Bank Capital and Liquidity

Tim Skeet

35 years: Debt capital markets

In this video, Tim explains the difference between bank capital and bank liquidity—a critical distinction that is all too often misunderstood.

In this video, Tim explains the difference between bank capital and bank liquidity—a critical distinction that is all too often misunderstood.

Bank Capital and Liquidity

14 mins 17 secs

Key learning objectives:

Learn the difference between capital and liquidity

Understand the role of capital in a property downturn

Explain how a bank uses it's liquidity portfolio to deal with deposit withdrawals

Overview:

Bank capital and liquidity perform different functions. Equity capital is provided by shareholders and is the first buffer against losses in a downturn. Equity enables banks to shrink the liabilities side of their balance sheets to match a shrinking asset base caused by losses. Liquidity can be deployed to meet short-term obligations such as large-scale sudden deposit withdrawals. Withdrawals reduce the liabilities side of the balance sheet; the liquidity portfolio can be shrunk to match that change.

Explain the difference between capital and liquidity

Equity capital is provided by shareholders and is the first buffer against losses in a downturn. When it is absorbing losses, capital is the mechanism enabling banks to shrink the liabilities side of their balance sheets to match a shrinking asset base caused by losses. Liquidity is a readily-accessible asset that can be made available to meet short term obligations such as large-scale sudden deposit withdrawals. Withdrawals reduce the liabilities side of the balance sheet; the liquidity portfolio can be shrunk to match that change.

The best way to understand the difference between capital and liquidity is in the context of a simplified 100bn bank balance sheet that consists of:

