Comparing Securities Lending and Repo

Richard Comotto

30 years: Money markets

In this video, Richard explores the legal and market differences between the repo and securities lending markets. He also examines how repo involves a true sale of securities against cash, while securities lending is a unilateral transfer of title to the security against non-cash collateral.

In this video, Richard explores the legal and market differences between the repo and securities lending markets. He also examines how repo involves a true sale of securities against cash, while securities lending is a unilateral transfer of title to the security against non-cash collateral.

Comparing Securities Lending and Repo

6 mins 15 secs

Key learning objectives:

Understand the market and legal differences between securities lending and repo markets

Outline the factors that should be considered when choosing between securities lending and repo markets

Overview:

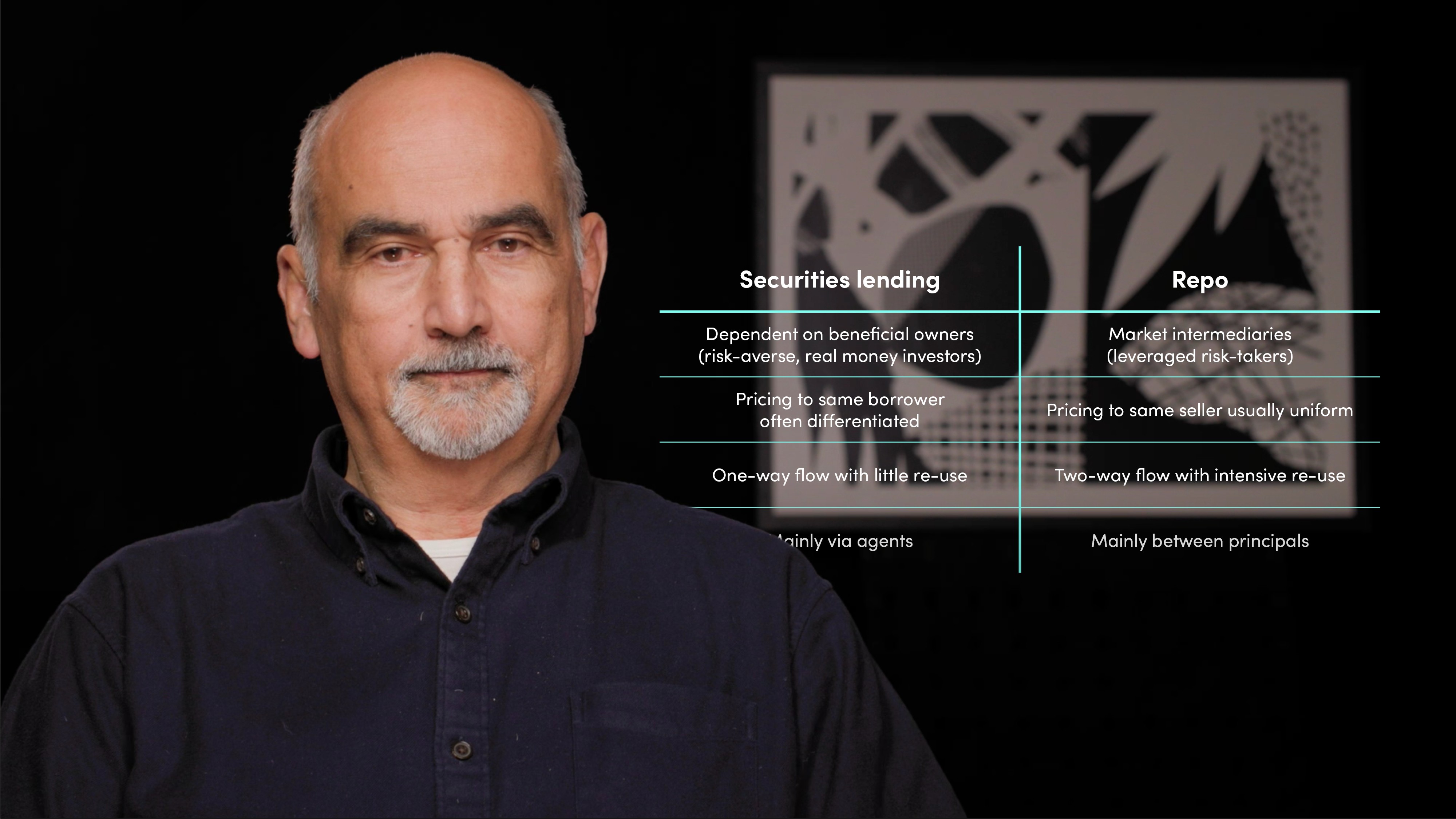

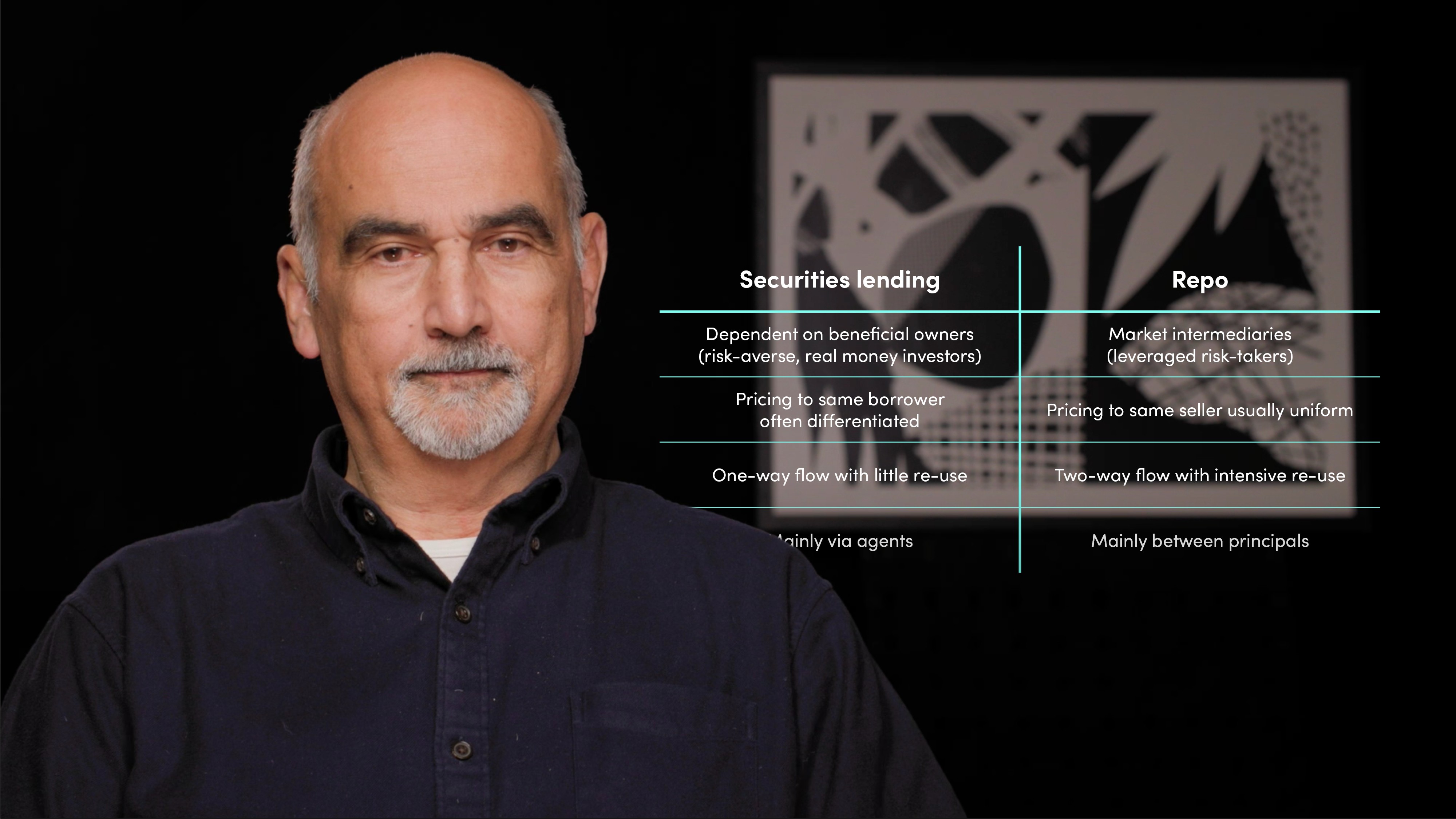

Securities lending and repo markets perform similar functions, but legal differences and market characteristics explain their coexistence. One key difference is that securities lending is securities-driven, and initial margin or haircut favors the securities lender, while repo is cash driven and it is the party providing cash that benefits. Beneficial owners, typically risk-averse investors, drive the securities lending market, while the repo market is driven by market intermediaries, who are leveraged risk-takers. The securities lending market is preferred for borrowing equity, while the repo market is favored for cash borrowing and larger deals.

What are the legal differences between repo and securities lending?

The legal difference between repo and securities lending is that repo involves a true sale of securities against cash, while securities lending is a unilateral transfer of title to the security against non-cash collateral.

