Classic Hedge Fund Trading Strategies II

Trevor Pugh

20 years: Trading & hedge funds

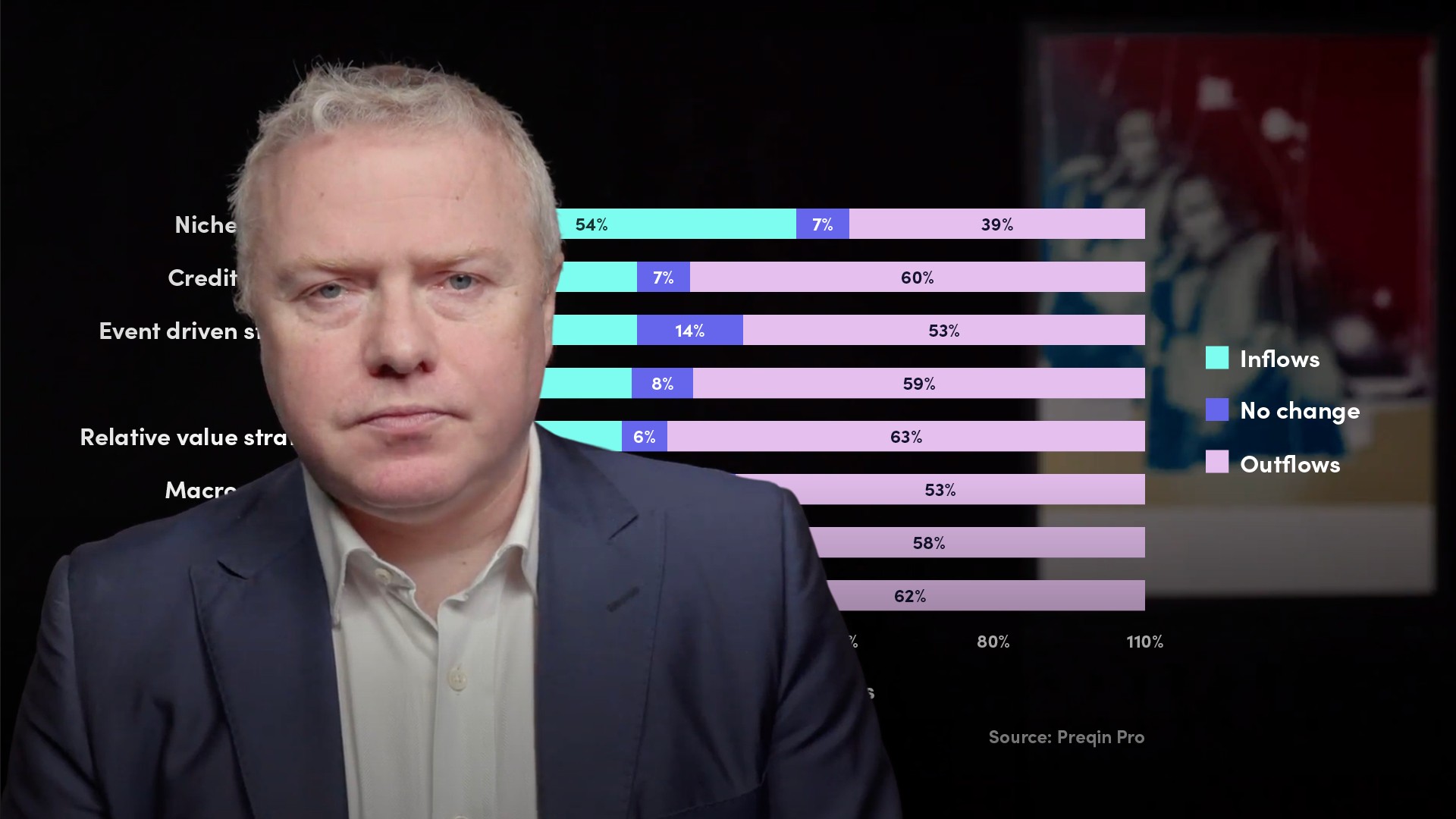

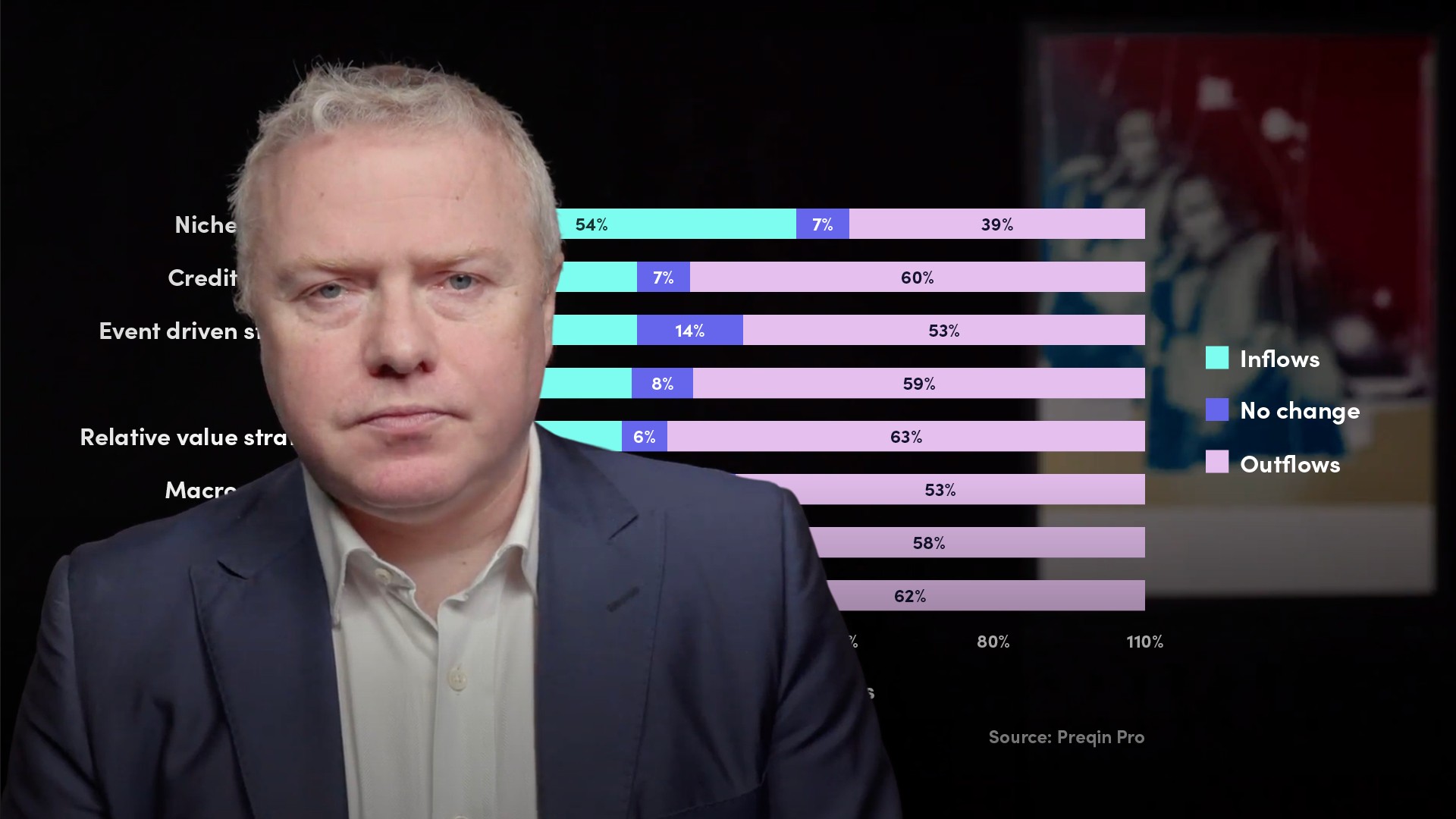

Hedge fund strategies vary greatly from fund to fund, and for an investor, choosing the right fund is no less difficult a task than picking individual stocks. In the first video of this two-part series Trevor covered equity, macro and high-frequency trading strategies. In this video he continues explaining the remaining hedge fund strategies, i.e. "CTA", "Event-Driven Strategy", "Credit Strategy" and "Niche Strategy".

Hedge fund strategies vary greatly from fund to fund, and for an investor, choosing the right fund is no less difficult a task than picking individual stocks. In the first video of this two-part series Trevor covered equity, macro and high-frequency trading strategies. In this video he continues explaining the remaining hedge fund strategies, i.e. "CTA", "Event-Driven Strategy", "Credit Strategy" and "Niche Strategy".

Classic Hedge Fund Trading Strategies II

11 mins 45 secs

Key learning objectives:

Define Relative Value trading

Define Commodity Trading Advisors

Define Event Driven Strategies

Define a Credit Strategy

Define a Niche Strategy

Overview:

Hedge fund strategies differ significantly from fund to fund, and selecting the best fund for an investor is no easier than picking individual stocks. It is useful to categorize them into general themes, with Macro strategies and Equity strategies being the most important. These various strategies provide a useful alternative investment class to the basic bond and equity strategies, allowing investors to choose a risk profile that is appropriate for their overall portfolio.

What is Relative Value trading?

Relative value trading involves buying and selling similar securities and exploiting perceived mismatches in value between them. Relative value tends to require an element of reversion to mean. Cheap securities need to richen and correct in price, whereas rich securities need to cheapen.

