A Closer Look at Digital Banking

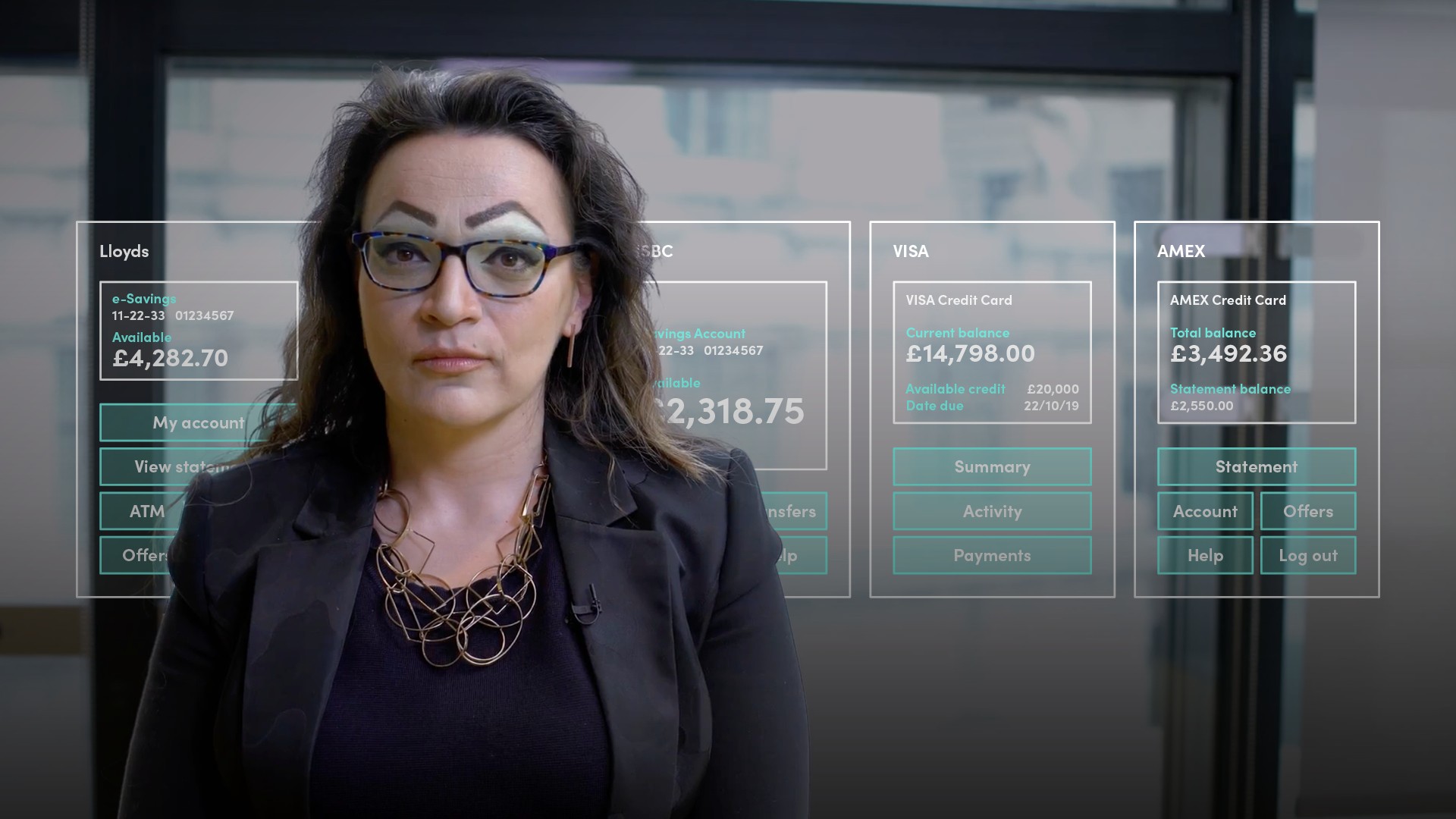

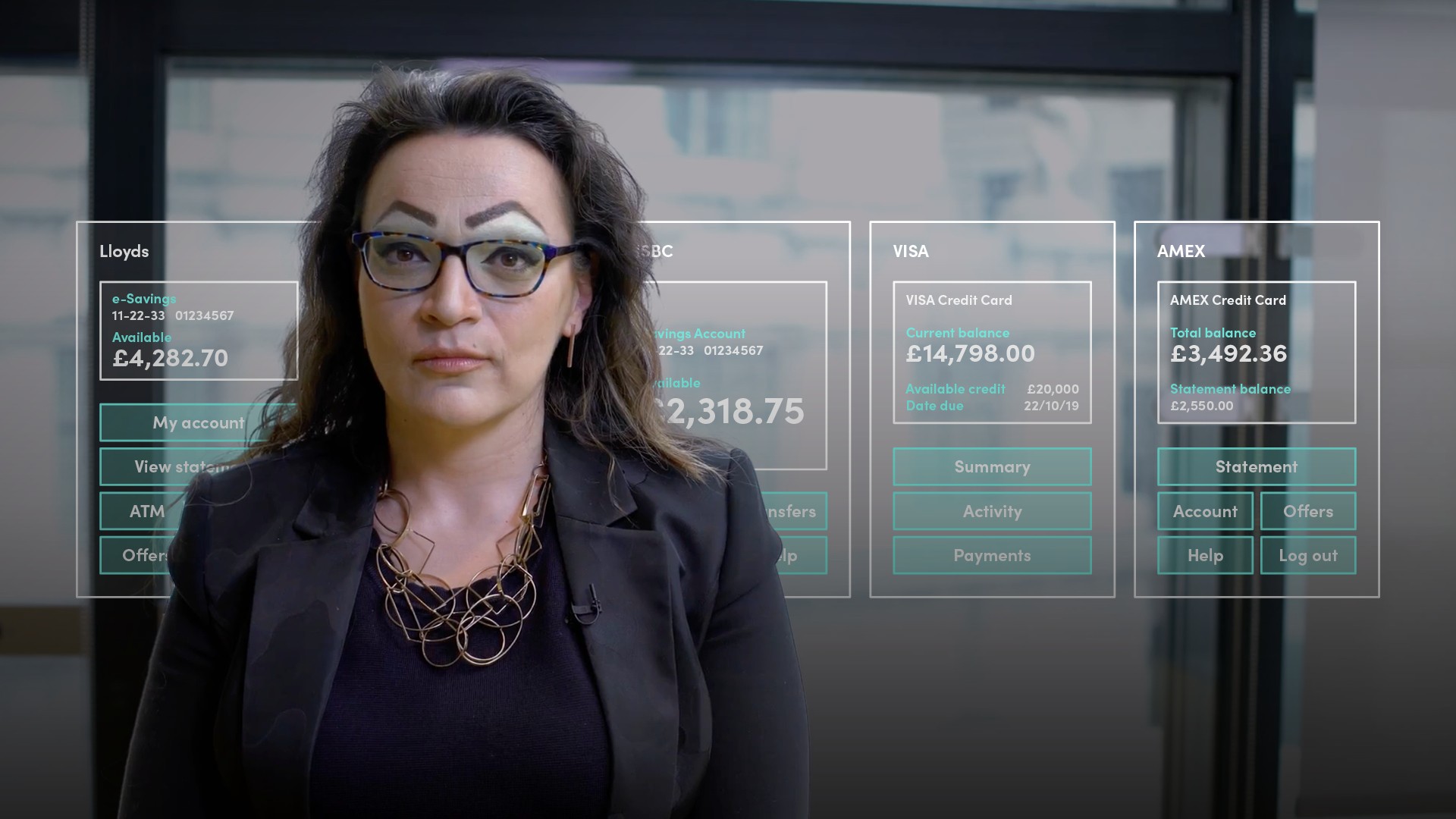

Duena Blomstrom

20 years: Financial services & culture

In this video, Duena explains digital banking: what it is, how it developed and where it is heading.

