What is a Comfort Letter?

Kate Craven

35 years: Capital markets

In a capital markets transaction, underwriters will seek to protect themselves against any potential liability caused by misinformation from the issuer. One way they can do this is by requesting a comfort letter from the issuer's auditors. In this two-part video series, Kate discusses why issuers and underwriters use comfort letters and the different market practices between European and American issuers.

In a capital markets transaction, underwriters will seek to protect themselves against any potential liability caused by misinformation from the issuer. One way they can do this is by requesting a comfort letter from the issuer's auditors. In this two-part video series, Kate discusses why issuers and underwriters use comfort letters and the different market practices between European and American issuers.

What is a Comfort Letter?

11 mins 44 secs

Key learning objectives:

Define a Comfort letter

Identify the comfort letter given in European capital markets transactions

Understand who can rely on a comfort letter

Overview:

In a capital markets transaction, underwriters will seek to protect themselves against any potential liability caused by misinformation from the issuer. One way they can do this is by requesting a comfort letter from the issuer's auditors. In this video we introduced comfort letters, what they are, how they’re put together, when they’re provided and who can rely on them.

What is a Prospectus?

The Prospectus is the offering document companies use when seeking to raise capital in the form of equity or debt. The names of the banks acting as underwriters of the transaction appear on the front cover of the Prospectus which is used to market the offering to potential investors.

What due diligence do the underwriters perform in order to check the prospectus?

- Meetings and discussions with senior personnel at the company.

- Asking third parties such as law firms and auditors to review the information it contains and provide written confirmation of their findings in the form of legal opinions and comfort letters.