- An 80bn mortgage portfolio on the assets side

- A 20bn liquidity portfolio, also the assets side

- 95bn of customer deposits on the liabilities side

- 5bn of shareholders' equity, also on the liabilities side

Bank balance sheet under normal circumstances

| Assets | Liabilities | ||

| Mortgages | 80 | 95 | Deposits |

| Liquid asset portfolio at central bank | 20 | 5 | Equity |

| 100 | 100 |

Explain the role of capital in a property downturn

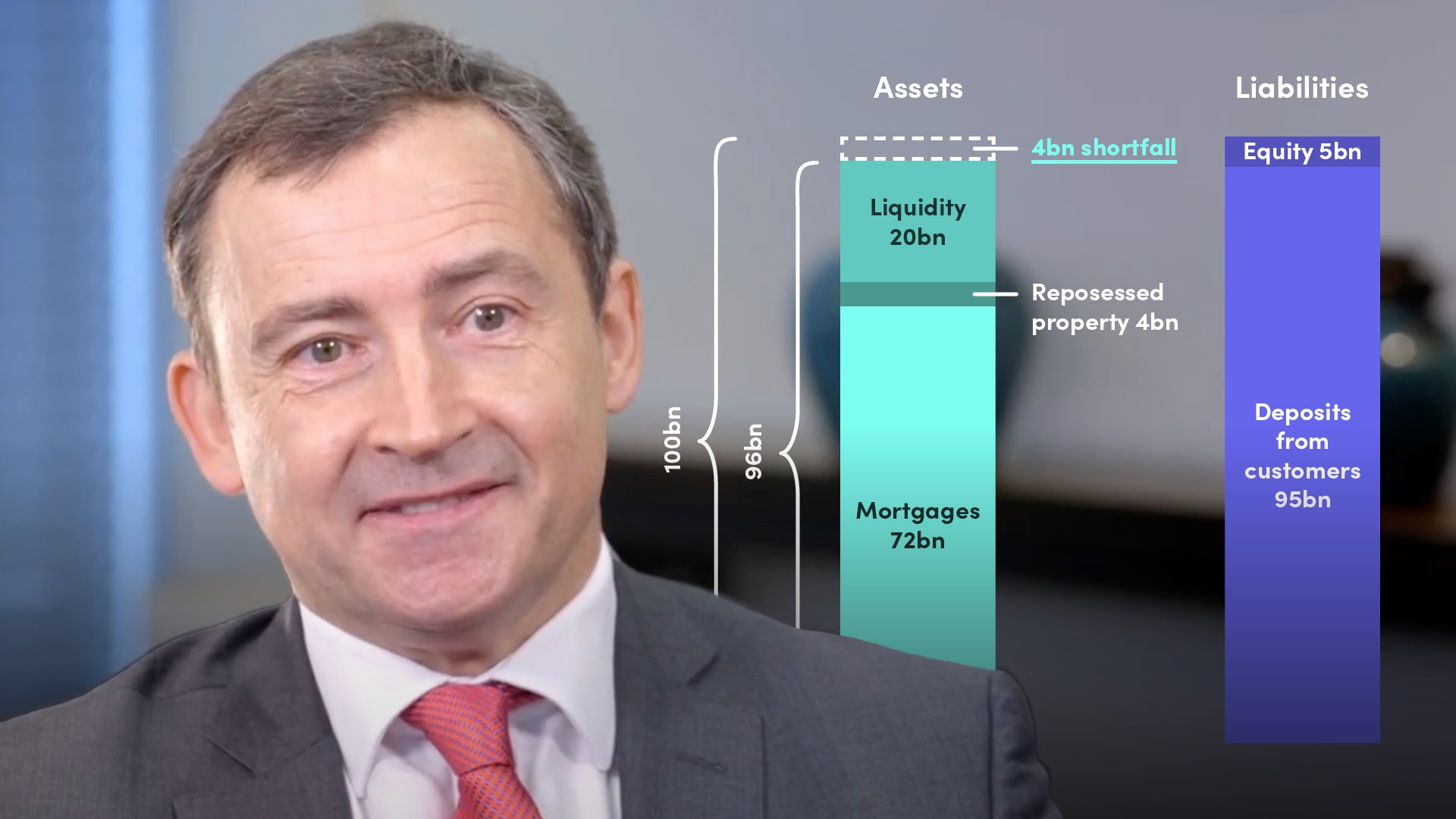

The role of bank capital is well illustrated by what happens to the balance sheet in a property downturn. If 10% of mortgage holders default and the bank repossesses property revalued at 4bn, this is recorded by an 8bn reduction in the value of mortgages sitting on the assets side and the addition of the 4bn of foreclosed property. The net effect is the balance sheet has fallen by 4bn to 96bn.

When a bank suffers losses, shareholders are first in line to have the value of their investment reduced. In this case, the 5bn of equity they had invested in the bank absorbs the 4bn in losses from the reduction in property values. The bank reduces the equity to 1bn, thereby returning the balance sheet into balance. Equity, a.k.a. the capital buffer, is there to protect depositors; it acts like a shock absorber to absorb losses. When capital is absorbing losses, it is the mechanism whereby banks can shrink the liabilities side of their balance sheets to match the shrinking asset base that has been caused by losses on assets.

Changes in a property downturn

| Assets | Liabilities | ||

| Mortgages | 80 | 95 | Deposits |

| Mortgage defaults | -8 | 5 | Equity |

| Foreclosed property (50% of loan value) | 4 | -4 | Equity takes losses in loan values |

