Covered Bonds vs Securitisation

Richard Kemmish

30 years: Capital markets & covered bonds

Covered bonds and securitisations have a lot in common, but they are also very different in some important ways. In this video, Richard discusses the similarities and the differences, between the two products, in terms of their uses, structure and regulation.

Covered bonds and securitisations have a lot in common, but they are also very different in some important ways. In this video, Richard discusses the similarities and the differences, between the two products, in terms of their uses, structure and regulation.

Covered Bonds vs Securitisation

10 mins 10 secs

Key learning objectives:

Identify similarities

Outline the differences in structure, performance, uses, asset eligibility and regulatory treatment

Explain why securitisations require less over-collateralisation

Overview:

Covered bonds and securitisations have a wide array of similarities. For example, they both utilise residential mortgages as their principle asset for covered bond collateralisation. However, they are also very different in terms of their structure, regulatory treatment and uses.

What are the similarities between covered bonds and securitisations?

- Mainly issued by banks

- Use security over a pool of assets

- Secured on high quality assets

- Share a very similar legal technology

What are some general differences?

- Covered Bonds are ‘dual recourse’ instruments – meaning if the bank fails, the assets will be used to service the interest and principal payments and vice versa if the assets fail. However, securitisations only rely on the assets.

- Securitisation transfers some credit risk relating to the assets from the bank to the investor. Covered bonds, on the other hand, don’t transfer the risk of the assets.

- Contrasting pay back arrangements – for securitisations, the bonds usually pay down when the assets pay down. If someone repays their mortgage early, the bond secured amortises a little. However, for a covered bond, if someone repays their mortgage, the bank uses the incoming cash to buy new mortgages and keep the bond size constant until the date it matures.

- Securitisations are usually floating-rate, pre-payable and shorter dated (3-5 years). Whereas covered bonds are usually fixed-rate, have a fixed maturity and longer dated (>10years).

How did their performances differ during the Financial Crisis?

For covered bonds, not one ever defaulted; investors received every interest and principal payment on time, in full. Also, the number of credit rating downgrades was relatively low.

In comparison, the securitisation market was more mixed – the majority of bonds in Europe were backed by high-quality assets and performed well. However, the credit performance wasn’t mirrored by their value. There were also heavy sell-offs and periods of illiquidity.

Has the regulatory treatment changed for either?

The treatment of covered bonds has improved – they are now eligible for bank liquidity buffers and the associated swaps are exempt from clearing obligations. In contrast, securitisations treatment has fundamentally changed. The EU has specified a new standard – the Simple Transparent Standardised (STS) securitisation, which defines a lot of the features that securitisations should now have.

Is the covered bond and securitisation structure any different?

Covered bonds are structured in accordance with an act of parliament, associated regulations and day-to-day supervision by the bank regulator. There is comparatively little room for variation within any given country’s covered bonds. Securitisations typically have less rules about their structure and investor protection. They instead rely much more on contract law, the needs of investors and rating agencies.

Do the eligible assets used to back the bonds vary from either?

Covered bonds use bonds outlined in article 129 under EU law.

Securitisations uses auto-loans, credit cards, student loans and even intellectual property.

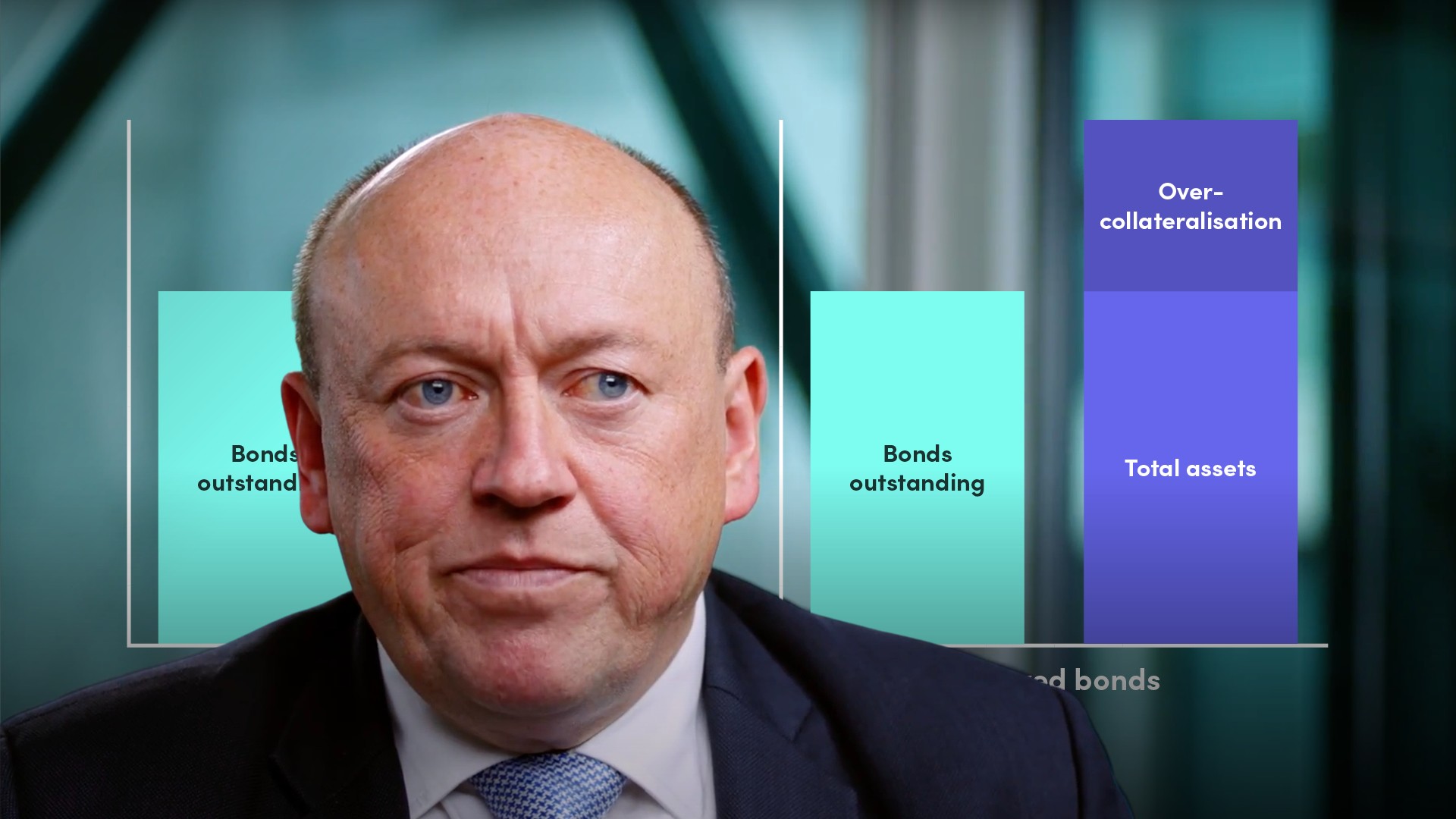

Why do securitisations require less over-collateralisation?

- The subordinated tranches in securitisations mean a higher total advance rate for any given pool of assets

- Covered bonds typically have to put aside more collateral for refinancing risks

Richard Kemmish

There are no available Videos from "Richard Kemmish"