Introduction to Linear Derivatives

Gontran de Quillacq

25 years: Derivatives trading & ETFs

The very first video on this series was a general introduction to derivatives – their history, their main categories, as well as the main benefits and drawdowns of using such instruments. In the second video on this series, Gontran takes us through the first ‘linear’ (non-optional) derivatives like "Futures" and "Forwards".

The very first video on this series was a general introduction to derivatives – their history, their main categories, as well as the main benefits and drawdowns of using such instruments. In the second video on this series, Gontran takes us through the first ‘linear’ (non-optional) derivatives like "Futures" and "Forwards".

Introduction to Linear Derivatives

13 mins 23 secs

Key learning objectives:

Define Delta 1

Define Future payments

Define Exchanges

Define Forward payments

Overview:

Derivatives are a large and complex topic. In this segment, we will look at the first ‘linear’ (non-optional) derivatives, like futures and forwards.

What is Delta 1?

Linear derivatives are also called ‘delta1’ because their Greek measure of market exposure ‘delta’ is worth 1. In other words, they are 100% correlated to their underlying, and they have no optionality.

What are the Derivative products?

- Futures (first listed derivatives)

- Forwards (OTC equivalents of futures)

- Swaps

- ETFs

What are Future payments?

Exchange-listed contracts related to the price of an asset or benchmark. It is an agreement to exchange cash for an asset at some point in the future.

