Introduction to Derivatives Exchanges

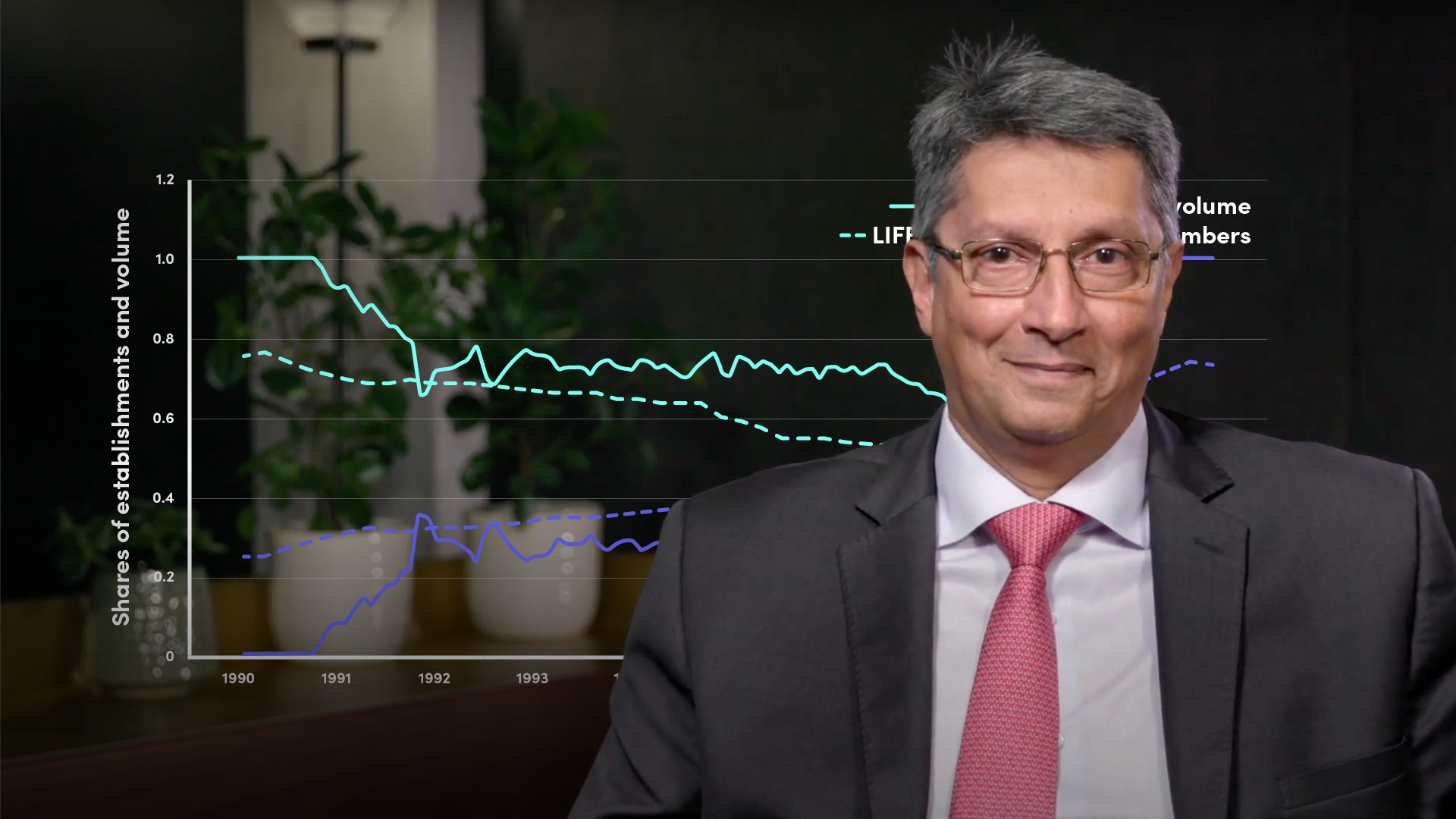

Abdulla Javeri

30 years: Financial markets trader

Join Abdulla as he outlines the background of derivatives contracts, and discusses the development of the forwards/futures market throughout time.

Join Abdulla as he outlines the background of derivatives contracts, and discusses the development of the forwards/futures market throughout time.

