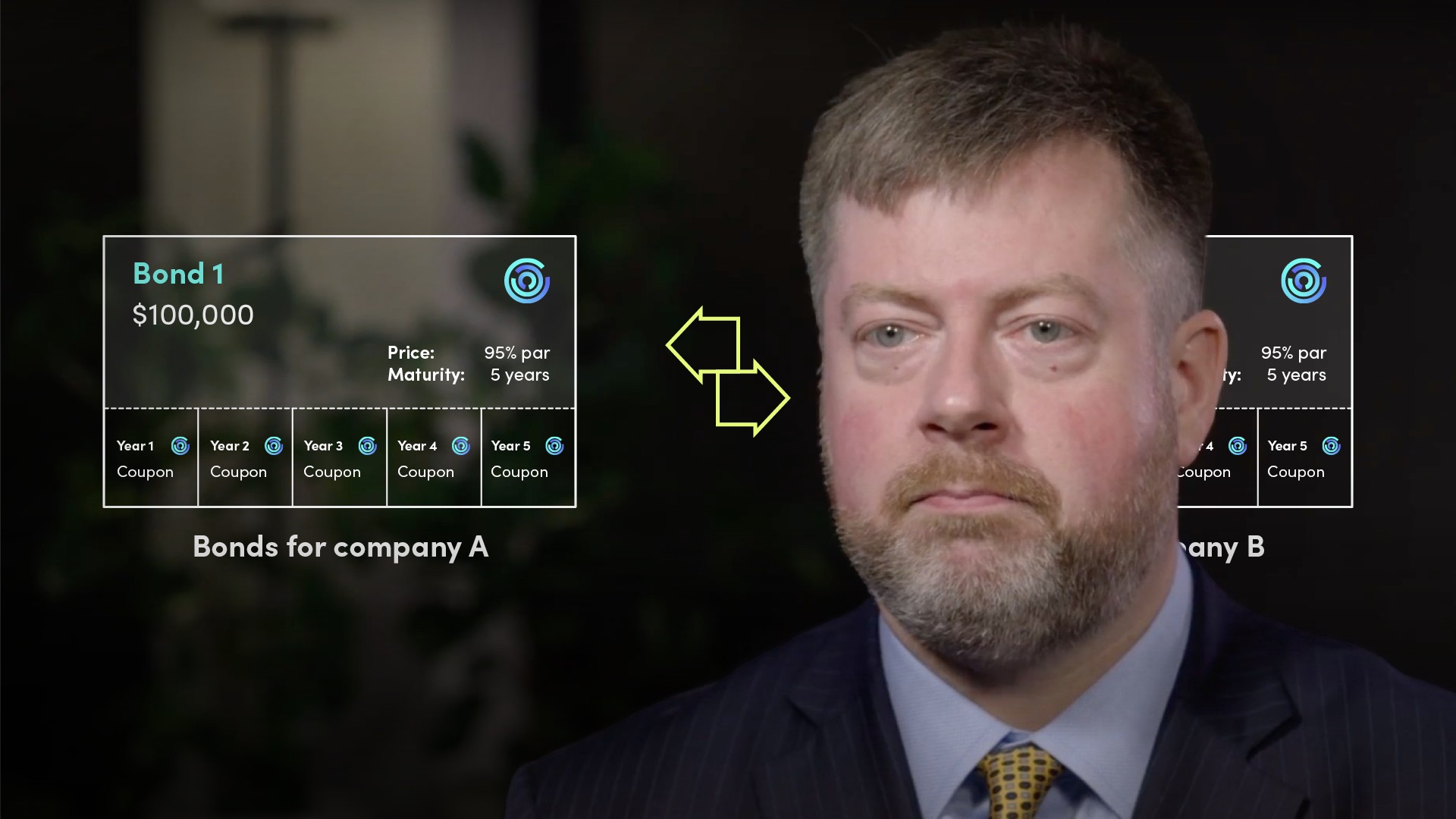

When a fixed rate bond includes a make whole call, this feature allows the issuer to repay the bonds early, based on a formula that is designed to approximate their fair value, or a small premium to it, at the time they are called for redemption.

- It considers the yield in the future for a government bond in the same currency with a similar maturity

- Adds a credit spread to that yield, but which is lower than the credit spread when the bonds were initially issued

- Discounts the remaining payments on the bond itself based on that interest rate

How is an insurance error corrected?

- Claim that the problem is a “manifest error”, i.e., a drafting problem, and to ask the Trustee to allow a correction to the documentation post-issuance. it can be quite difficult to give the trustee sufficient comfort that they are willing to accept this, and so as a result this route is not commonly used

- The issuer can work with its agents and advisors to develop a logical and/or legal argument as to why the adjustment isn’t needed, and then simply to do nothing. In this situation, the issuer has a memo in his file to back up his position and can then defend his lack of action if the investor claims in the future

Mark Dalton

There are no available Videos from "Mark Dalton"