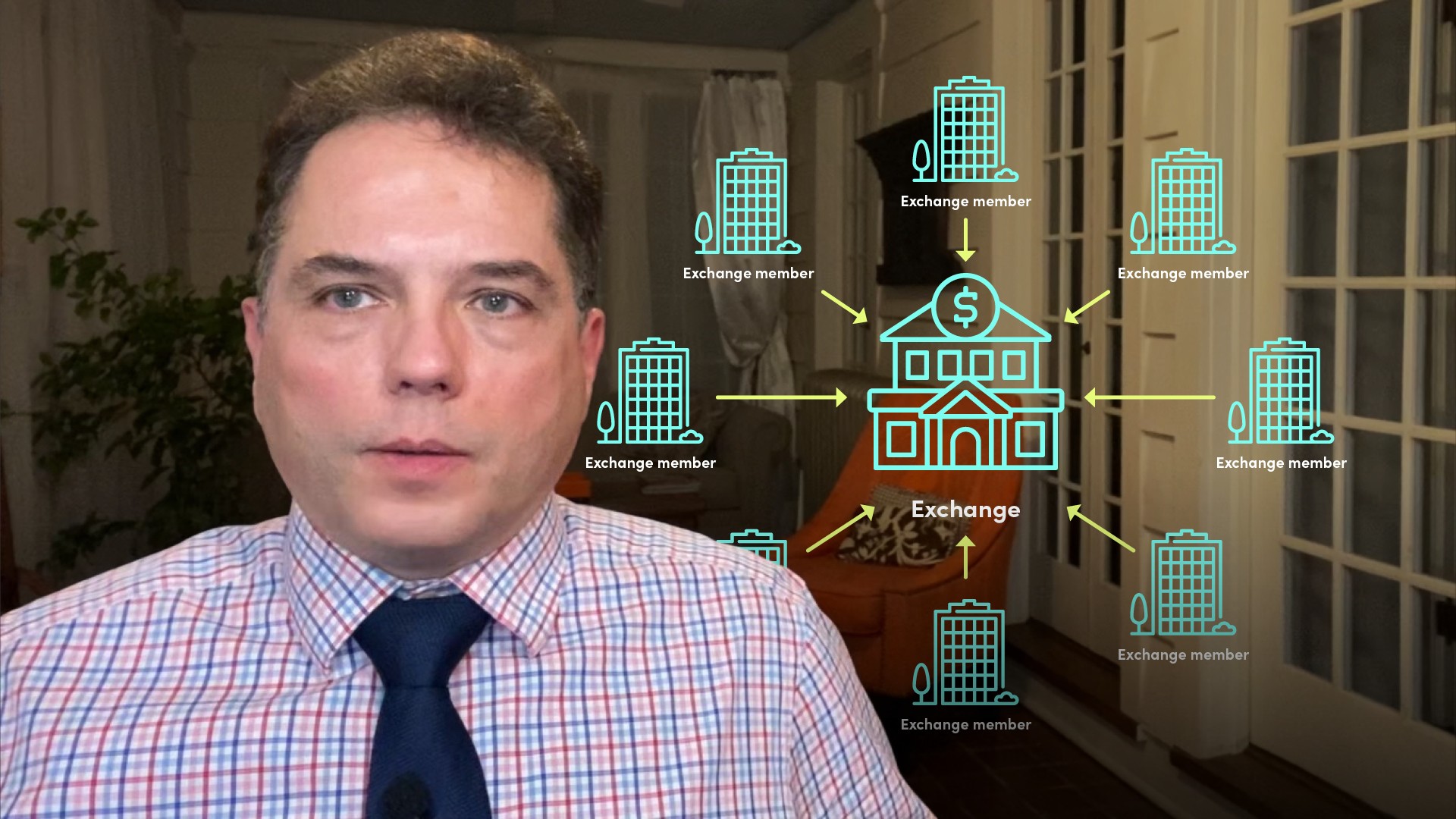

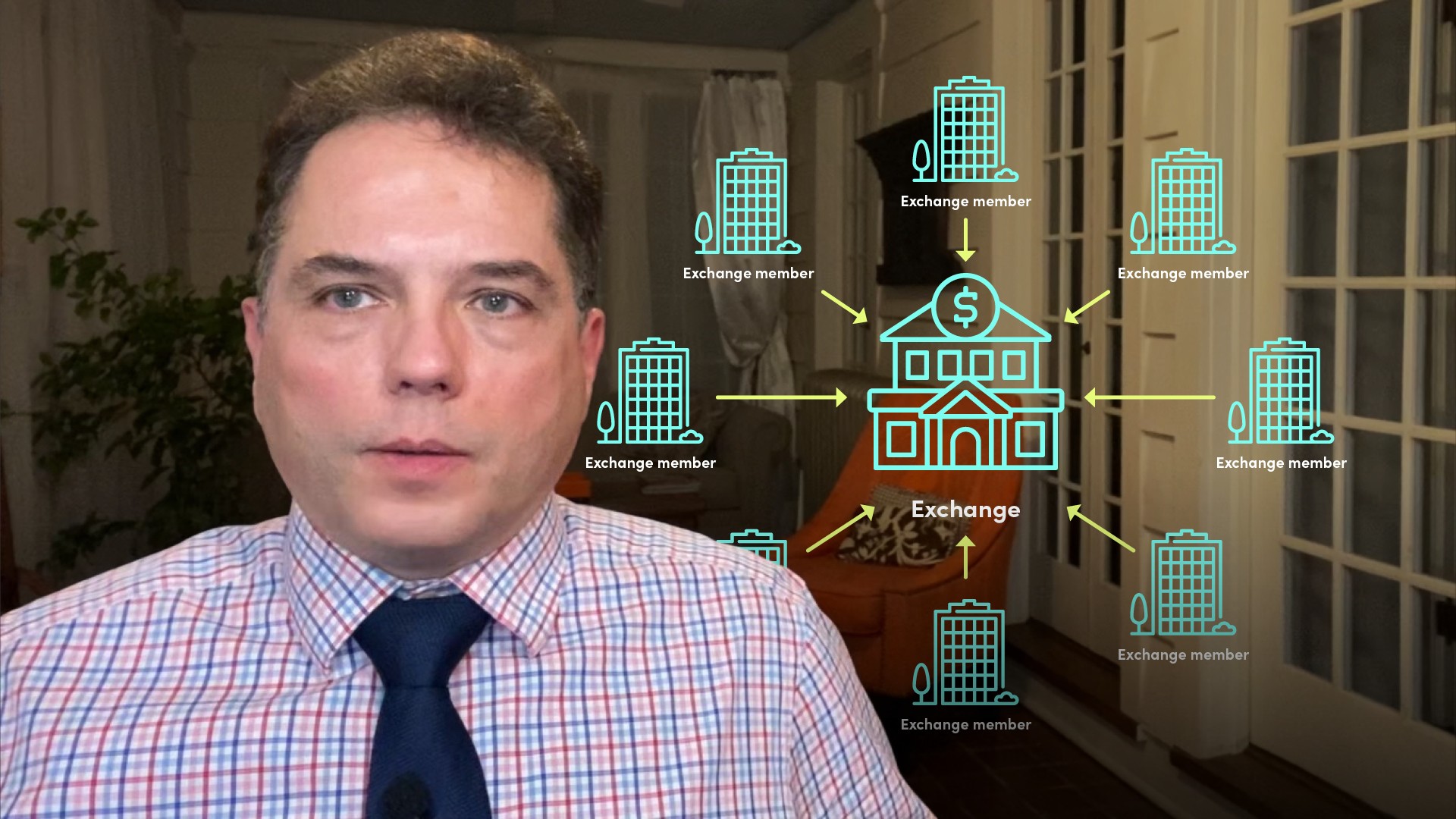

What are Exchanges?

Exchanges are private for-profit corporations which provide a trading venue to the public for the securities that they offer.

How do the Exchanges generate revenue?

Their revenues are essentially derived from- Execution fees

- Clearing fees

- Processing fees

- Member fees

What are the terms specified by the exchanges in advance?

- When the contract can be traded

- What the underlying is

- For a commodity, what is the asset, what is its grade

- For an index: how it is calculated and by whom

- For an interest rate: how the rate is calculated and by whom

- The quantity of the referenced underlying (quotity)

- When the final valuation will take place

- How complex benchmarks are calculated and by whom

- How the future will be quoted

- What the future will be called (ticker)

The exchanges also specifies the margining process

- Initial margin - How much you have to deposit at the exchange for your trade.

- The variation margin and the entire daily margining process:

- What will the DSP be

- How and when payments have to happen

- Whether cross-margining is possible

- Margin requirements change from time to time

What are Forward payments?

Futures and forwards give you virtually the same exposure. They essentially differ by their legal nature. The futures and the forward have the same price, but they do not have the same market exposure because the exposure of a futures contract is slightly bigger than the forward exposure because you collect interest that you collect from the margin calls.

Gontran de Quillacq

There are no available Videos from "Gontran de Quillacq"