Corporate Credit Approval Process

Iain Hoggarth

15 years: Risk & compliance

In this video, Iain explains the structure and key content of a credit proposal, and how corporate credit information should be presented in an approval process.

In this video, Iain explains the structure and key content of a credit proposal, and how corporate credit information should be presented in an approval process.

Corporate Credit Approval Process

11 mins 32 secs

Key learning objectives:

Identify the initial problems of credit proposals and the solution

Describe the structural process and identify the key information required at each step

Overview:

Information is not being presented in a way that best represents the credit itself, and thus, to tackle this: bankers should engage with credit teams and customers effectively to present their credit proposal in a structured way which is tailored towards a justification for the bank to take a risk.

What are some instances of good credits experiencing difficulties in the approval process?

- The need to supplement the information at the same time as the credit is being considered which in turn, causes delays

- The information provided doesn’t align with the requirements of the approval teams

What is the solution to this problem?

- Credit and frontline teams should engage with one another

- Move the customer through the structured process and be proactive in terms of presenting the essential information

What are the main pillars being assessed by banks?

- Background

- People & Management

- Financial

- Risk & Security

- Recommendation

What is the first section of any application?

Background – This is essentially an executive summary and should be very clear in the type of request, and also, the circumstances that have led to the request being submitted. The depth and length of this information varies based on:

- The size or scale of the request

- The level of risk

- The general story regarding the customer

- Some basic industry and trading information

- Status or reason for the application

What is included in the People & Management section?

Banks will place a high priority on a thorough assessment of the backgrounds, experience and success of the individuals and teams responsible for running that business. Key information that is analysed in this section is:

- Time served

- Business function responsibility

- Technical competence

- Strategic information

- Information relevant to the bank relationship, and all risks

How do banks analyse the Financial section?

Financial risks and an understanding of the financial performance is vital to drive the right decision. From the bank’s perspective, can the debt obligations be serviced or repaid according to their agreed terms? Basic information required at this time is:

- Historical financial information

- Projected performance – this includes an analysis of business plans, industry information, and third-party analysis

- Detailed assessments of cash flow performances – this is derived from EBIT and EBITDA.

