CLO Equity Return Optimisation

Christos Danias

20 years: Credit & structured finance

CLOs are designed specifically to provide attractive returns to the equity investor. In this video, Christos will cover actions that can optimise an investment, including Calls, Refis and Resets.

CLOs are designed specifically to provide attractive returns to the equity investor. In this video, Christos will cover actions that can optimise an investment, including Calls, Refis and Resets.

CLO Equity Return Optimisation

9 mins 1 sec

Key learning objectives:

Describe the options for equity optimisation

Overview:

CLO investors must be aware of the options available to optimise their investment in a CLO. These options take shape in a call, refi, or reset.

SummaryRefis and Resets

What is CLO equity optimisation?

- Calls

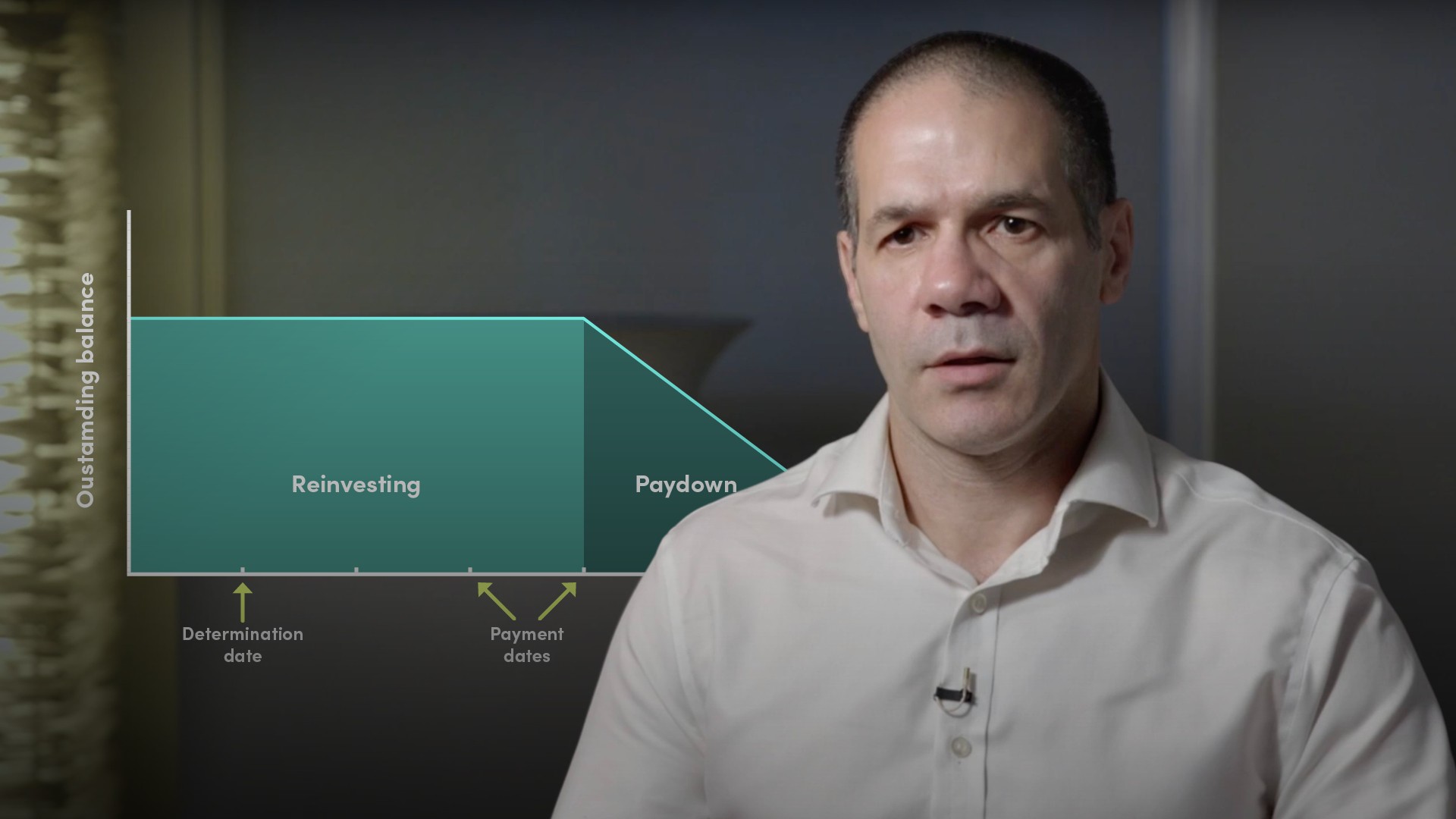

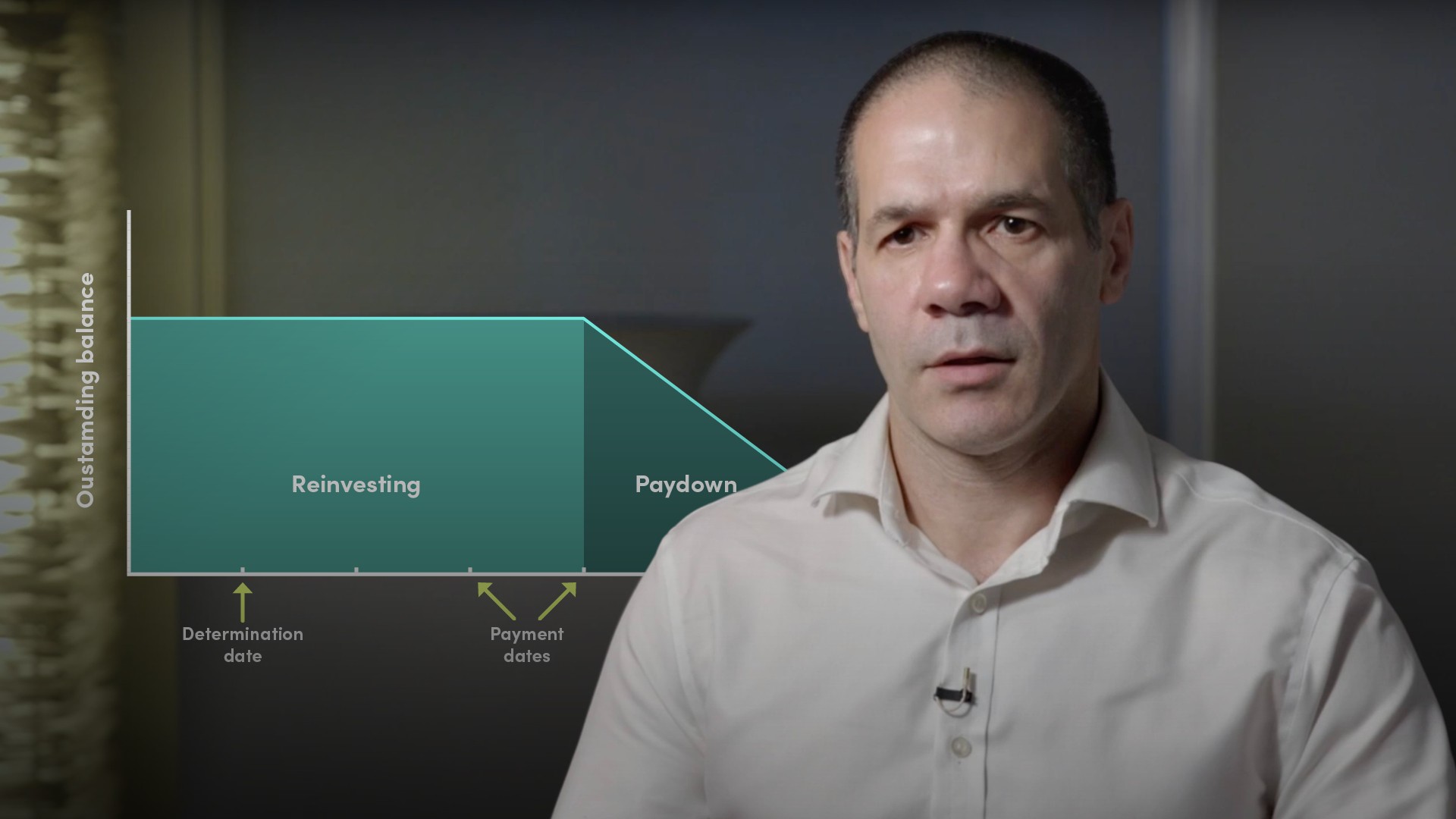

- At some stage in its life, a CLO will end up in a situation where it stops providing an attractive return to the equity. This will happen after your reinvestment period is over. Typically there is a 2 year non-call period and then a specified majority of the equity has the ability to call the deal.

- Your CLO can also become inefficient as an investment, if there are better investments elsewhere. Sometimes this could be a newly issued CLO. For example, if you as an equity holder bought your CLO equity a couple of years ago and now newly issued CLOs are issued with cheaper debt. Such newer CLOs will naturally be giving better returns as the arbitrage is better, so you are better off holding a new one.

- Firstly, the CLO may be documented as such, that after a certain period of time, you are allowed to simply renegotiate the spread of your AAA notes - a ‘refi’.

- Or secondly, by extending the whole deal again, similarly to calling and reissuing a new deal, (but without the corresponding costs of putting together a new deal) a ‘reset’.

- For a refi or a reset to happen, it is key that there have to be investors willing to take on the new debt.

Christos Danias

Christos has worked in structured finance for over 20 years. He started out as a securitisation structurer and later worked at Credit Suisse. There, he transitioned into CLOs and ended up running BNP’s primary CLO business until the financial crisis. After a stint setting up a paddleboard business, Christos went back to work as a trader and sales, focusing on CLOs primarily.

There are no available Videos from "Christos Danias"