What are Commodity Trading Advisors?

Commodity Trading Advisors or CTA funds are funds that specialise in futures trading on exchanges. The National Futures Association in the United States uses the acronym CTA as a legislative term. They tend to use high levels of leverage as futures can generally be traded without putting down large amounts of margin.

Commodity Trading Advisors do frequently trade in commodity futures.

What is known as Event Driven Strategies?

Event driven strategies tend to take advantage of temporary mispricings of stocks, which occur around a significant corporate event. Merger arbitrage is one of the techniques used. As the name implies, this is a technique that includes buying and selling shares in two firms involved in a merger or acquisition and taking advantage of price differences.

The key point is that there will always be doubt on whether a transaction will succeed or fail, and the money is to be made by doing a better analysis of this chance.

What is a Credit Strategy?

Credit trading refers to the trading of corporate bonds and the bonds of other entities, not government bonds. At its simplest, this could be taking positions long or short credit spreads. A long credit position would involve buying a corporate bond and potentially selling a government bond against it.

Other strategies could include trading different corporates against each other, in much the same way that a trader can do in equities.

What is a Niche Strategy?

Niche strategies account for a very small portion of the hedge fund universe, accounting for approximately ($27) twenty-seven billion dollars in late Q3 2020. The strategies are usually more complex than those of a traditional hedge fund, with a rather narrow focus.

The advantage of niche funds is that they tend to be the most uncorrelated of any funds with the overall market.

Trevor Pugh

There are no available Videos from "Trevor Pugh"