Introduction to Derivatives Exchanges

4 mins 1 sec

Key learning objectives:

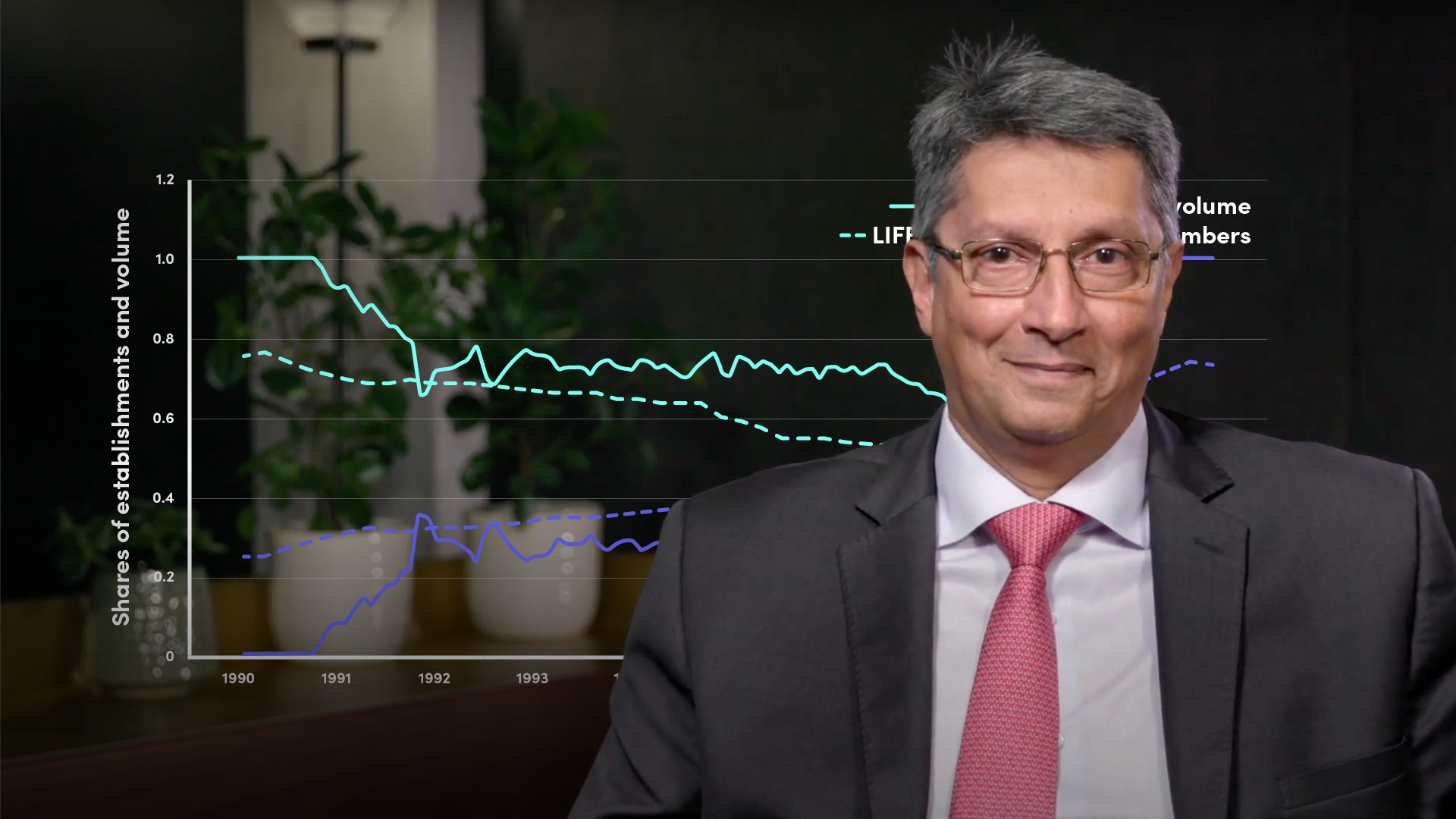

The growth of trading on derivative exchanges especially since the advent of financial futures and options contracts.

The move from country based exchanges to large cross border groupings.

The ‘demise’ of open outcry as a way of trading and its replacement by electronic screen based platforms.

Overview:

Derivatives contracts in the form of forwards and options have been around for a very long time - around four thousand years.

What are some early examples of futures exchanges?

Formalised trading of futures and options contracts on organised exchanges is a more recent phenomenon. An early example of futures exchanges dates back to the sixteen hundreds, in the Dutch Republic.

What are some examples of the modern exchanges?

Some of the modern exchanges that are recognisable today were established in the eighteen hundreds, The Chicago Board of Trade in 1848, the London Metal Exchange in 1877, the New York Mercantile Exchange in 1882 and the Chicago Mercantile Exchange in 1898.

What has been the recent trend?

The recent trend has been the growth of the Asian markets. They are now some of the largest in terms of notional value and contracts traded.

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"