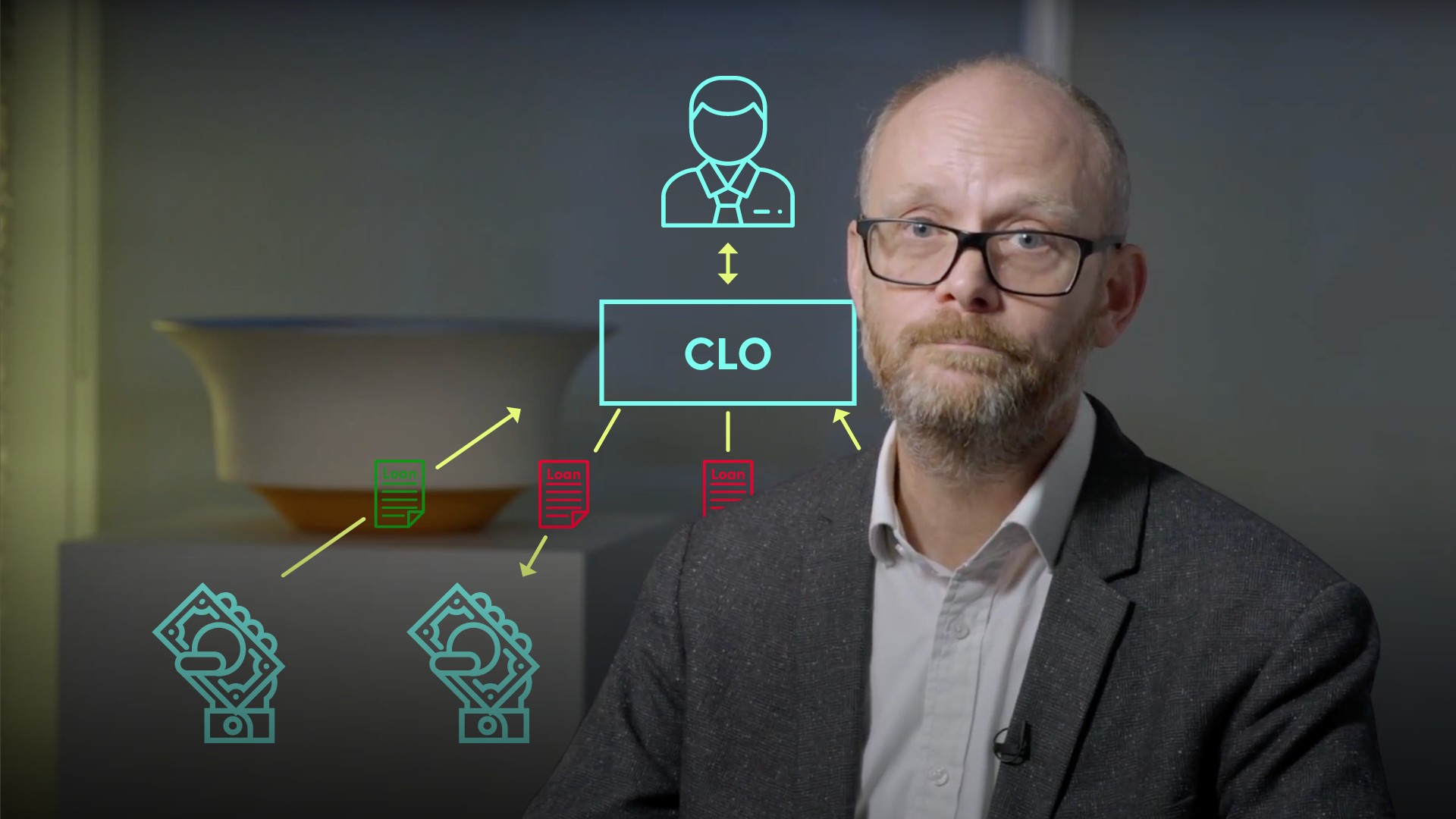

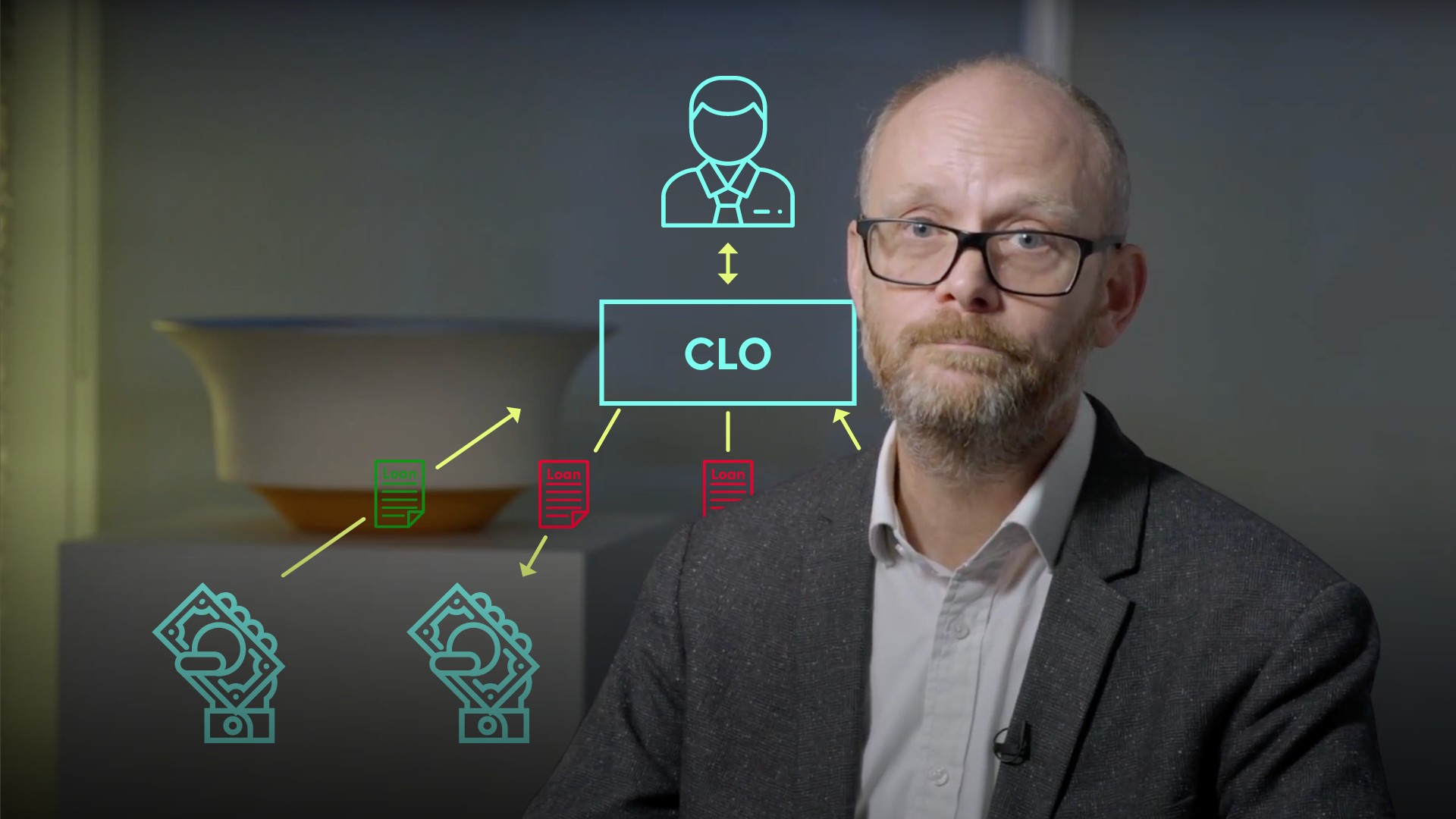

Key Participants in CLO Transactions

Mike Peterson

20 years: Capital markets media

Most of the time, the key firm in any given CLO is its manager. However, there are other key figures in the CLO market. In this video, Mike will discuss the roles of these participants, including the manager, the arranger, the investors, the trustee and the collateral administrator.

Most of the time, the key firm in any given CLO is its manager. However, there are other key figures in the CLO market. In this video, Mike will discuss the roles of these participants, including the manager, the arranger, the investors, the trustee and the collateral administrator.

Key Participants in CLO Transactions

8 mins 5 secs

Key learning objectives:

Understand and define the roles of the parties involved in a CLO

Overview:

CLOs have many different parties that make a fund possible. Involvement starts with the manager and goes all the way down to the investor base.

What is the role of the Manager in the life of a CLO?

Most of the time, the key firm in any given CLO is its manager. The manager usually has the original idea of creating the CLO, and chooses its name and decides the investment strategy.

And yet, the manager is not a party to the central governing document of a CLO, the indenture. It is important for reasons of tax and investor protection that this company, the CLO, is legally separate from the manager. As we have learnt, the manager’s first task is to buy assets – loans and sometimes bonds – with the money raised from selling the CLO notes. Once this has been achieved, and the CLO has gone effective, the manager often decides to sell some assets and replace them with new ones, either to generate a gain for the CLO or because the manager is concerned about the credit quality of a particular borrower.

What does the CLO Arranger do?

Another important participant in the CLO market is the CLO arranger. This is the firm that sells the CLO tranches to investors, and structures the deal. In other words, it figures out what types of CLOs and what tranche sizes can be sold at a given time. CLO arrangers are mostly large investment banks.

What is the Role of the Trustee?

The trustee is a bank that represents the interests of the CLO debt investors. In most circumstances, the trustee does not get actively involved in any aspect of running the CLO, other than to host the various bank accounts used by the CLO. However, in the case of a dispute between investors or between the manager and investors, the trustee may have to step in and make a decision interpreting the rules of the CLO, such as which class of investors are entitled to a particular payment.

What is the Collateral Administrator’s job?

Manages the day to day operations of the CLO, such as making payments and settling trades on the instruction of the CLO manager. The collateral administrator also prepares the monthly and quarterly reports that tell investors how the CLO is performing.

Who does the Investor base consist of?

CLOs usually have many different investors. It is not unusual for a whole tranche to be owned by a single investment firm. But it is also possible for a tranche to be owned by multiple firms and for the CLO as a whole to have dozens of different investors.

Mike Peterson

There are no available Videos from "Mike Peterson"