Managing Credit Risk in the Underlying CLO Portfolio

Ian Robinson

25 years: Securitisation

In Ian's series on CLOs, he will discuss the risks and valuation of these products. This video will cover the assessment of credit risks when deciding whether to purchase a bond. It will also consider what he terms "manager risk", which is the way in which manager actions can affect the risks and value of a bond.

In Ian's series on CLOs, he will discuss the risks and valuation of these products. This video will cover the assessment of credit risks when deciding whether to purchase a bond. It will also consider what he terms "manager risk", which is the way in which manager actions can affect the risks and value of a bond.

Managing Credit Risk in the Underlying CLO Portfolio

11 mins 6 secs

Key learning objectives:

Identify all the inherent credit assessment checks/tests

Explain the importance of hedging and diversification in portfolio management

Define manager risk, and outline the key questions to ask a collateral manager

Overview:

Investors of CLOs are paid a percentage of the value increase in their portfolios, and thus, it is of great importance that they evaluate and manage the fundamental credit risks before purchasing, trading out of, or holding on to bonds.

What may be flagged as being “negative” in a portfolio?

- Excessive leverage of the company

- Poor market position

- Low regard for the management team

- Being in an industry which is in decline, such as UK high street retail

What key metrics in the trustee report and portfolio spreadsheets are important to consider?

Generally there is a market standard range for these elements and any transaction trying to break free of those standard restrictions is a warning flag of an overly aggressive collateral manager:

- Percentage of covenant lite loans

- Industry and geographical concentrations

- Amounts of bond nuggets

- CCC buckets

- Other portfolio parameters

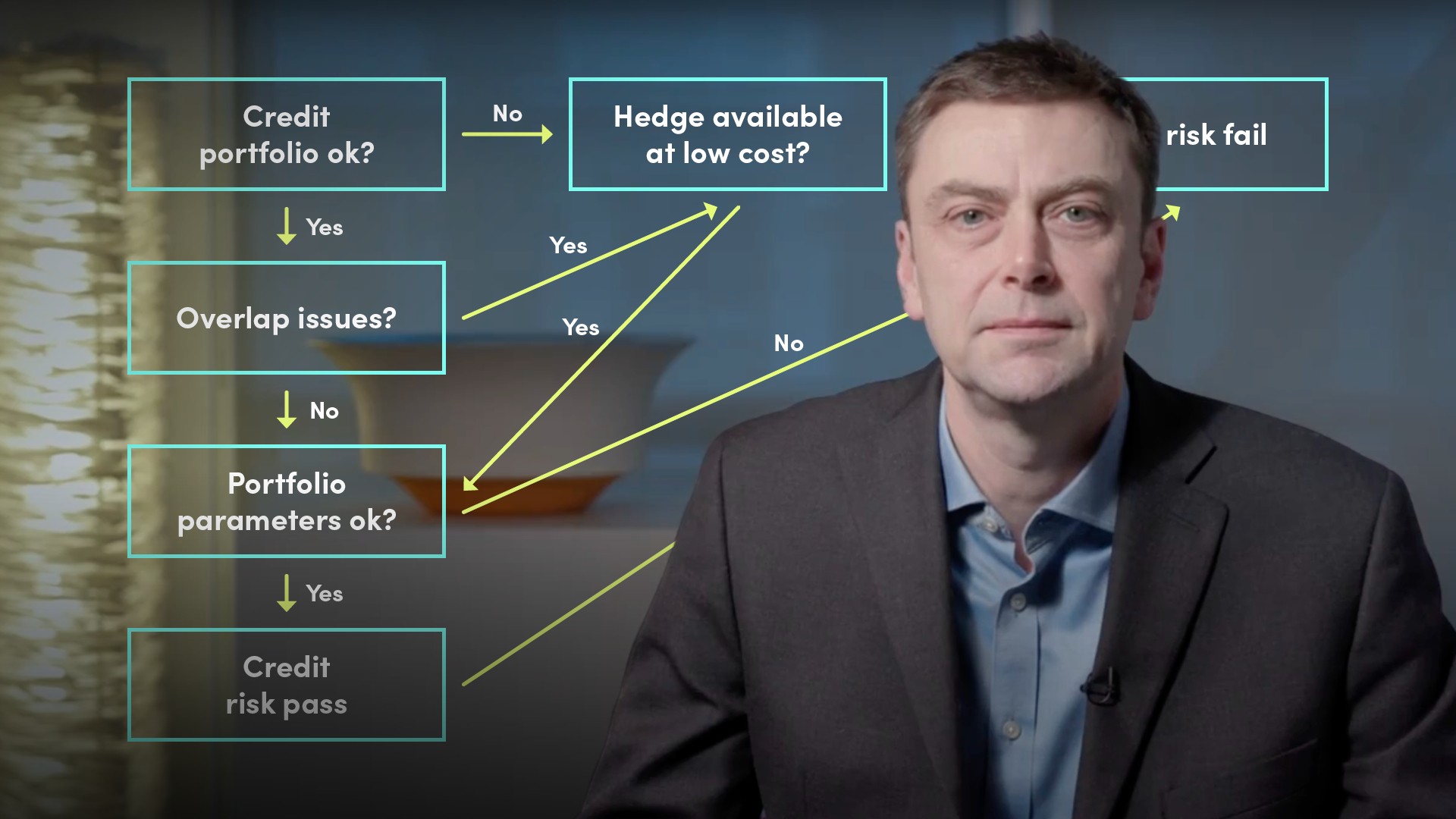

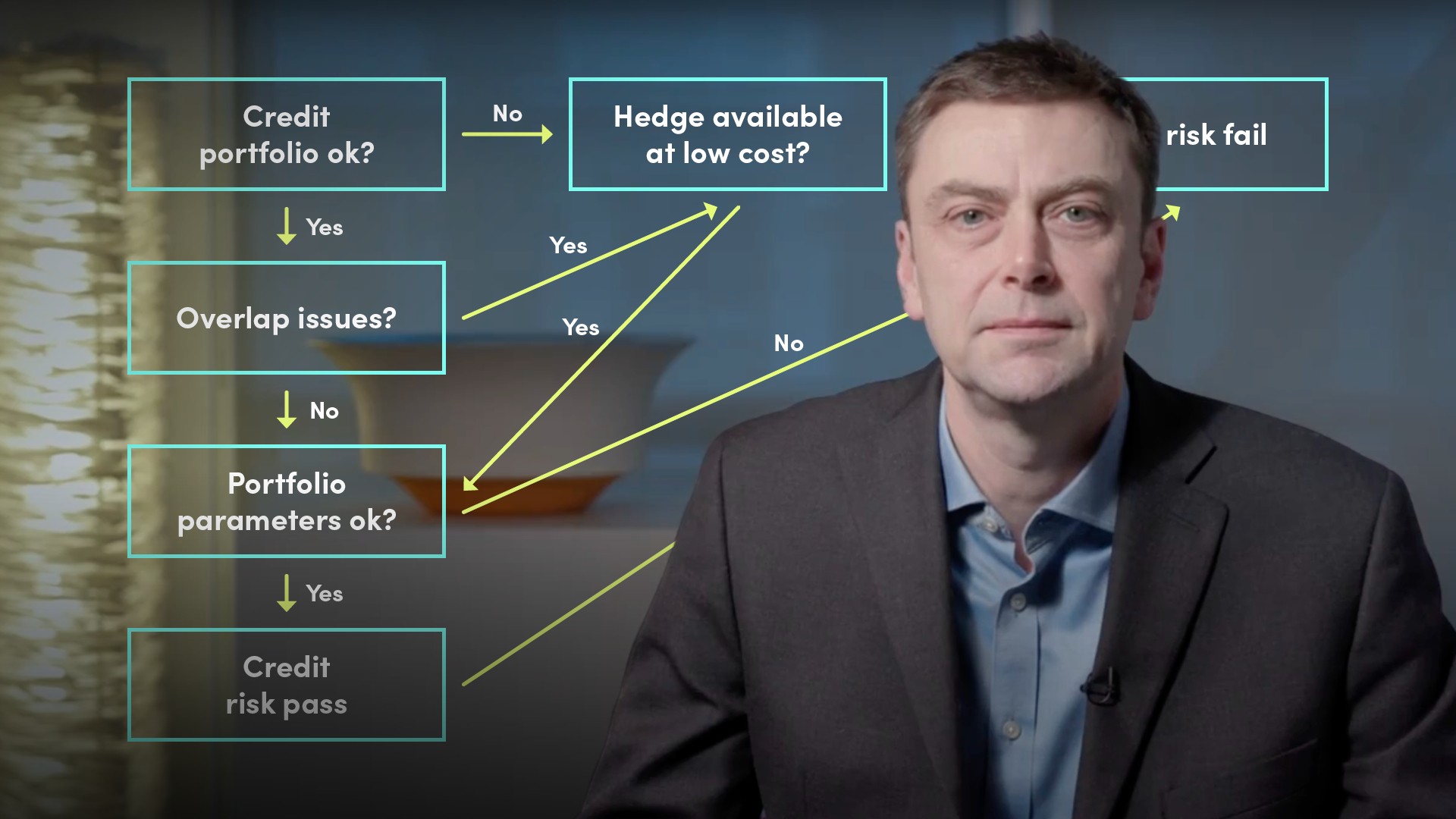

What portfolio profile tests must be assessed?

- Moody’s WARF test

- Equivalent rating agency test for probability of default

- Diversity Score

Why is the diversification of a portfolio so important?

Diversity is important in assessing the overall credit risk to a tranche of bonds because the more diversified a portfolio is, and the more credit enhancement a tranche has, the less likely it is that there will be enough defaults to create principal losses to a tranche.

Senior tranches would look for a high level of diversification. This essentially means that there are lots of events which would have to happen in order to create a loss, the risk is spread. On the other hand, subordinated tranches generally have less diversification and enhancements, and thus, are more susceptible to credit risk.

What is the importance of hedging?

Another major credit risk factor would be to check for any overlaps between the portfolio in the prospective deal and the portfolios of other bonds held in other investment funds. This would inform any hedging that would need to occur against risk concentrations on individual names or particular industry sectors, for example.

This is important because problems arise when there are large exposures to a particular name or sector that cannot be hedged in some form. Since the credit crisis, many of the new names are not well known public companies, and so are difficult to hedge. A compromise needs to be made between the high overlap of more liquid names that can be hedged, and low overlap between less liquid names that cannot effectively be managed by the investor.

In what ways can the tranche be impaired?

- Principal loss - that is, the losses on the portfolio are enough to mean the investor will not receive any or all of their money back

- Losses are not enough to cause principal losses on the tranche of bond, but cause a diversion of a coupon which may not be recovered over time

What is manager risk?

The assessment regarding how capable, or not, the collateral manager is in managing the credit risk of a transaction on an ongoing basis.What are some examples of risk-based questions to ask the collateral manager?

- How reliably are they able to source good loans and bonds?

- The extent to which a collateral manager is able to source good assets from other members of this club will have a large bearing on the quality of portfolio that they can build and maintain over time

- What is their recovery strategy?

- Some collateral managers sell their loans in the secondary market at the first sign of trouble, whilst others hold on and believe they can extract more value by working out of a defaulted loan

- What is the size of the organisation?

- If they are too small, they won’t have the analyst numbers to cover the credits properly

- What is the manager's track record?

- This includes, what they’ve done in the past, and how long they’ve done it for. A good collateral manager consistently beats market returns to equity holders, has lower than market default rates, never having had a rated tranche downgraded, etc.

Ian Robinson

There are no available Videos from "Ian Robinson"