| Liquidity portfolio at central bank | 20 | ||

| 96 | 96 |

Explain how a bank uses its liquidity portfolio to deal with deposit withdrawals

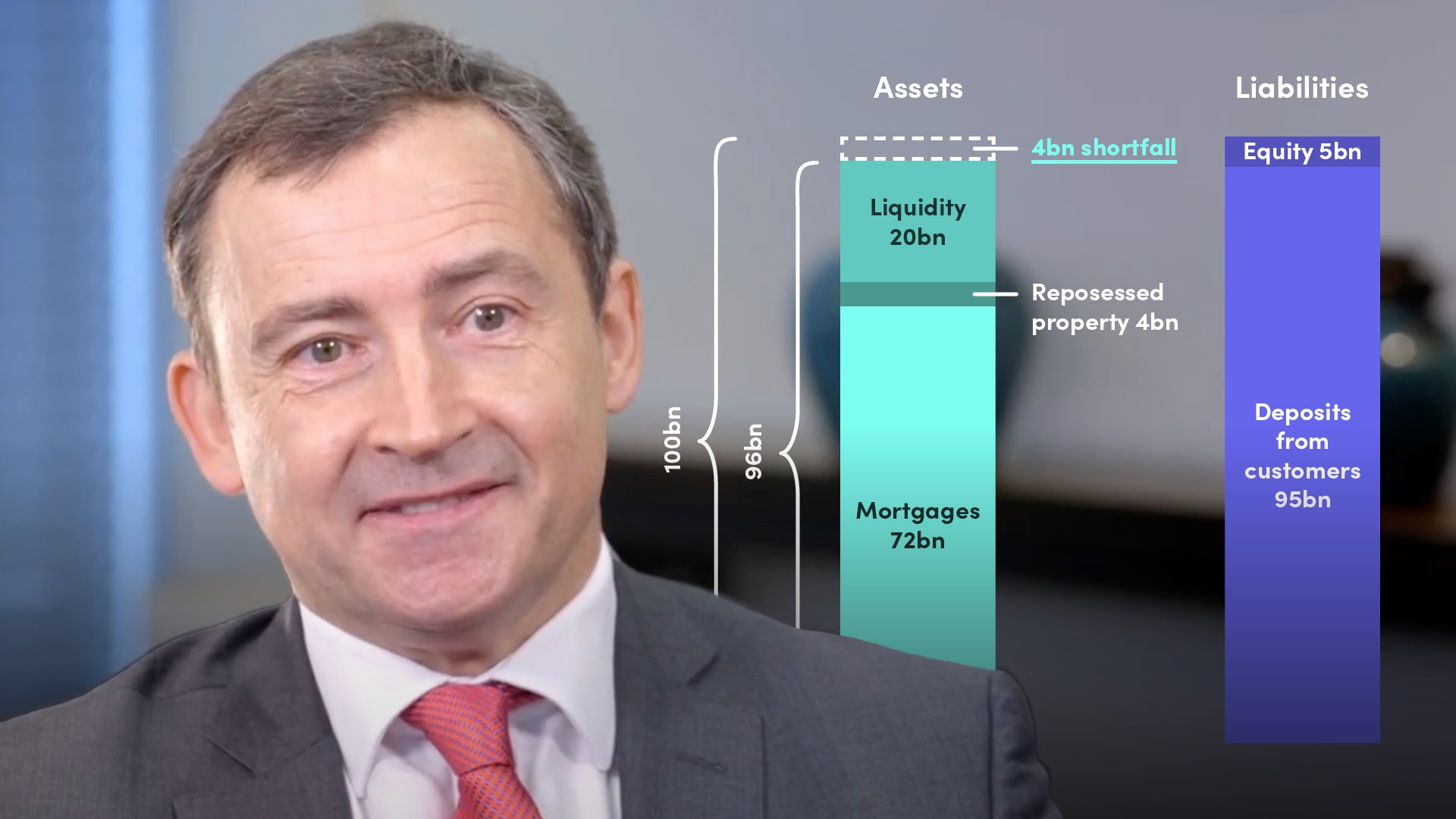

Liquidity sits on the asset side of the balance sheet. Liquidity comes in a variety of forms, but a liquidity portfolio can be turned into cash at a moment's notice. What is the utility of this liquidity? If 10bn of the bank's 95bn of deposits is withdrawn over a short period of time, the reduction in the liability side of the balance sheet has to be matched by an equal reduction in the assets side, so the bank sells 10bn of its 20bn liquidity portfolio to meet customer deposit withdrawals. When a bank is deploying its liquidity, it is making sure it can meet sudden and large-scale withdrawals from depositors. Customer withdrawals reduce the liabilities side of the balance sheet. The liquidity portfolio can be shrunk to match that change.

Liquidity position if depositors withdraw cash

| Assets | Liabilities | ||

| Mortgages | 72 | 95 | Deposits |

| Property | 4 | ||

| Liquidity portfolio at the central bank | 20 | ||

| Bank sells part of liquidity portfolio to cover withdrawals | -10 | -10 | Depositors withdraw money |

| 1 | Equity | ||

| 86 | 86 |

Tim Skeet

There are no available Videos from "Tim Skeet"