Synthetic Forward Using Options

Lindsey Matthews

30 years: Risk management & derivatives trading

In the previous video on his series on "Derivatives Unlocked", Lindsey explained us the valuation relationship – relating together calls and puts at the same strike and showing that we only need to think about valuation and risk of the out of the money option. In this video we can see the same effects by looking at breakeven graphs.

In the previous video on his series on "Derivatives Unlocked", Lindsey explained us the valuation relationship – relating together calls and puts at the same strike and showing that we only need to think about valuation and risk of the out of the money option. In this video we can see the same effects by looking at breakeven graphs.

Synthetic Forward Using Options

7 mins 14 secs

Key learning objectives:

Understand how options are valued

Understand what is long protection

Overview:

Valuation of options is based on the price of the underlying, not the strike. Value of an option can be deduced from the value of its out-of-the-money option. The key relationship between options is something we used to use all day every day on the trading floor. It is a key relationship which junior traders were taught all day, every day. It can be used by investors to help them in valuation, risk management and pricing. It will require some kind of option pricing model, but there are some key parts that do not require it.

How are Options Valued?

Valuation of options is based on the price of the underlying, not the strike. Value of an option can be deduced from the value of its out-of-the-money option. The 800 strike 3 month call on Platinum is deep in the money. The Platinum price would have to fall by more than 20% for it to end up out of the money . Value is calculated simply as the forward price minus the strike, and then discounted back. The value of an options call is based simply on its value at the strike vs the forward, discounted back The key relationship between options is used all day every day on the trading floor. It is a key relationship which junior traders were taught all day, every day. It can be used by investors to help them in valuation, risk management and pricing. It will require some kind of option pricing model, but there are some key parts that do not require it.