This means that repo interest starts accruing on the value date and stops accruing on the maturity date, whether or not securities are delivered, whereas fees and rebate interest on securities loans only start when the loaned securities are delivered and carry on until they are returned, even if that is late.

However, both transactions can be documented under the same type of agreement, as shown by the European Master Agreement, and they have similar legal foundations.

What are the market differences between repo and securities lending?

The main market differences between repo and securities lending relate to typical assets and users. Securities lending usually involves equity, while most repo is against bonds. Securities lending is securities-driven, while repo is cash-driven. In securities lending, the securities lender is typically favored by initial margins or haircuts, whereas in repo, the party providing cash is favored. Securities loans tend to be small, while repos tend to be large, fixed-term, and plain vanilla. Securities lending is often used by risk-averse real-money investors, while repo is driven by market intermediaries who are leveraged risk-takers.

What factors should be considered when choosing between the two markets?

When choosing between securities lending and repo markets, factors such as the type of asset you want to borrow or lend, whether you are a cash investor or borrower, and the size and term of the deal should be considered.

Cash investors are incentivised to use the repo market because of favorable initial margins and haircuts, while cash borrowers prefer it because of easier fixed-term and larger deals. For equity borrowing, securities lending is the preferred market. Beneficial owners often choose securities lending due to existing agreements and security vs security options that avoid cash collateral and provide indemnification by agent lenders.

Richard Comotto

There are no available Videos from "Richard Comotto"