In this video, Duena explains digital banking: what it is, how it developed and where it is heading.

A Closer Look at Digital Banking

13 mins 4 secs

Key learning objectives:

Define digital banking

Explain the impact digital banking has on traditional banks

Explain the current situation of digital banking on a global scale

Overview:

Digital banking entering the market has revolutionised financial services. Digital banking addresses the demand for faster and easier money transfers, and on demand information about your finances.

What is digital banking?

It is an umbrella term to cover all non-physical channels through which financial services and products are being delivered, i.e. online and mobile. These financial services include the viewing of account balances, viewing statements and making payments and transfers.

Is digital banking threatening the existence of branches?

While new entrants, called challengers, enter the financial services market, and do so on a direct-banking, digital-only model, high street banks and traditional incumbents are closing branches and not investing in new ones.

Although, there are statistics that suggest specific banking operations are preferred to be performed in person, such as mortgages.

What purposes does digital banking serve?

Digital banking serves two functions: information and action.

- Information - all the features that offer the user data without the ability to action it, such as account balance, Personal Financial Management (PFM), spending reports, transaction list, etc. Users can also receive information pre-login, such as information about the nearest branch or ATM, and in some cases as a new feature from neo-banks and even high-level account information such as balance

- Action - actions that can be executed in the online or mobile bank channel are situated post-login and pertain mainly to money movements and account operations

What are users looking for when it comes to the experience of using digital banking?

Usability - The better designed the digital banking experience, the more intuitive it is to process money transfers. Neo banks offer the ability to move money to contacts by any means from entering their account information, to using their phone numbers or instant messaging contact information. This ease of access for transfers is one of the most rapidly spreading pieces of digital banking functionality.

Speed - Users look for speed when it comes to money transfers, forcing banks to respond by shortening the period it takes to transfer money, bringing the norm from next-day operations to a few hours or even instant money transfers.

What key feature has enabled digital banking to get ahead of traditional banks?

The trend appears to be that new banks in the UK, the US, Europe and Asia have been able to leapfrog incumbents in onboarding. Account opening, traditionally a cumbersome, paper driven, bureaucratic process taking place in a branch, has seen a reinvention with the advent of the new digital financial services providers. Many of these new banks accept proof of identity from photos online in order to sign-up new clients. Most incumbents have quickly had to follow suit and overhaul their onboarding practices towards digital account opening as well.

What is the current state of digital banking internationally?

The US - While the US has started as a favourite in the digital banking race, they have been left behind when as Australian, Asian and even Eastern European banks unveiled their online and mobile bank offerings which were a lot more complete and innovative.

The European Union - The EU has become involved as an innovation driver through regulation pertaining to access to information mandating that transactional data be made visible so that consumers are able to use it as they see fit. Governments are also moving towards encouraging new market entrants by simplifying the process of applying for a license to become a bank or a European money transfer financial services provider.

The UK - The UK has the most challenger banks of any other country with over 40 new banking service provider licenses having been issued by the end of 2018. It is possible that London can become the epicentre of the next wave of financial services innovation.

What is considered “best practices” in digital banking?

One of the most well-known examples of best practice in innovative digital banking came out of Poland in 2014 and was called mBank. What they created was a collection of new features designed with the consumers’ best interest in mind and aiming to make their financial lives better, such as digital onboarding and credit facilities in under 30 seconds.

What is on the horizon for Digital Banking in the near future?

Now that consumers’ expect a high level of digital experience from banking, similar to other online and mobile tech interactions, there will be further progress and innovation in the years to come with open banking enabling new business models for challengers and incumbents alike.

Duena Blomstrom

There are no available Videos from "Duena Blomstrom"