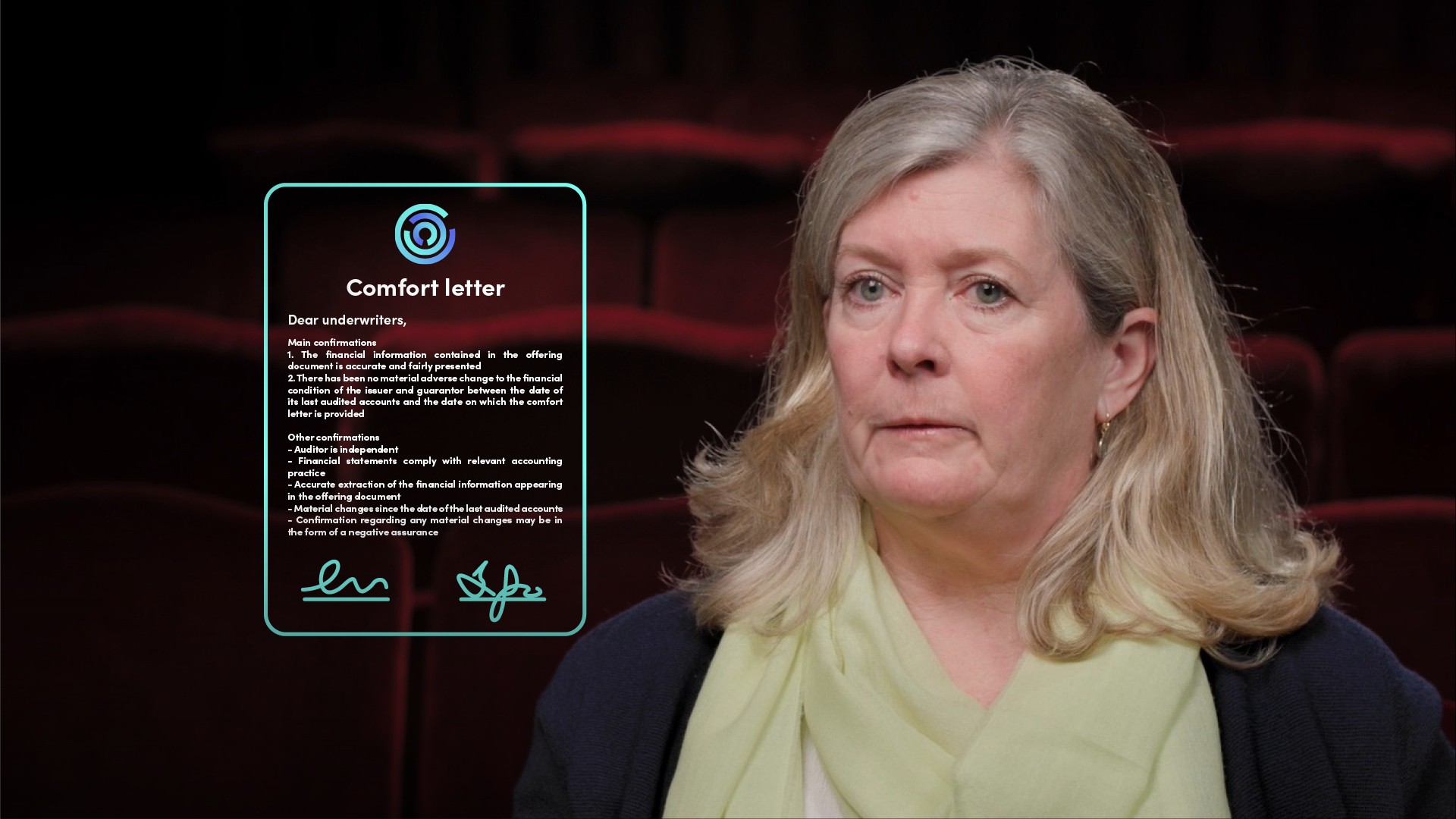

What is a Comfort Letter?

A comfort letter is a letter written by the issuing company’s auditors to the underwriters in the context of an offering of securities. It provides comfort around the information in the prospectus not covered by the auditor’s report, as well as confirmation that the financial information taken from the company’s annual account has been correctly extracted.

What does a comfort letter confirm?

- Firstly, that the financial information contained in the offering document is accurate and fairly presented.

- Secondly, that there has been no material adverse change to the financial condition of the issuer and guarantor between the date of its last audited accounts and the date on which the comfort letter is provided.

How do the practices in relation to accountants’ comfort letters differ between the United States and European markets?

A key difference is the 135-day rule. In the U.S Auditors can only provide a negative assurance comfort letter if the cut-off date for the letter is within 135 days of the last audited financials or the date of the last reviewed interim financials.

The 135-day rule is not problematic for U.S. issuers, as their quarterly interim financials are usually reviewed by their auditors - unlike in Europe, where this is not customary and where auditors generally only review semi-annual financials

Increasingly, European auditors (for example in Spain and Italy) are pushing to apply this U.S.based 135-day rule to non-U.S. offerings. Where they succeed, this may lead to weaker comfort letters without negative assurance.

What are the key items assessed by auditors in order to provide a comfort letter?

- The audited accounts

- Monthly management accounts

- The Board minutes

When is the comfort letter given in European capital markets transactions?

Underwriters typically receive a comfort letter from the auditors at the date on which the offering circular or prospectus is published -- this means the signing date, in the case of a standalone issue, or the establishment or update of the programme, in the case of a medium-term note programme. Many bond issues are for frequent issuers that are well known to investors. However for issues that are complex or from less frequent issuers the company may decide to prepare a preliminary prospectus for marketing purposes.

Sometimes a further comfort letter is required as a condition precedent to closing. When this happens, it is often no more than a confirmation that the statements made in the earlier comfort letter remain true as at the updated cut-off date – this is known as a “bring down comfort letter” and the cut-off date is updated to 2 to 3 business days prior to the closing date.

Way back, it was normal for there to be several weeks between the launch and closing of a transaction. It was therefore the custom to get two comfort letters – one on the signing date and one on the closing date. Now that most bonds happen on a very tight timetable with just days between signing and closing, often only one comfort letter is provided.

Who can rely upon a comfort letter?

Only the addressees of the comfort letter may rely upon it. For example, the comfort letter delivered on the establishment or update of a Medium-Term Note programme will be addressed to the named dealers on the programme. Any other dealer doing a trade under the programme – for example as a dealer for the day - will not be able to rely upon the comfort letter provided to the dealers when the programme was established or updated.

Kate Craven

There are no available Videos from "Kate Craven"