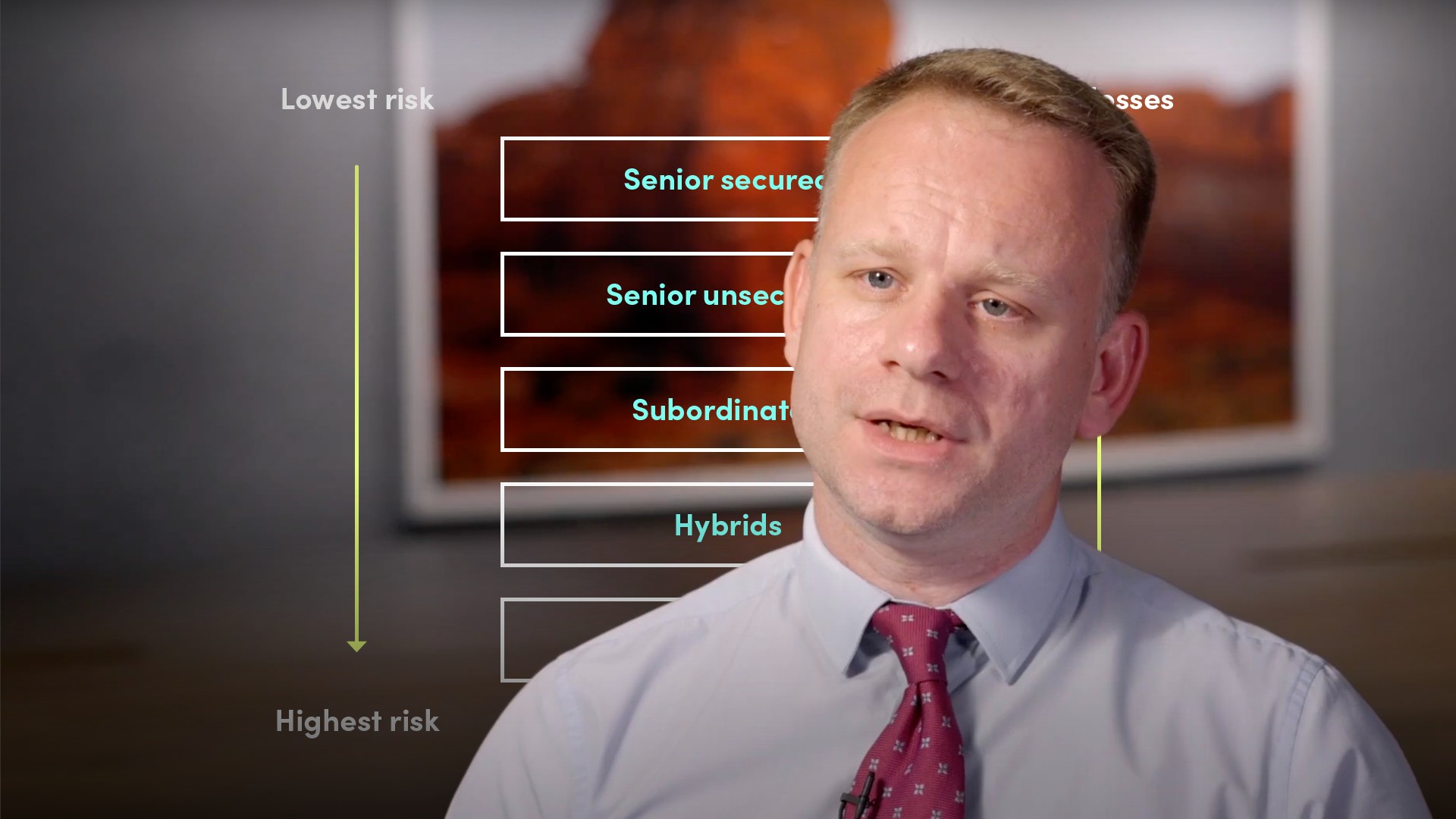

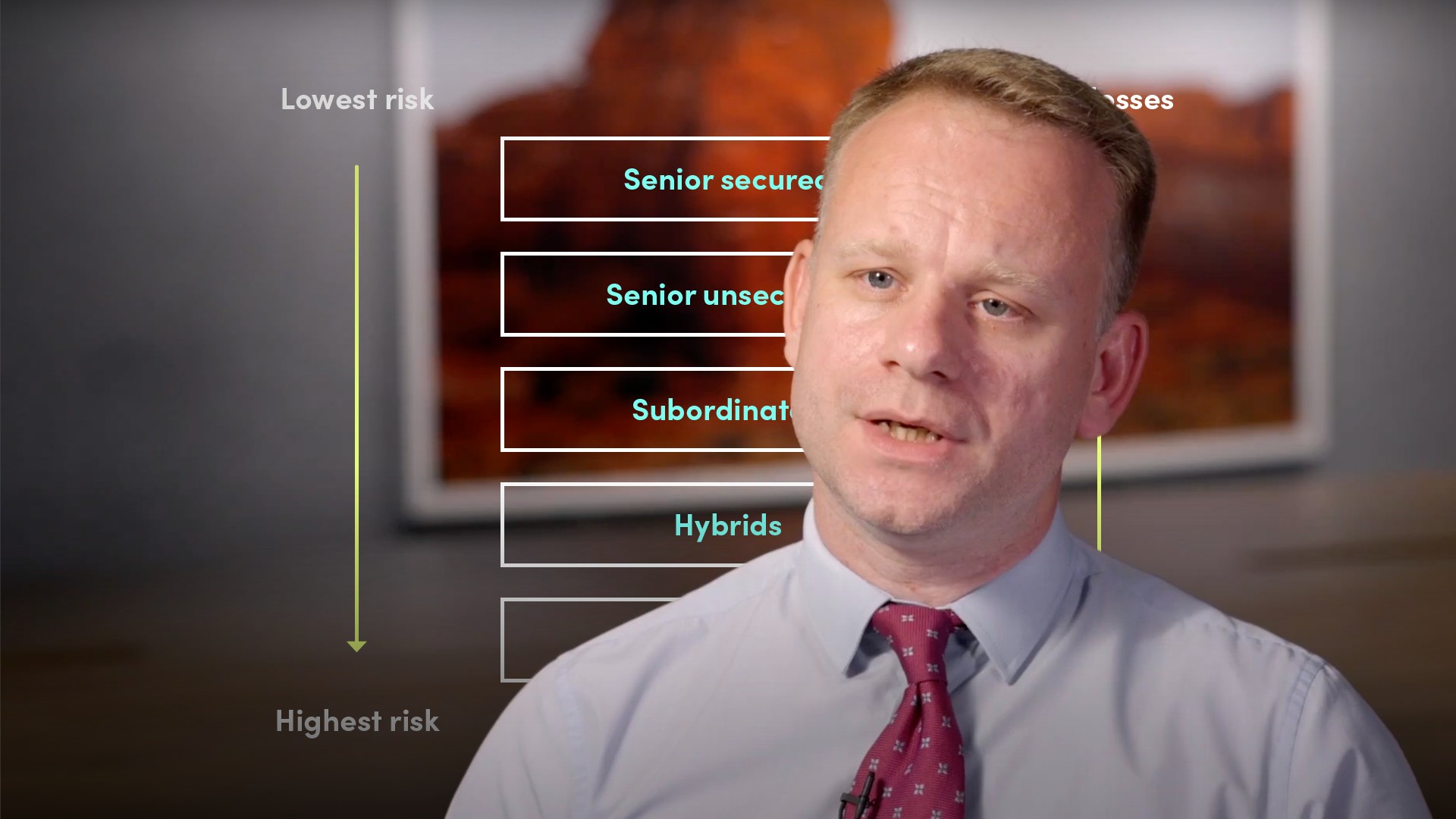

What is required in the Risk & Security part of the application?

A recovery situation is something that the bank needs to consider. Debt is often seen as a negative, and thus, is frowned upon. The ways in which banks achieve security is:

- Secure safety in the assets of the business, i.e. guarantees

- Secured lending via attachment to assets, whether trading or fixed assets

- It is also important for the proposer to comment on market values, quality and the viability of the assets being used to secure the debt.

What is the last stage of the application?

Recommendation – This involves a solid summary of the request, the merits, the risk and the financial health of the customer which should be presented to the credit team.

Iain Hoggarth

There are no available Videos from "Iain Hoggarth"