Put-Call (Options) Parity

Lindsey Matthews

30 years: Risk management & derivatives trading

In this video, Lindsey walks us through a basic option valuation technique that all market participants should know.

In this video, Lindsey walks us through a basic option valuation technique that all market participants should know.

Put-Call (Options) Parity

11 mins 58 secs

Key learning objectives:

Understand how to value options using a simple valuation relationship

Overview:

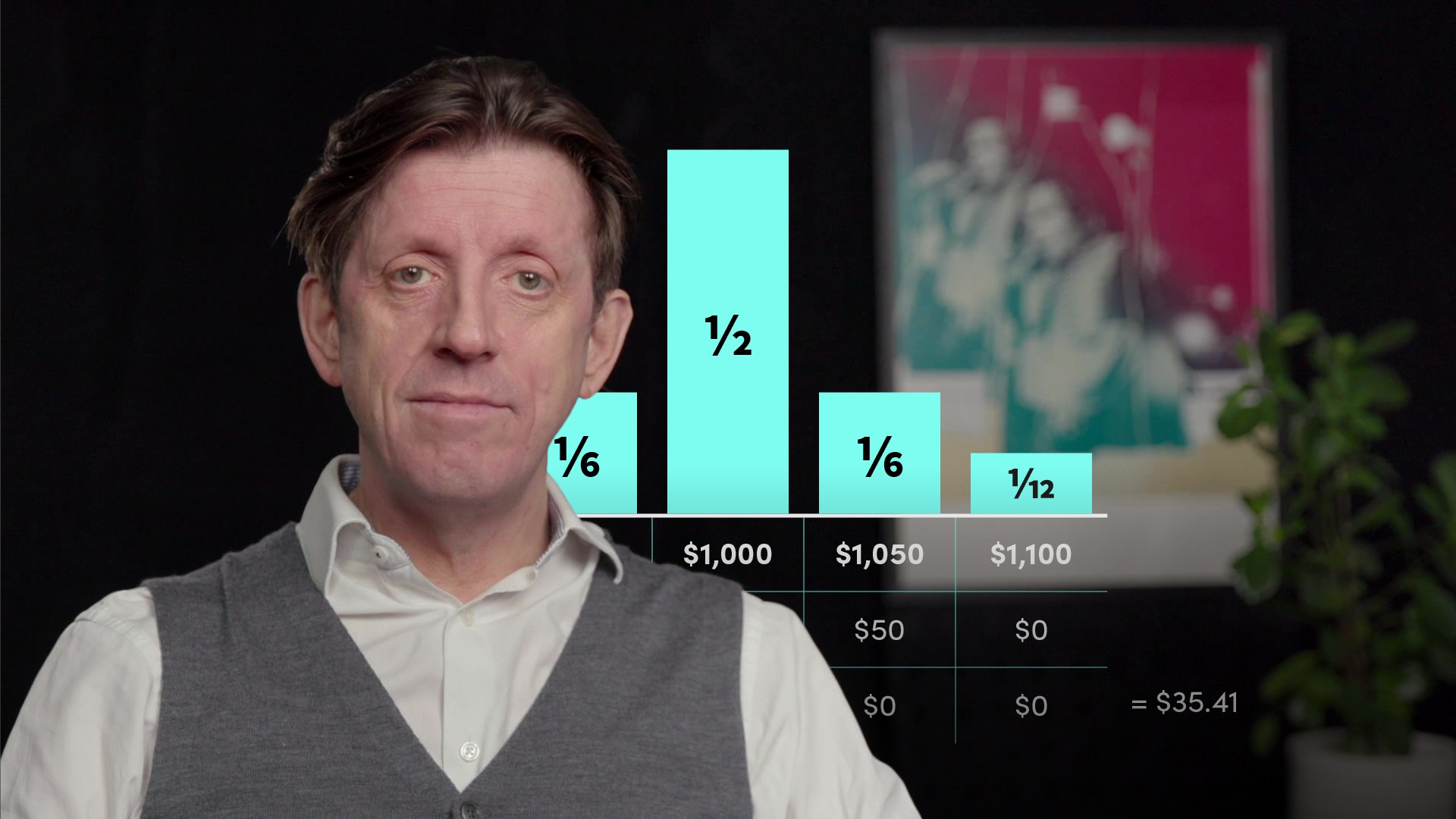

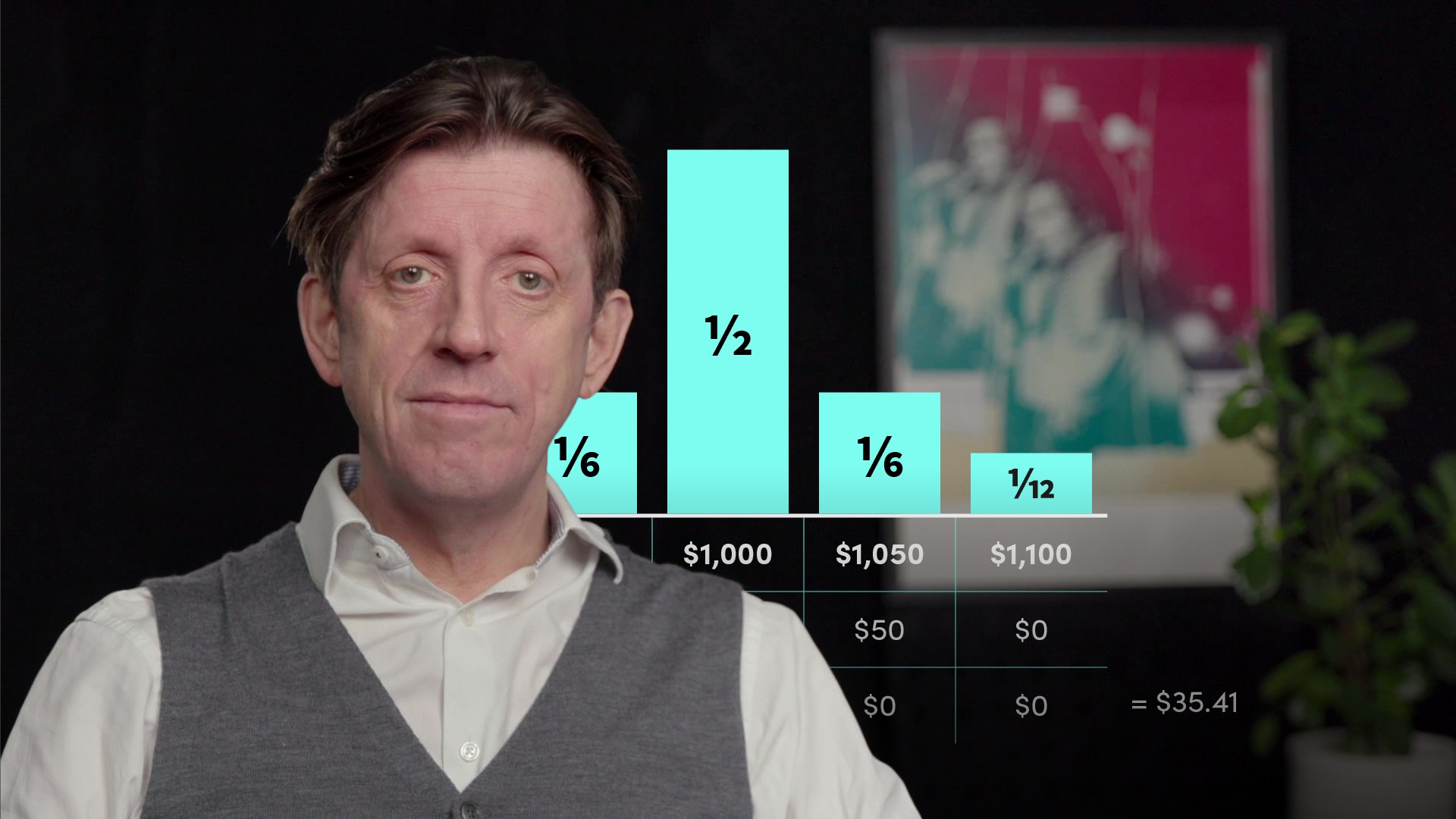

Valuation of options is based on the price of the underlying instrument. Complex option valuations will require models, however there are simpler valuation methods for less complex valuations. If you are able to value the out-of-the money option, the value of the other option can be inferred from that, using the put-call parity. It can be used by investors to help them in valuation, risk management and pricing.

How are simple options valued?

When you value options, for any given strike, you only need to value the out-of-the-money option. The other option can be inferred from that.

Assume the 3 month forward on platinum is trading at $1000 per oz. The $800 strike 3 month call on Platinum is deep in the money. The Platinum price would have to fall by more than 20% for it to end up out of the money.

A call option can be interpreted as being long the underlying forward, whilst also having downside protection so that the underlying cannot fall below the strike price.

To calculate the call price, firstly in relation to the forward, if the call is in the money the value is simply the forward price - strike price, then discounted back or <formula>F-X{\div }(1+{r}^{t})</formula>

For the second part, the downside protection, this is the same as buying a $800 strike put. Therefore the value of an $800 long call is $$F-X{\div }(1+{r}^{t}) + value of the long $800 put$$

What is the key value relationship between options?

The above method works for every pair of options using the same strike price, you can value both calls and puts, by using the value of the out-of-the-money option.

We have outlined the relationship above without explicitly mentioning it. We can express the relationship as:

$$Call-Put=(F-X)1+{r}^{t}$$

Or, mathematically this is the same as:

$$Put-Call=(X-F)1+{r}^{t}$$

This relationship works perfectly for European style options, those which can only be exercised at expiration. For American options, there are added complications – due to the ability to exercise early there are added complications due to the ability to exercise early – but the underlying story is substantially similar.

The key relationship between options is used all day every day on the trading floor. It can also be used by investors to help them in valuation, risk management and pricing.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"