What is Long Protection? Explain with example

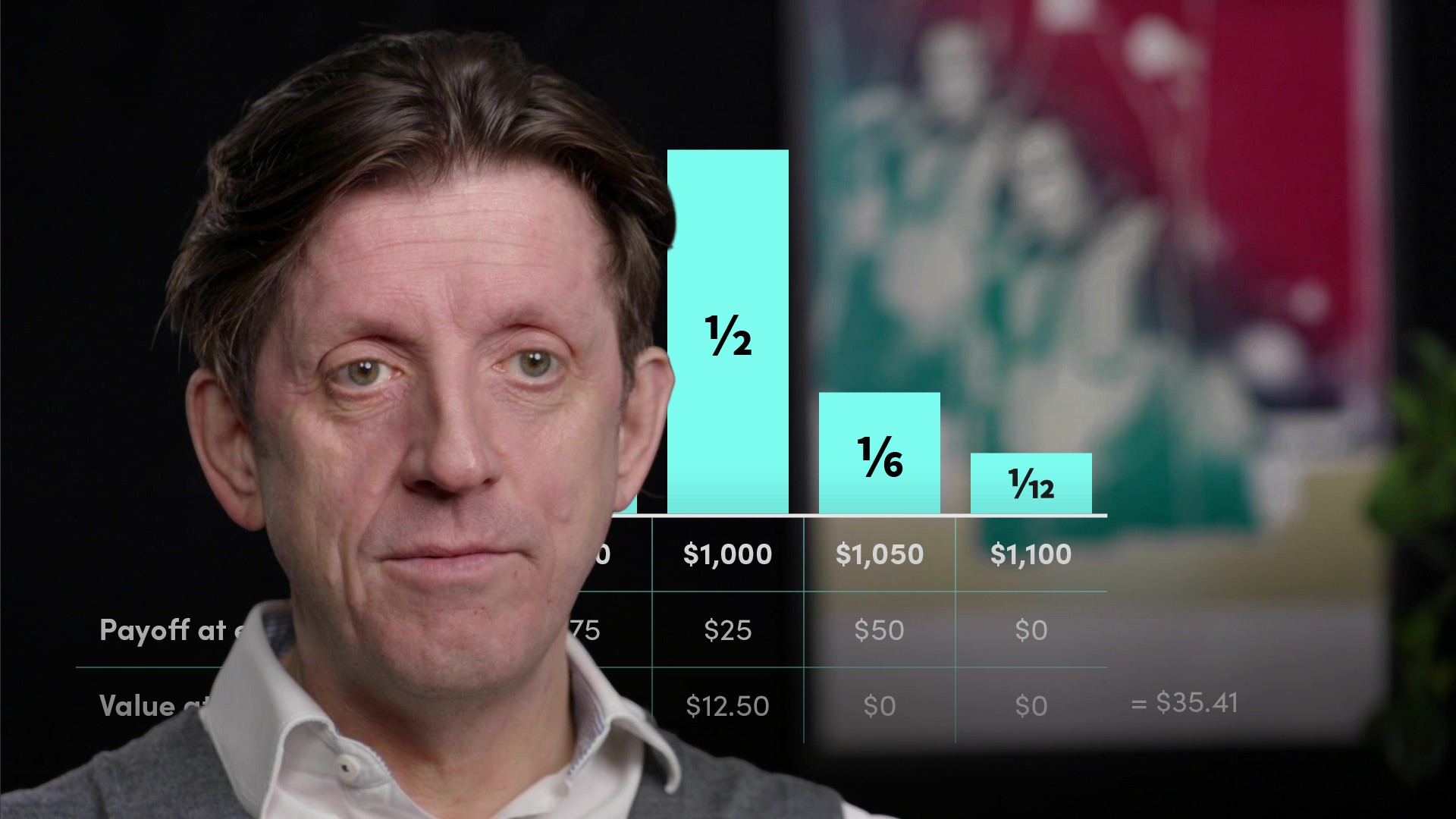

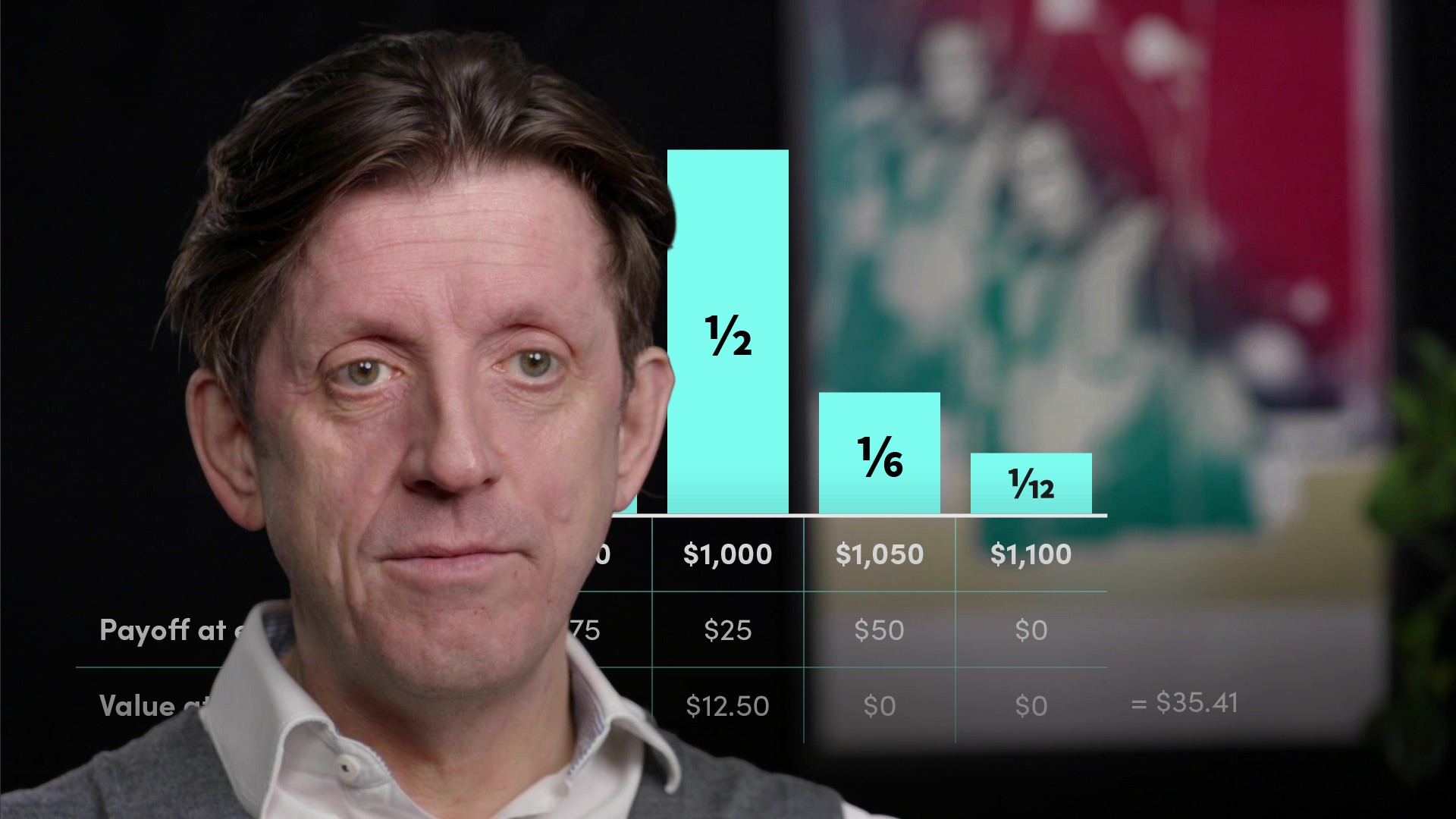

Long Protection against the platinum price falling below 800 dollars. What is this worth? Well if you think about, you will realise that this is the same as another option. This is true of every pair of options at the same strike. For example, if we look at the long 1100 put on Platinum, this is like being short the forward at 1100. While the forward is actually trading at 1000, this one is worth 100 points, discounted back. mathematically this is the same as: Put – call = X - F, discounted, plus value of out of the money put at same strike OR the in-the-money put value equals (X-F) discounted,plus value of. out-of- the-money call at the same strike. We can actually express these both using one formula: Call – put = F – X, discounted or divided by 1 plus rt. This relationship works perfectly for European style options – those which can only be exercised at expiration. For American options, there are added complications – due to the ability to exercise early. Remember that the equity index futures are trading at 3925. The 3800 call can be bought for 176 index points and the 3800 put for 51 index points.

Explain the working of Call Options

Platinum 6 month futures are trading at 1100 dollars per ounce. Assume interest rates are zero and so there is no discounting

The 6 month 1050 dollar put is trading at 85 dollars per ounce, what is the 1050 strike call worth?

And if the 6 month 1000 strike call is trading at 167 dollars per ounce, what is the 1000 strike put worth?

And finally, If the 6month 1100 call is trading at 108 dollars per ounce, what is the 1100 put worth?

Please watch the video to see the working solutions

In a way, learning this has halved the size of our problem. For any given strike price, we only need to value the out of the money option and that will also tell us the value of the in the money options. Options traders tend to think about the out-of-the-money options only. And if you want to check your solutions – select the solutions hotspot of your choice.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"